- The $0.55 provide zone was highlighted as a vital resistance on a number of fronts.

- For dogwifhat, the shopping for stress in latest days was not robust sufficient to sign a development reversal.

The memecoin market noticed some aid over the previous 24 hours of buying and selling. At press time, CoinMarketCap information confirmed that the meme sector noticed an almost 2% improve in market cap and an 8.5% improve in every day buying and selling quantity.

This got here after a Bitcoin [BTC] bounce past the $82.5k resistance on the eleventh of April.

dogwifhat [WIF] has rallied 9% in 24 hours, nevertheless it nonetheless had a bearish outlook on the upper timeframes. The Solana [SOL] -based meme adopted SOL’s 18% transfer larger over the previous three days.

Ought to WIF merchants anticipate the momentum to be sustained over the approaching week?

Merchants would doubtless be extra worthwhile promoting than shopping for WIF

![Mapping dogwifhat’s [WIF] highway forward: Is it time for merchants to promote at… Mapping dogwifhat’s [WIF] highway forward: Is it time for merchants to promote at…](https://ambcrypto.com/wp-content/uploads/2025/04/PP-4-WIF-daily.png)

Supply: WIF/USDT on TradingView

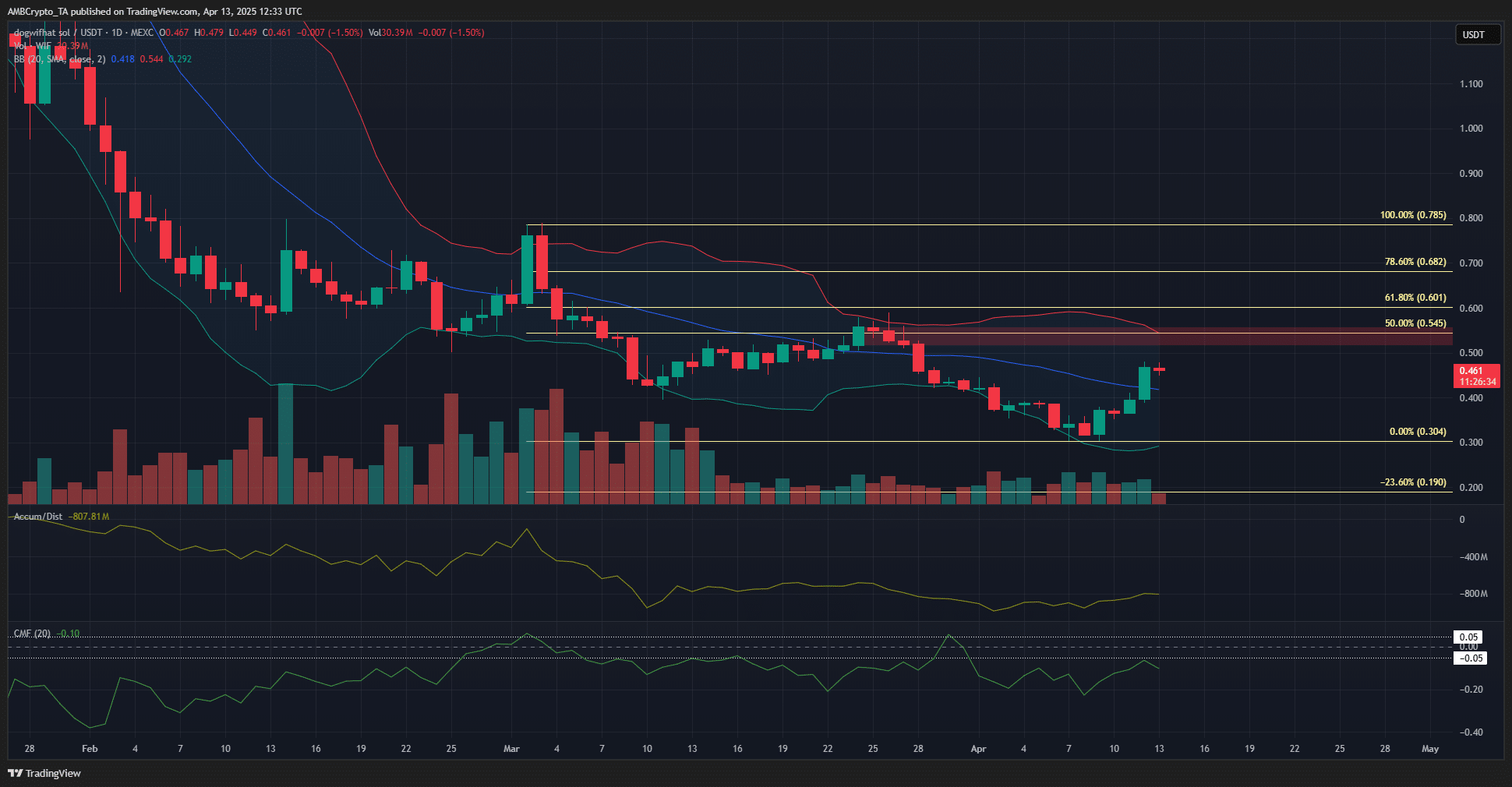

Regardless of the latest positive factors, dogwifhat labored beneath a bearish construction on the every day chart, like many different altcoins. The losses in latest weeks had been too extreme to get better, and merchants and buyers could be higher off in search of promoting alternatives.

Technical evaluation helped slim down the place these alternatives could current themselves.

Highlighted in pink, the bearish order block at $0.55 coincided with the 50% Fibonacci retracement stage, plotted primarily based on the previous six weeks’ downtrend. It additionally had confluence with the higher Bollinger Band.

