After reaching an area cycle excessive of $0.049 in January, XCN entered a downtrend, shedding vital worth over the following few months. The decline culminated in a pointy drop to a low of $0.007 on April 7. Nevertheless, that marked a turning level.

Since then, the demand for the altcoin has soared, pushing its worth up 171%. With rising bullish momentum, XCN seems poised to increase these positive aspects.

XCN Breaks Out With Bullish Momentum

Since bottoming out, XCN has rebounded strongly, breaking above a key descending resistance development line. The breakout triggered a bullish transfer that has pushed the altcoin to document vital positive aspects over the previous week.

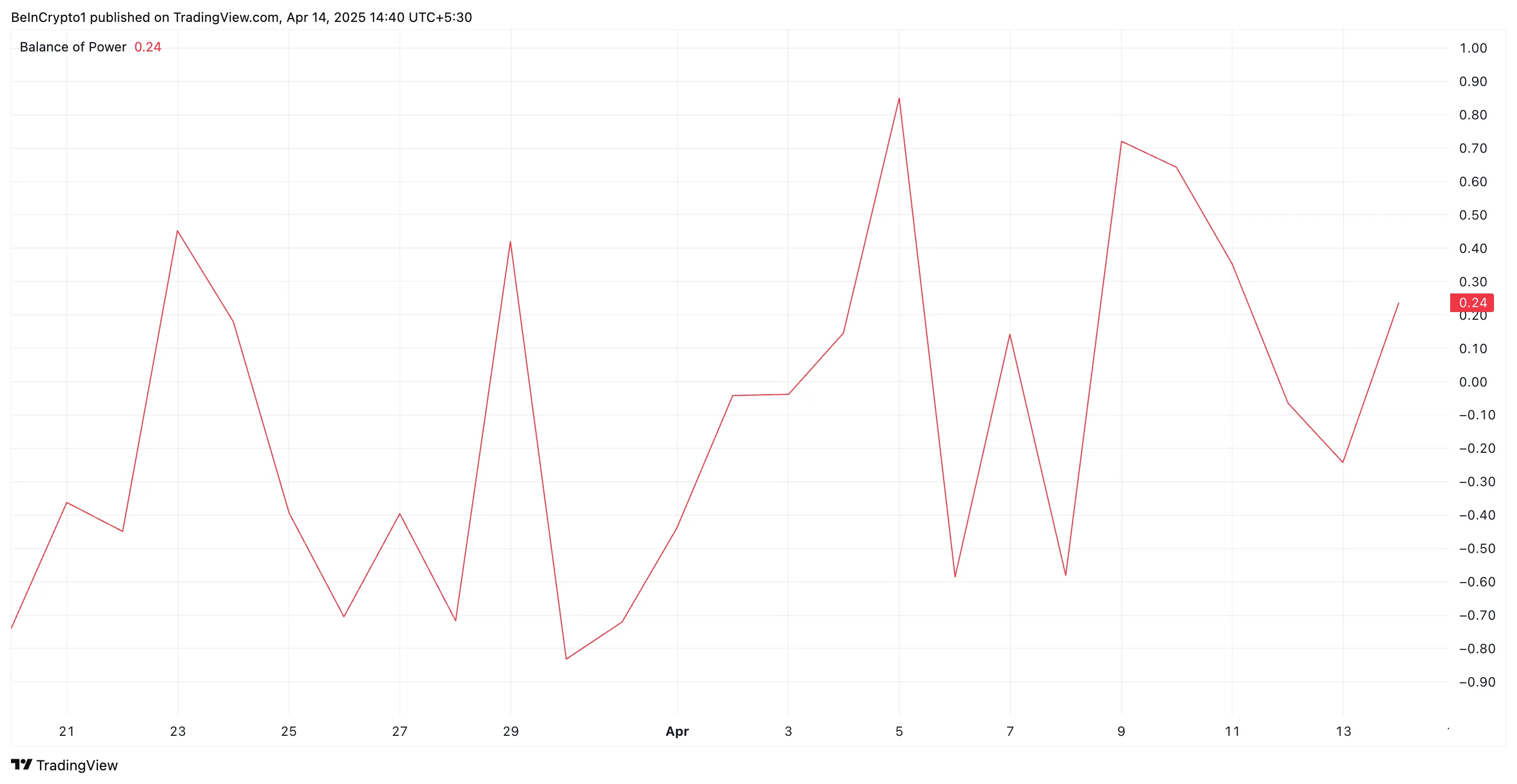

On the each day chart, XCN’s Stability of Energy (BoP) helps the continuing rally. At press time, this momentum indicator, which measures shopping for and promoting pressures, is above zero at 0.24.

