- WLD continues to trip the AI momentum with a $200M market cap surge, fueled by macro and micro drivers.

- The altcoin faces a key check on the $1 threshold, the place breaching this degree might set off widespread FOMO.

The AI sector is seeing a powerful bid following current tariff exemptions on semiconductors and key tech imports from China.

Synthetic Superintelligence Alliance [FET] is just not the one one benefiting – Worldcoin [WLD] is capitalizing on the momentum, registering a strong 30% acquire for the week.

Nevertheless, very like Trump’s erratic commerce insurance policies, is WLD’s rally simply one other liquidity sweep concentrating on weak arms, or does it have the structural power to carry its floor towards looming resistance? AMBCrypto investigated.

Macro and micro drivers fueling the WLD growth

Worldcoin, launched by the AI visionaries behind ChatGPT, continues to capitalize on the sector-wide AI narrative. Over the previous week, WLD’s market cap has expanded by almost $200 million, at the moment hovering close to $945 million. Therefore, a transparent signal of accelerating capital influx.

In reality, with a circulating provide of 1.25 billion, a reclaim of the $0.80 degree would vault WLD into mid-cap territory.

Momentum indicators reinforce bullish continuation. At press time, RSI remained in impartial territory however pointed north, whereas MACD was near flipping bullish.

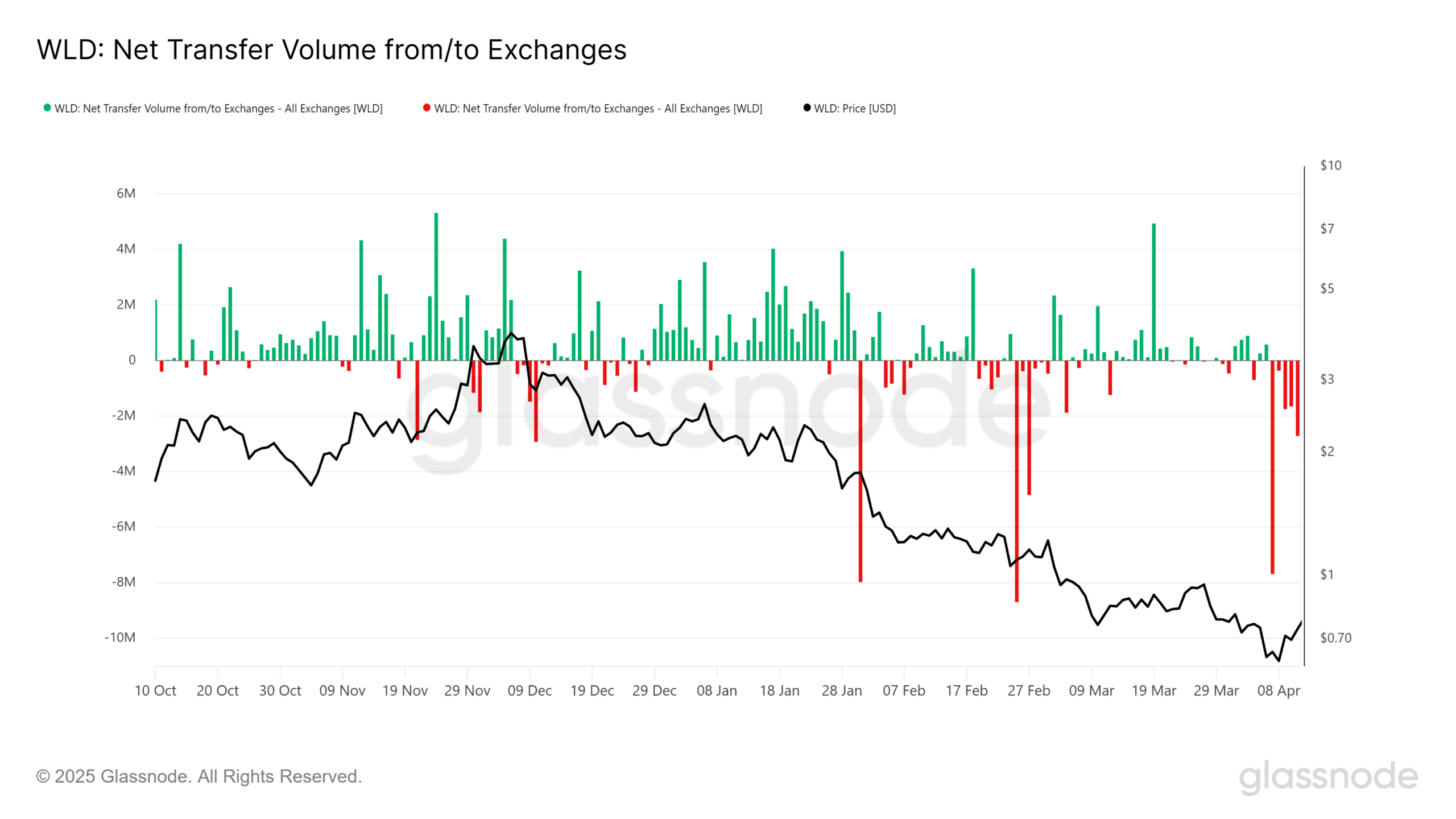

Notably, change outflows hit a four-day peak on the eleventh of April, with 2.78 million WLD tokens absorbed. This aligned with macro developments, as Trump halted tariffs on China-based electronics.

![Is Worldcoin’s [WLD] 30% rally a prelude to ‘FOMO-driven’ development to $1? Is Worldcoin’s [WLD] 30% rally a prelude to ‘FOMO-driven’ development to $1?](https://ambcrypto.com/wp-content/uploads/2025/04/glassnode-studio_wld-net-transfer-volume-from-to-exchanges.png)

Supply: Glassnode