The A/D indicator noticed a bounce in April however couldn’t climb above the latest excessive set within the third week of March. This confirmed some shopping for stress, however no dominance from them.

The CMF was extra scathing. It has been beneath -0.05 for almost all of the previous three months. Collectively, the amount indicators underlined the regular promoting stress and the dearth of bullish energy.

Merchants can use the $0.5-$0.55 area to promote WIF.

Supply: Coinglass

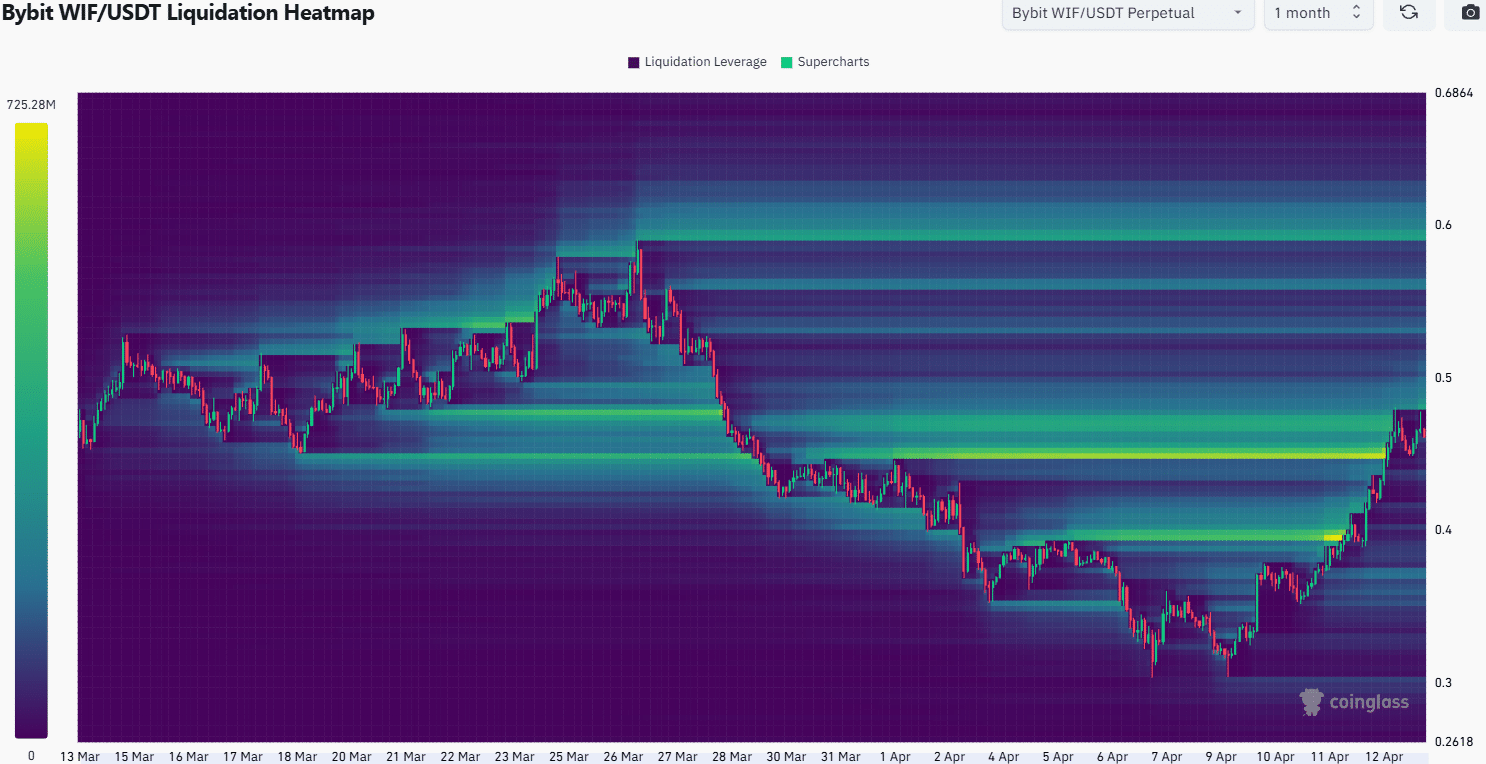

The 1-month liquidation heatmap confirmed that the $0.45-$0.47 area had been full of brief liquidations. After sweeping this stage, WIF bulls had been in a position to preserve costs above $0.42, as an alternative of seeing their positive factors worn out rapidly. The BTC worth transfer larger might have influenced market sentiment.

The build-up of liquidity round $0.48-$0.5 marked it as a short-term goal. Additional north, the $0.6 stage was the following notable liquidity pocket. Given the confluence of resistances round $0.55 and weak demand, a breakout appeared unlikely.

If WIF can consolidate round $0.46 over the following 24-48 hours, the liquidity round $0.5 would doubtless develop thicker. This state of affairs of WIF consolidation over the following day, adopted by a worth bounce and a bearish reversal thereafter, appeared the almost definitely short-term consequence.

Merchants seeking to brief the memecoin want to look at the $0.5-$0.55 space, in addition to the development of BTC, to find out if promoting could be a possible choice or not.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

![Mapping dogwifhat’s [WIF] highway forward: Is it time for merchants to promote at… Mapping dogwifhat’s [WIF] highway forward: Is it time for merchants to promote at…](https://i0.wp.com/ambcrypto.com/wp-content/uploads/2025/04/PP-4-WIF-daily.png?resize=1024,1024&ssl=1)