When an asset’s BoP is optimistic, it signifies that patrons are in charge of the market, exerting extra strain than sellers. It is a bullish signal, suggesting that XCN’s upward worth motion is being pushed by sturdy demand.

A constantly optimistic BoP for the token would point out sustained shopping for momentum, which, if maintained, might result in continued worth progress.

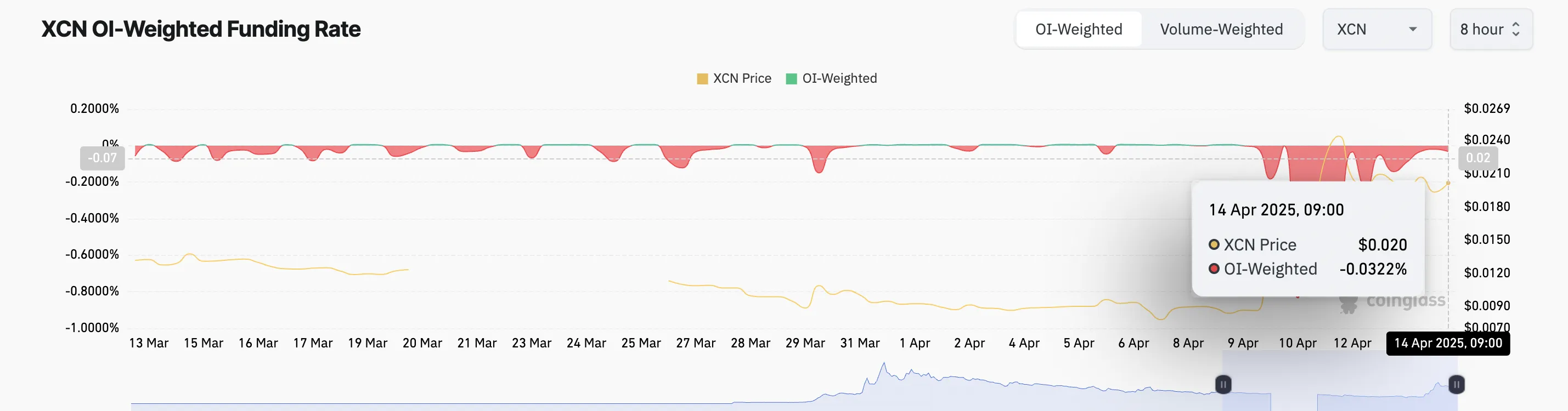

Nevertheless, XCN’s derivatives merchants don’t share this bullish bias. The token’s persistently damaging funding fee displays this. This stands at -0.032% at press time, highlighting the demand for brief positions.

The funding fee is a periodic cost exchanged between lengthy and brief place holders in perpetual futures contracts. It’s designed to maintain the contract’s worth in step with the asset’s spot worth.

When the funding fee is damaging like this, brief place holders are paying lengthy place holders, indicating that the market is bearish, with extra merchants betting on worth declines.

XCN’s climbing shopping for strain and damaging funding fee sign a divergence between spot market sentiment and derivatives market positioning. This development means that whereas the broader derivatives market expects a worth decline, precise shopping for exercise on the spot market is driving upward momentum, setting the stage for a brief squeeze if the rally continues.

XCN Worth Pushes Previous 20-Day EMA, Merchants Eye Continued Rally

XCN’s rally over the previous week has pushed its worth above the 20-day exponential shifting common (EMA). The 20-day EMA measures an asset’s common buying and selling days over the previous 20 buying and selling days, giving extra weight to current costs. When the worth climbs above it, it indicators that purchasing strain is excessive.

As XCN breaks above this degree, it confirms that the asset is coming into an uptrend. Merchants usually search for any such crossover as an indication of bullish energy, indicating elevated shopping for strain and a doable continuation of the rally.

If XCN maintains its uptrend, it might commerce at $0.023.

Alternatively, if the uptrend faces a correction, XNC might fall to $0.016.

Disclaimer

In step with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.