- BONK has fashioned a key technical sample on the chart, hinting at a bullish reversal forward.

- Shopping for exercise and bullish sentiment from the derivatives market presently contribute to BONK’s rally potential.

Bonk [BONK] has remained one of the vital spectacular tokens available in the market over the previous month. Prior to now week alone, the asset gained 44.63%, with a month-to-month transfer of 21.22%.

This transfer suggests there’s rising curiosity within the memecoin and a bent for it to document additional market features, as market sentiment shifts largely in favor of consumers.

A bullish sample might add to rally

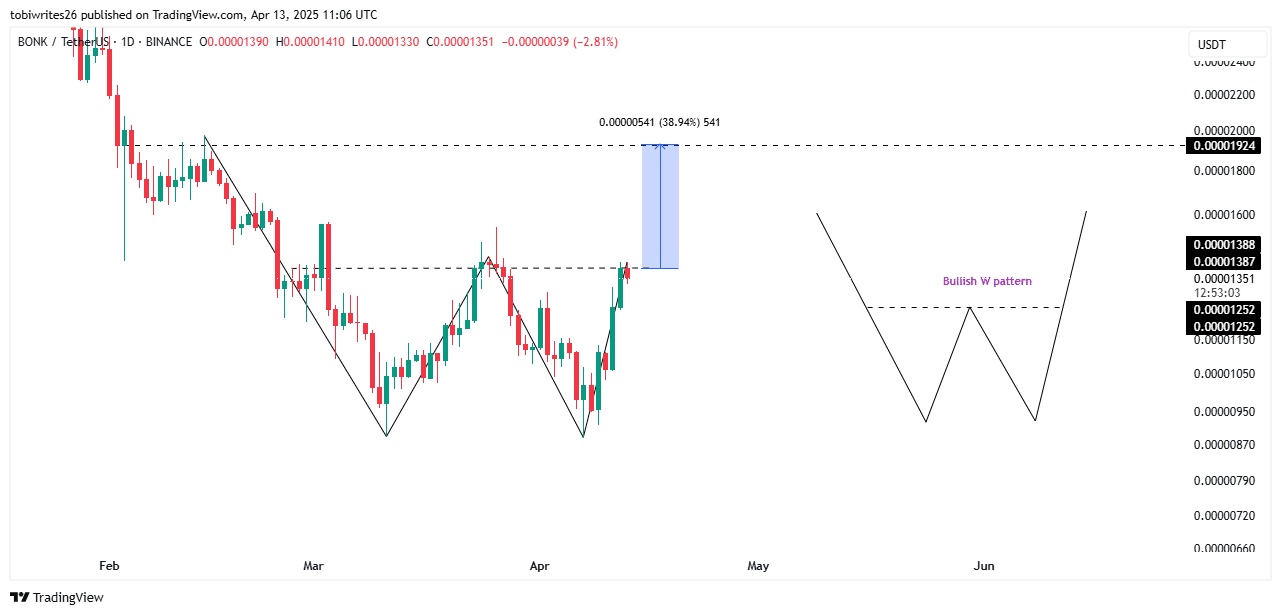

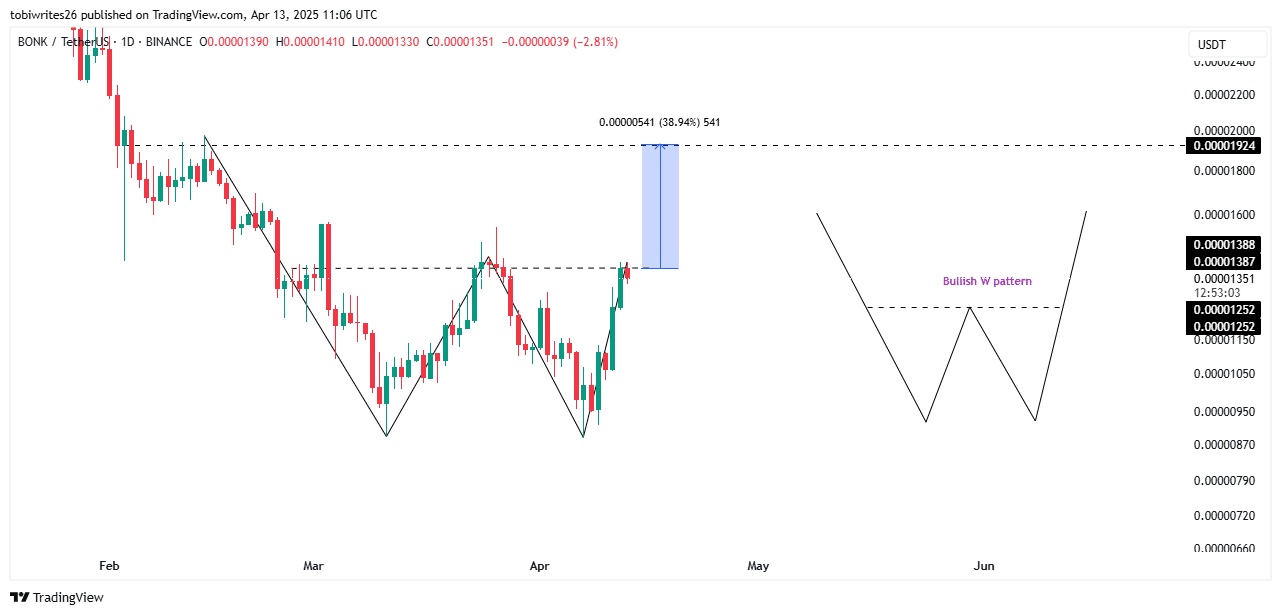

BONK has fashioned a bullish sample referred to as the “W” sample, recognized to behave as a catalyst for property to recuperate and document additional market features following a break of construction.

This break of construction happens when the asset breaches a resistance line, resulting in the beginning of a rally. Within the case of BONK, the prolonged dotted line marks the extent that must be breached.

Supply: TradingView

As soon as this breach happens, BONK might take a significant value leap, gaining roughly 38% and rallying to $0.00001924 on the chart.

Above this value goal are unmarked honest worth gaps, that are recognized liquidity ranges on the chart, suggesting the worth might document additional features by buying and selling into these factors.

