In a brutal flip, Mantra [OM] plunged over 90% in 24 hours, wiping out $68M in worth.

Co-founder JP Mullin blamed “reckless” liquidations, denying any wrongdoing – however buyers stay skeptical. With charts in free fall and sentiment crashing, many are calling it a reside rug pull.

Whether or not it’s misplaced confidence or one thing worse, the Mantra collapse is the newest cautionary story in crypto.

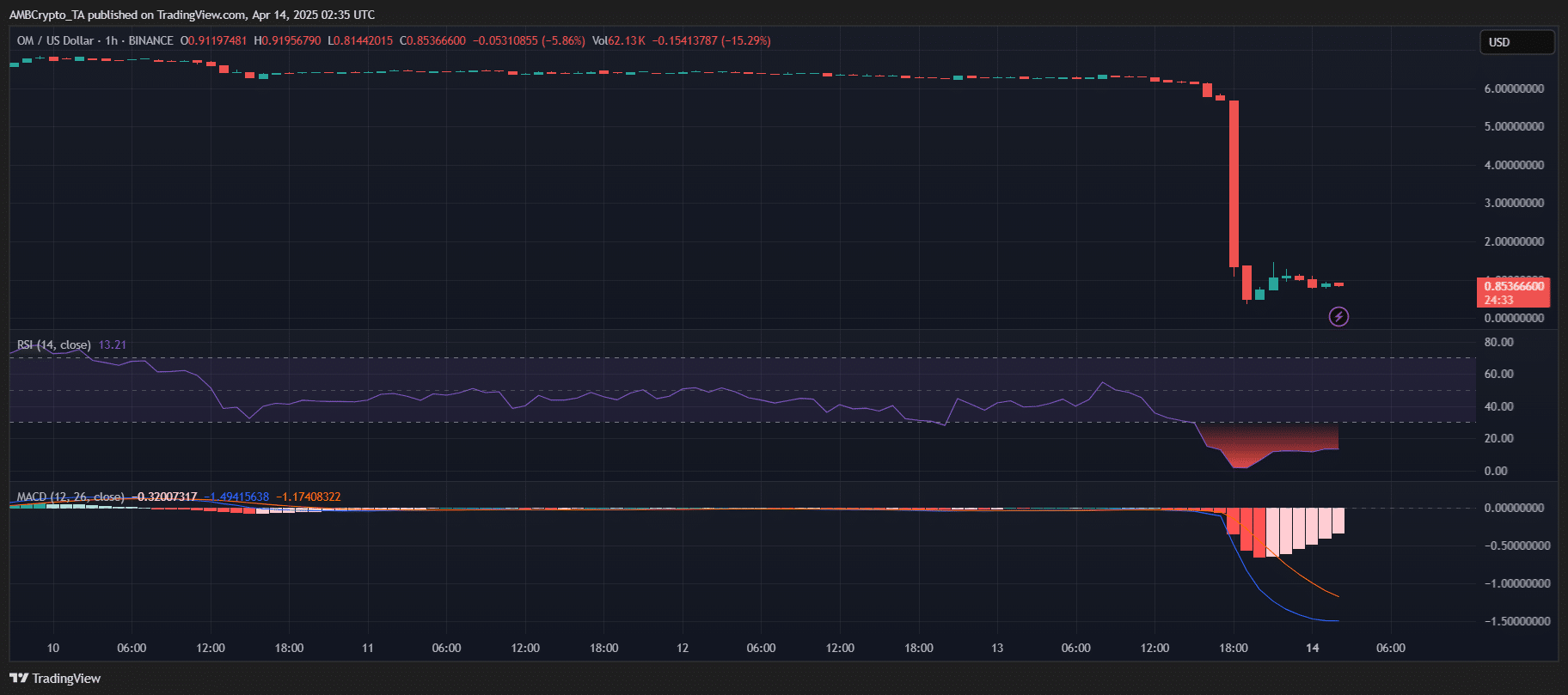

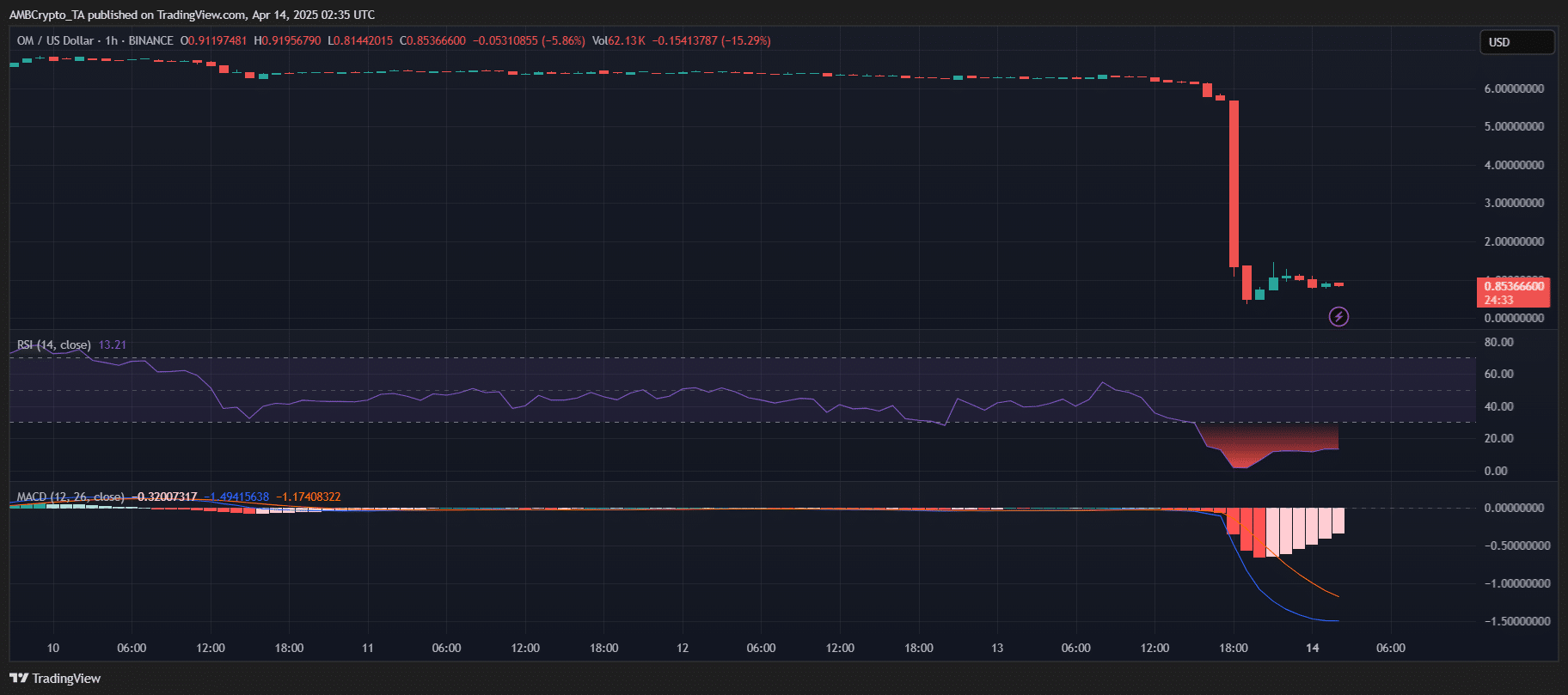

OM is in a demise spiral

Supply: TradingView

The dramatic crash of Mantra’s OM token — from round $6.30 to as little as $0.50 — has triggered chaos throughout leverage-heavy crypto markets.

