Bitcoin’s worth continues to wrestle under the psychological $85,000 mark, failing to interrupt previous this essential stage over the previous two months.

Regardless of some makes an attempt to safe an increase, the main cryptocurrency has remained stagnant, rising stress on long-term holders (LTHs). These traders, as soon as having fun with stable earnings, at the moment are seeing a decline of their unrealized beneficial properties.

Bitcoin Traders Are Pulling Again

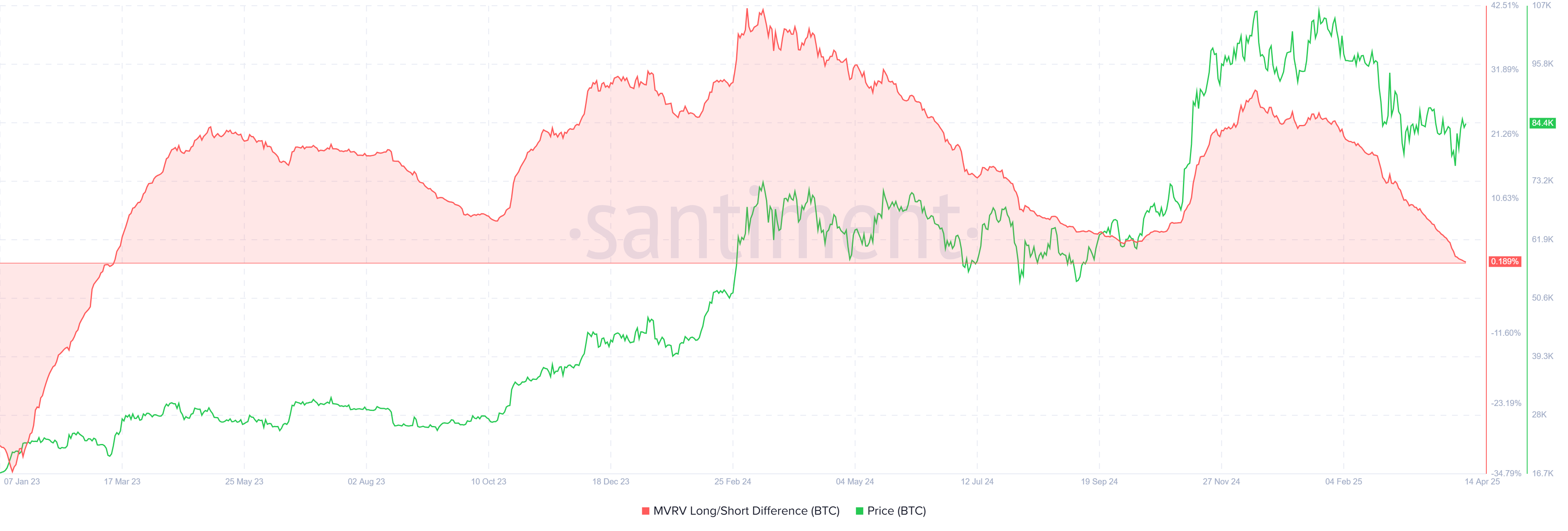

The MVRV Lengthy/Brief Distinction, a key metric used to gauge market sentiment, reveals a regarding development for LTHs. The indicator not too long ago hit a two-year low, suggesting that long-term holders’ earnings are at their lowest since March 2023. This shift signifies that the market circumstances are more and more unfavorable for LTHs.

As Bitcoin’s worth fails to recuperate, short-term holders (STHs) are starting to dominate, capitalizing on the value fluctuations. In the meantime, long-term holders (LTHs), going through diminishing earnings, maintain off on shopping for or holding extra.