Brief liquidation knowledge additional bolstered the pattern: On the twelfth of April, roughly 206k quick positions had been worn out, suggesting bears had been caught offside as bulls defended key ranges.

Furthermore, the current wick to $0.64 in the course of the market-wide flush triggered a pointy rebound in Web Unrealized Revenue/Loss (NUPL).

Though nonetheless within the purple (capitulation zone), the transfer suggests an early-stage shift towards the optimism quadrant. Historically, it’s a potential precursor to FOMO-driven upside.

From a structural perspective, WLD is exhibiting each technical and behavioral conviction. Moreover, macro catalysts, sensible cash rotation, and rising momentum collectively sign that this can be greater than only a reflexive bounce.

Key degree to look at for FOMO

Usually, a rebound in NUPL usually marks the onset of sell-side exhaustion — a part the place weak arms are flushed, paving the best way for early accumulation.

Present on-chain tendencies, particularly sensible cash absorption, recommend this foundational stage may very well be underway.

Nevertheless, for true FOMO to ignite, which suggests pulling in each sidelined capital and prompting long-term holders to delay revenue realization, WLD must reclaim the psychological $1 degree.

In response to AMBCrypto’s evaluation of the chart under, earlier entries into the FOMO/Hope zone on the NUPL metric have persistently aligned with value motion breaching the $1 threshold.

Supply: Glassnode

Till WLD clears the $1 barrier, the probability of liquidations — each weak and robust arms — stays elevated, making the present dip a higher-risk zone for brand spanking new entries.

Thus, NUPL turns into a pivotal indicator for monitoring potential bullish continuation. Look ahead to a decisive shift.

![Is Worldcoin’s [WLD] 30% rally a prelude to ‘FOMO-driven’ development to $1? Is Worldcoin’s [WLD] 30% rally a prelude to ‘FOMO-driven’ development to $1?](https://i2.wp.com/ambcrypto.com/wp-content/uploads/2025/04/glassnode-studio_wld-net-transfer-volume-from-to-exchanges.png?resize=1024,1024&ssl=1)