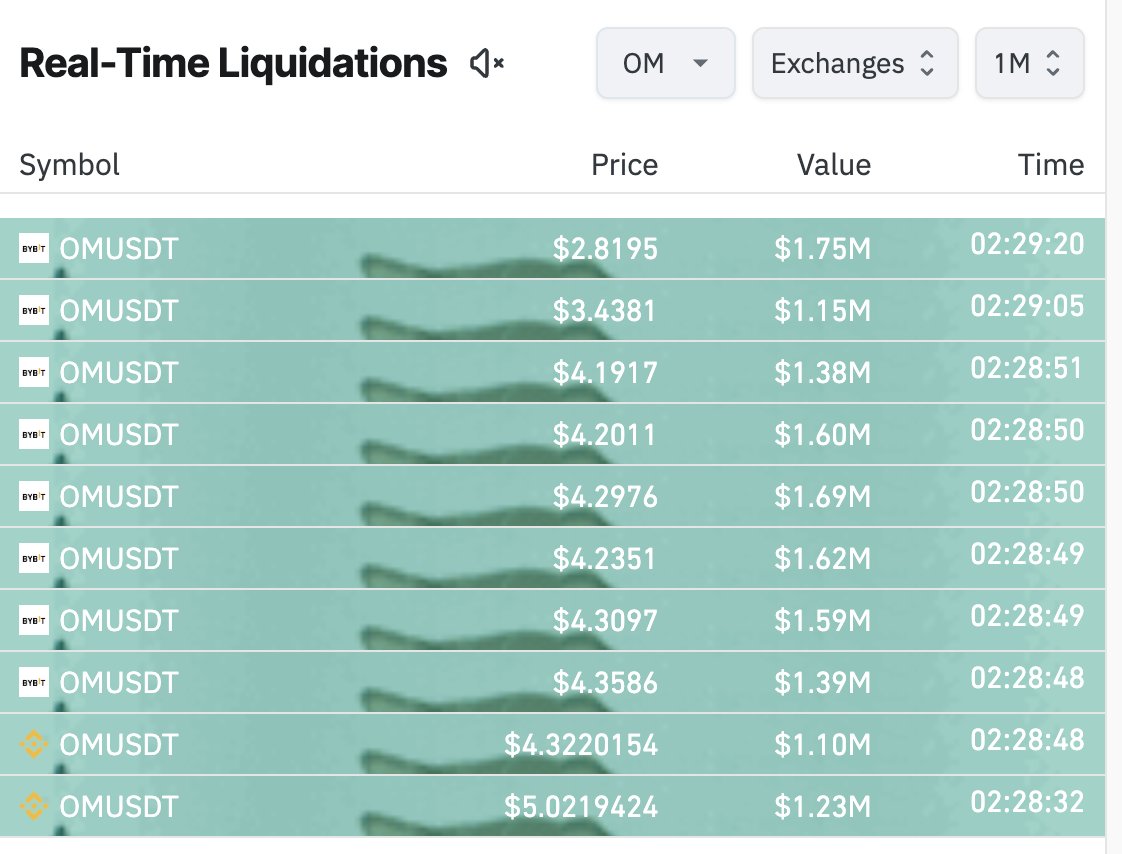

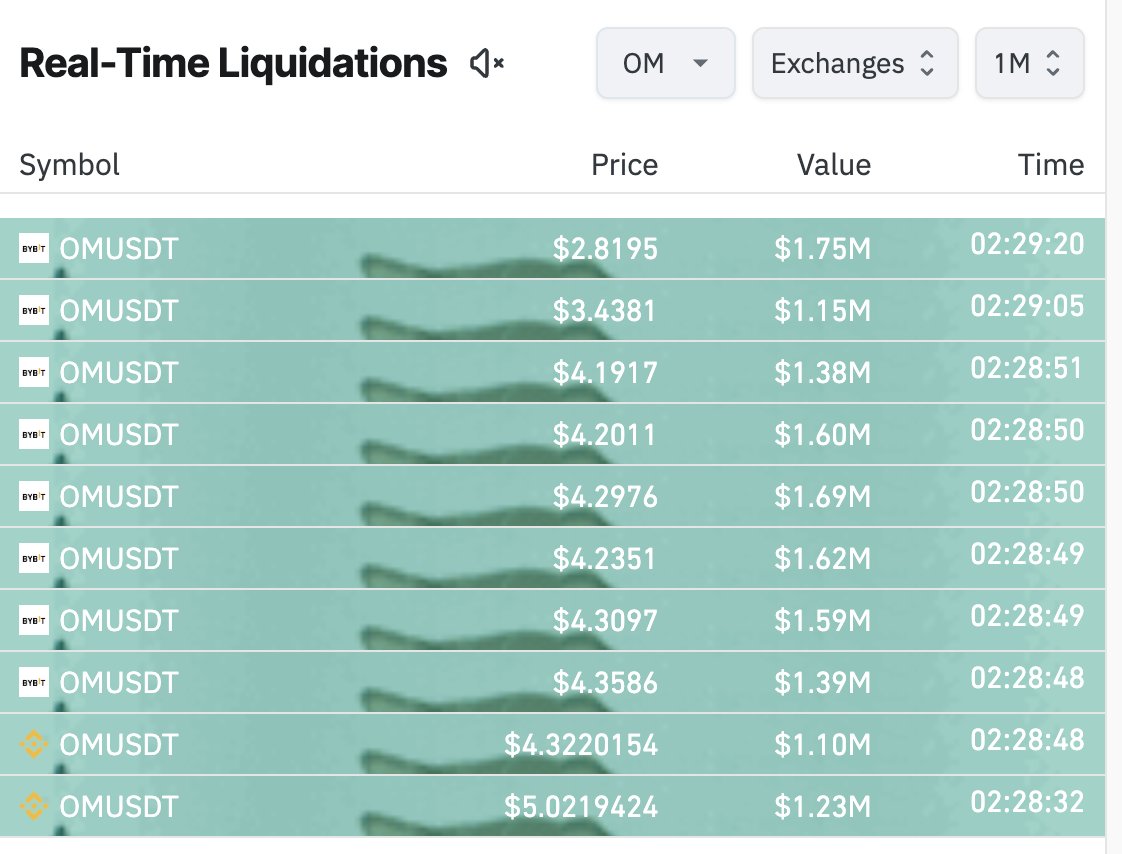

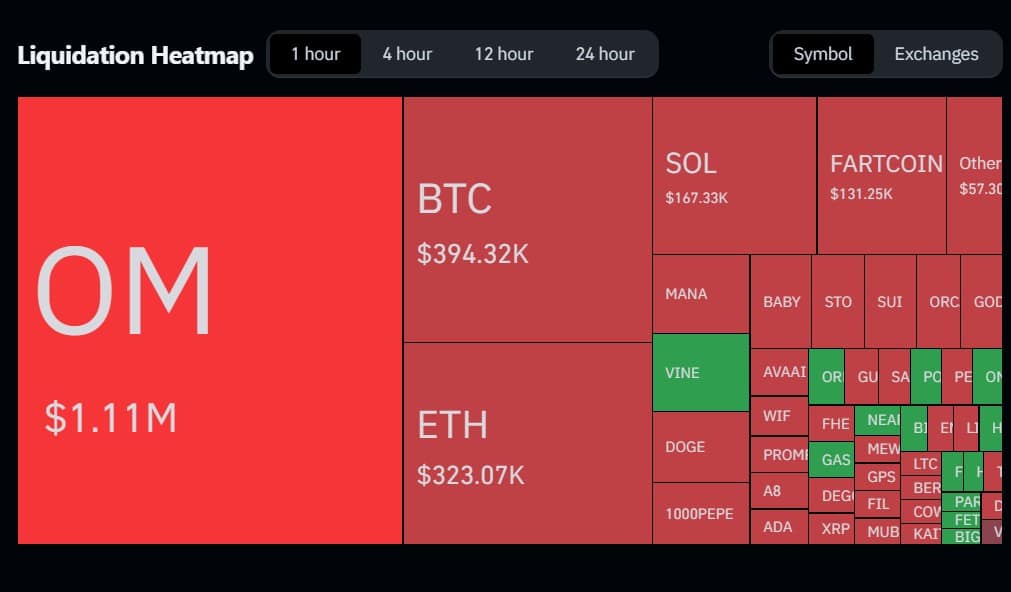

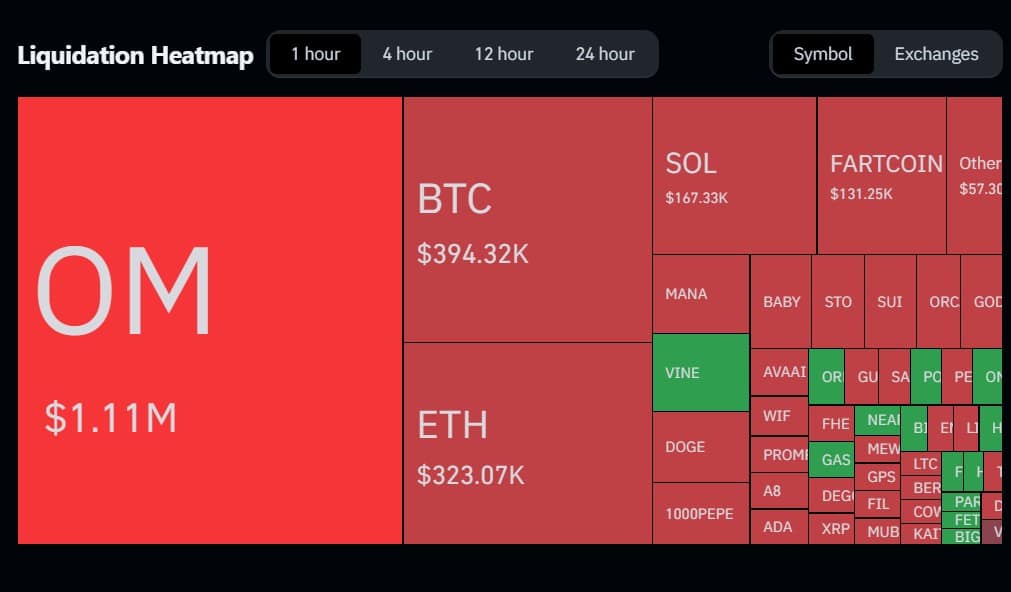

OM not solely suffered the biggest worth drop but additionally led the liquidation heatmap. Inside simply 12 hours, merchants liquidated over $68 million in lengthy positions, together with greater than 10 trades exceeding $1 million.

Supply: X

Previously hour alone, $1.11 million value of OM lengthy positions had been forcibly closed, surpassing even Bitcoin [BTC] and Ethereum [ETH] in liquidation quantity.

Supply: Coinglass

The speedy plunge caught over-leveraged merchants off guard, triggering a series response of margin calls as OM nosedived via key help ranges.

Different tokens like Solana [SOL] and even the joke coin Fartcoin [FARTCOIN] noticed liquidations – however none got here near OM’s scale. It’s a uncommon sight when BTC and ETH are relegated to supporting roles within the liquidation leaderboard.

The chaos could have began with a 3.9 million OM deposit from a attainable crew pockets to OKX.