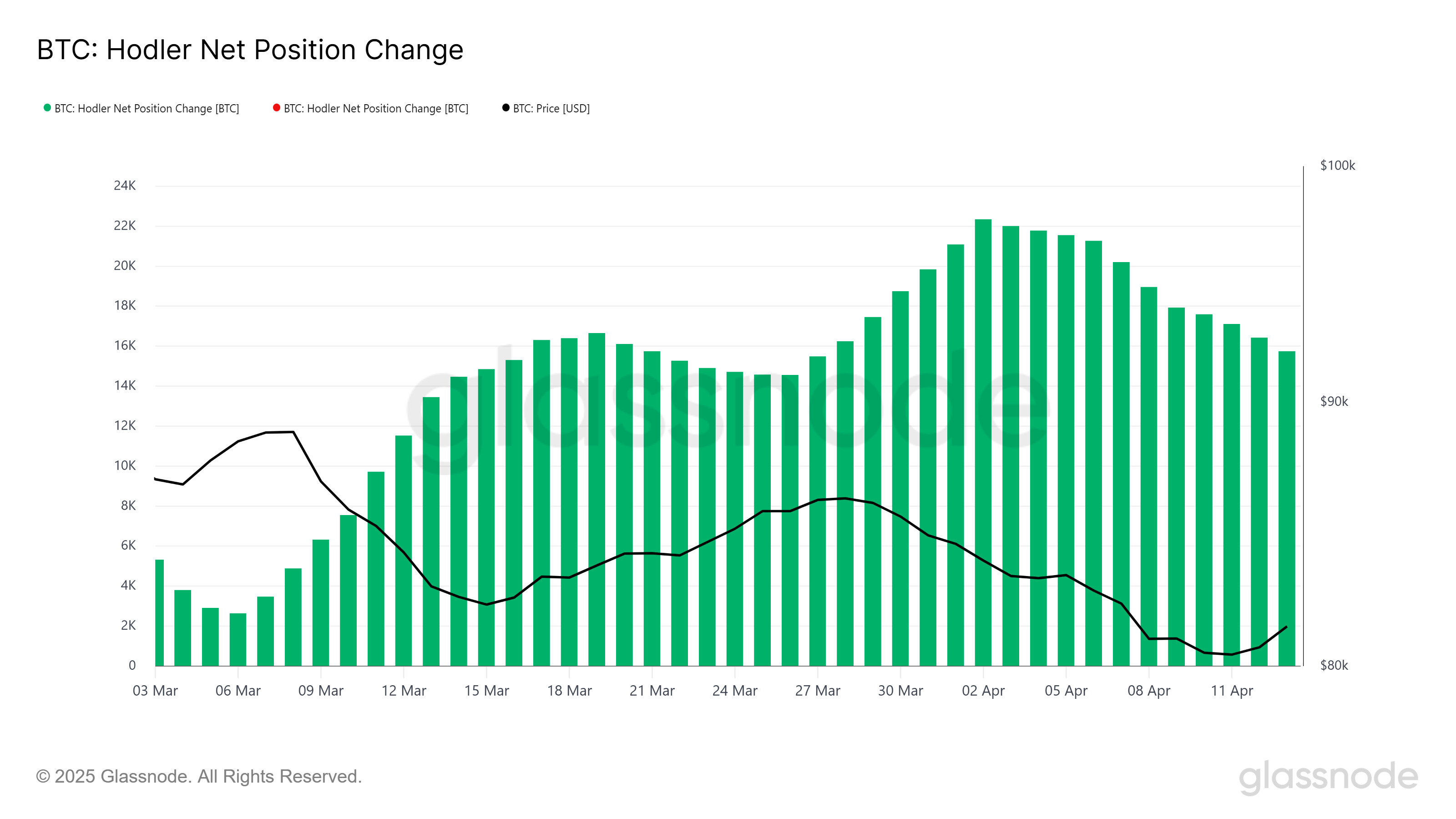

The general momentum of Bitcoin, measured by technical indicators, additionally displays bearish indicators. The HODLer web place change additional backs this narrative, because it reveals that LTHs have offered a good portion of their holdings during the last two weeks. In complete, these gross sales amounted to greater than 6,596 BTC, which is value over $550 million.

Though this determine might not be monumental, the psychological shift from confidence to warning amongst LTHs is a bigger concern. This lack of conviction may delay Bitcoin’s restoration and contribute to additional worth stagnation. In flip, this might additional restrict market exercise and exacerbate the continuing downturn.

BTC Worth Is Going through A Decline

Bitcoin’s worth is buying and selling at $84,421, hovering simply above the essential help stage of $82,619. The worth stays trapped below the important thing $85,000 resistance stage, which may trigger additional stress if it fails to interrupt above. If Bitcoin loses help at $82,619, a decline to the following main psychological help of $80,000 is feasible.

If the bearish development continues, the value may fall additional, with $78,841 rising as a essential stage to look at. Dropping this help would mark a extra vital downturn, confirming the continued market weak point and deepening the bearish outlook for Bitcoin.

Nonetheless, if Bitcoin manages to breach and maintain $85,000 as help, it may ignite a restoration, pushing the value again up towards $86,848. A sustained rise above $85,000 would invalidate the present bearish development and pave the best way for a possible surge towards $89,800, reestablishing confidence amongst traders.

Disclaimer

According to the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.