Market indicator and demand provides to bullish sentiment

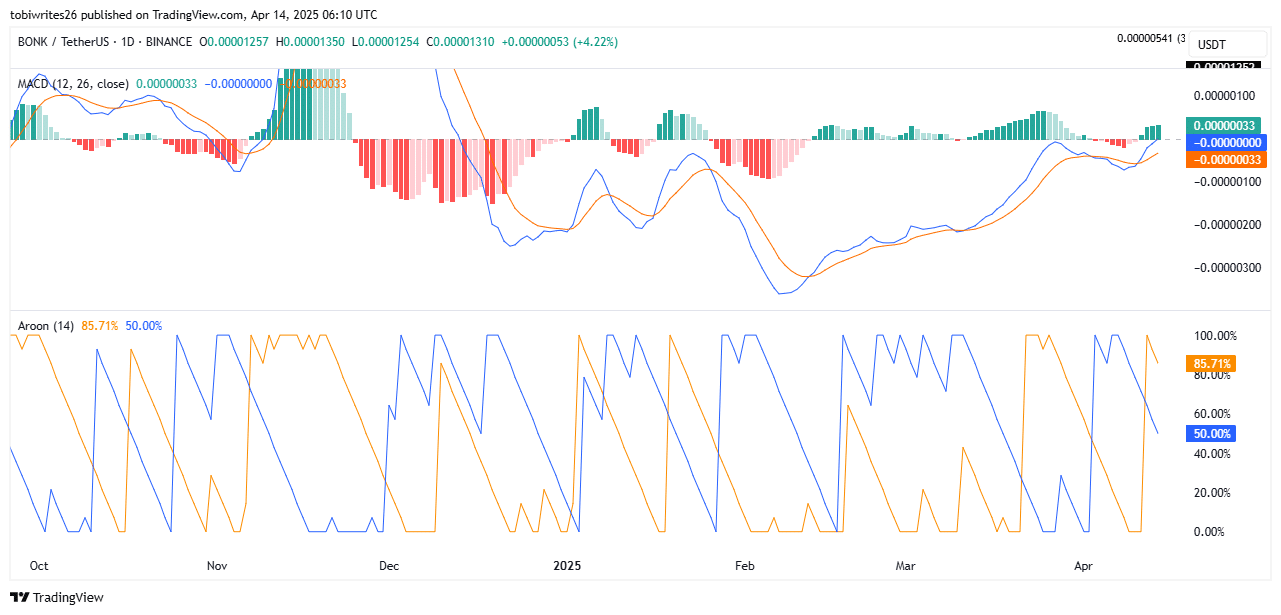

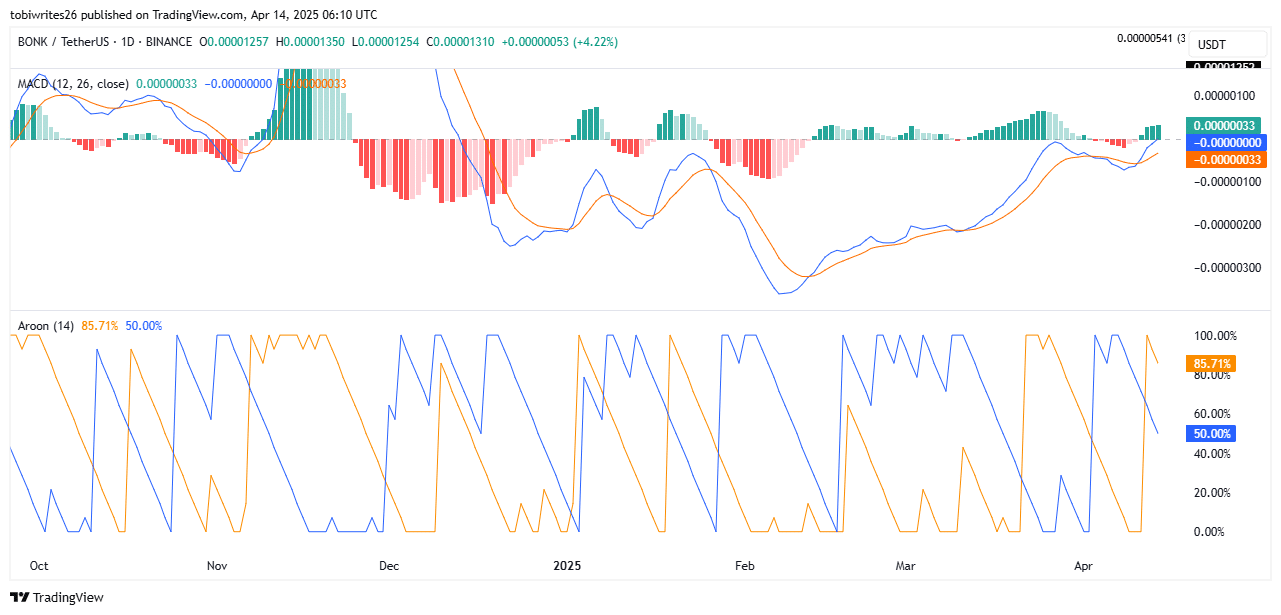

Technical indicators recommend {that a} breakout of this resistance stage is imminent. The Transferring Common Convergence and Divergence (MACD) signifies the rally could quickly take form.

At press time, the blue MACD line was positioned on the impartial stage of 0.00 and was trending upward. The amount histogram shows exponential progress.

If the MACD line strikes into the optimistic area and the histogram continues to extend, it can affirm rising momentum amongst merchants actively shopping for BONK.

Supply: TradingView

The Aroon indicator analyzes market developments and their power utilizing two strains—Aroon Up (orange) and Aroon Down (blue).

A bullish sentiment is confirmed when the Aroon Up line stays above the Aroon Down line. Present readings present the orange line at 85.71% and the blue line at 50.00%. These readings align with the prevailing market narrative.

Within the spot market, consumers have been actively buying BONK. They bought $2.6 million price of the asset and transferred it to non-public wallets for holding.

This shift from exchanges to non-public wallets signifies rising confidence within the asset’s long-term potential.

