Regardless of latest chaos and fears of a recession, public corporations Technique and Metaplanet are doubling down on new Bitcoin purchases. Technique bought BTC value $285 million, whereas Metaplanet spent $26.3 million.

Metaplanet’s exercise is especially noteworthy as a result of Japan’s 30-year treasury yields are hovering. For public corporations in Japan, typical financial apply is to drag again from the greenback, however committing to Bitcoin is a daring technique.

Technique (previously MicroStrategy) is without doubt one of the world’s largest Bitcoin holders, and it’s been going by means of a chaotic interval. In latest weeks, it has alternated between large BTC purchases and abrupt acquisition pauses, prompting an excessive amount of hypothesis.

Right now, nonetheless, its Chair, Michael Saylor, introduced a serious new Bitcoin purchase at $285 million:

“Technique has acquired 3,459 BTC for ~$285.8 million at ~$82,618 per bitcoin and has achieved BTC Yield of 11.4% YTD 2025. As of 4/13/2025, Technique holds 531,644 BTC acquired for ~$35.92 billion at ~$67,556 per bitcoin,” Saylor claimed through social media.

Numerous this chaos is because of fears of a US recession, which has made the worth of Bitcoin swing wildly. When Bitcoin was down, it prompted hypothesis that MicroStrategy could should dump its belongings.

Nonetheless, since BTC has began to get well, Michael Saylor’s agency is again available on the market.

Critically, Technique isn’t alone in its Bitcoin acquisitions. Metaplanet is a Japanese agency with substantial BTC holdings and ambitions to amass much more.

Two days earlier than Technique made its personal main buy, Metaplanet CEO Simon Gerovich introduced an identical funding:

“Metaplanet has acquired 319 BTC for ~$26.3 million at ~$82,549 per bitcoin and has achieved BTC Yield of 108.3% YTD 2025. As of 4/14/2025, we maintain 4525 BTC acquired for ~$386.3 million at ~$85,366 per bitcoin,” Gerovich claimed.

Metaplanet’s dedication right here is especially noteworthy as a result of it contradicts near-term macroeconomic headwinds. The worldwide market is full of risk-averse conduct proper now, and Japan’s 30-year bond yields surged to the very best stage in over 20 years.

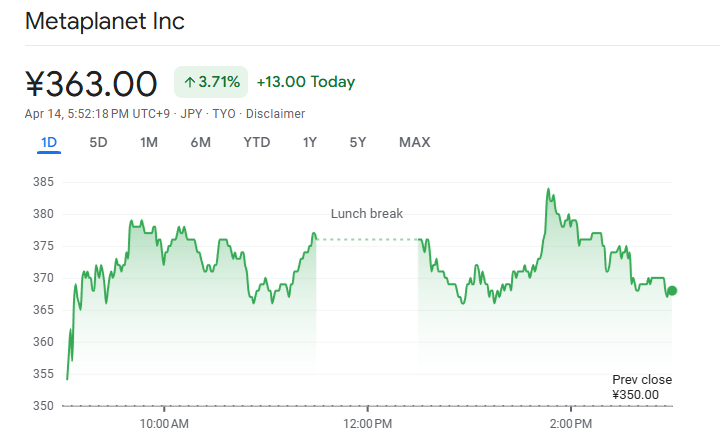

Regardless of this clear sign, the Japanese Metaplanet is continuous to make main Bitcoin investments. The newest purchases additionally had a optimistic influence on the corporate’s inventory market. It’s at present up by 3% in the present day, after struggling notable losses the previous month.

Briefly, main company Bitcoin holders like Technique and Metaplanet aren’t considering really fizzling out but. Regardless of the latest chaos, there’s critical confidence that BTC will both acquire in worth or characterize a secure retailer of worth.

Both means, when public companies like this publicly take a bullish stance, it may well shore up confidence throughout the whole market.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.