With practically 90% of the provision allegedly managed by the crew – and a historical past of market manipulation, delayed airdrops, and discounted OTC offers – panic promoting rapidly escalated.

As OTC patrons went underwater, a wave of exits could have triggered cascading liquidations.

Mantra blames CEXs, however the market cries rug pull

JP Mullin, co-founder of Mantra Chain, defended the mission after OM’s $1.11M liquidation crash, blaming “reckless compelled closures” by centralized exchanges throughout low-liquidity hours. He insisted tokens stay locked underneath vesting schedules and claimed the crew, buyers, and advisors didn’t promote.

However merchants aren’t shopping for it.

On X, accusations of manipulation exploded. Outstanding market watcher, AltcoinGordon, in contrast the collapse to earlier disasters:

“Greatest rug pull since LUNA/FTX??”

One other consumer referred to as OM “one of many greatest scams I’ve ever seen in crypto,” accusing the crew of OTC dumping and demanding “the crew belongs in jail after this.”

Screenshots on-line claimed 90% of OM’s provide was dumped, and Mantra deleted its Telegram, fueling exit rip-off fears. One put up went so far as branding the state of affairs: “Welcome to Terra Luna V.2.”

Market commentator Miles Deutscher referred to as the OM crash a textbook case of inflated valuations. He burdened that liquidity issues greater than market cap.

“The chart didn’t look regular for a while,” he famous, pointing to a broader difficulty of costs diverging from fundamentals. As belief in OM fades, he sees potential for capital to rotate into extra credible RWA protocols.

Identical script, totally different token

From Terra Luna’s catastrophic $60 billion crash in 2022 to FTX’s prison downfall, crypto has confronted quite a few rug pulls.

Now, comparisons to previous occasions are rising as OM faces a $1.1 million liquidation and allegations of insider dumping.

Whether or not it’s a deliberate rip-off or real market dislocation, one factor stays clear: the crypto market is unforgiving and swift in its judgment.