If the development continues into the upcoming week, BONK might see additional value appreciation. This state of affairs will increase the potential for a significant upward motion within the buying and selling periods forward.

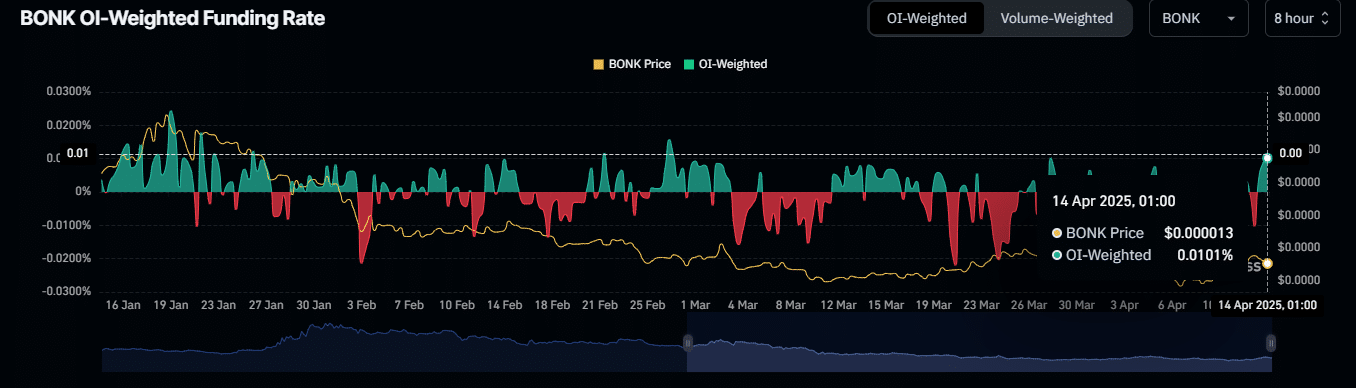

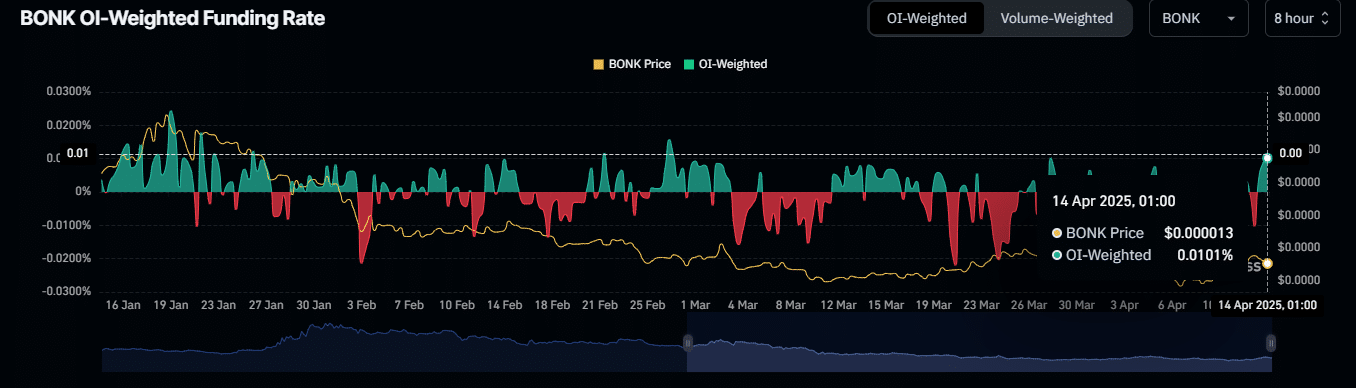

Supply: Coinglass

The OI-Weighted Funding Price combines the Funding Price and Open Curiosity to evaluate potential market course.

It signifies that the market is favoring lengthy merchants. On the time of writing, the OI-Weighted Funding Price stood at 0.0101%.

This studying confirms excessive shopping for exercise available in the market, which might help a breakout of the resistance stage. If the resistance stage is breached, it might drive an extra rally, doubtlessly resulting in new highs for BONK.

Total, the BONK rally seems doubtless, with the market anticipated to rise and the asset surpassing marked targets.