This week, a number of prime crypto information occasions are within the lineup, with tales spanning varied ecosystems and having value implications for involved tokens. From Jupiter and Orca decentralized exchanges (DEX) to PolitiFi meme coin TRUMP, a number of developments are already within the pipeline.

The next roundup provides merchants and traders the first-mover benefit to capitalize on the volatility round these occasions.

Jupiter Cellular V2 and Product Launches

Jupiter, a Solana-based decentralized alternate aggregator, is ready to announce a number of product launches this week, with the highlight on Jupiter Cellular v2.

This upgraded cellular utility goals to boost consumer expertise (UX) with a extra intuitive interface, sooner transaction processing, and seamless entry to Jupiter’s liquidity aggregation instruments.

The Jupiter cellular V2 launch is predicted to incorporate superior options like improved token swap routing, real-time market knowledge, and enhanced pockets integration. These options would cater to each novice and skilled merchants.

Jupiter’s concentrate on cellular accessibility aligns with its mission to make DeFi extra inclusive, probably driving larger consumer choices. The brand new product suite can also introduce governance enhancements for the JUP token, strengthening group participation within the Jupiter DAO.

Forward of this growth, Jupiter’s JUP token traded for $0.39, down by virtually 2% within the final 24 hours.

Nonetheless, with Solana’s high-speed, low-cost blockchain as its spine, Jupiter Cellular v2 might set a brand new customary for DeFi cellular platforms. Particularly, it might enhance buying and selling quantity and ecosystem engagement.

These launches mirror Jupiter’s dedication to innovation and its function as a key participant in Solana’s DeFi taking part in area, positioning it to compete with prime aggregators like Uniswap.

EigenLayer Slashing Improve

EigenLayer, an Ethereum-based restaking protocol, can also be amongst this week’s prime crypto information. The community will activate its Slashing Improve on Thursday, April 17, introducing a vital mechanism to penalize validators who act maliciously or fail to satisfy efficiency requirements.

“Protocol-complete change into actuality on April seventeenth with the launch of Slashing on EigenLayer,” the community shared not too long ago.

The transfer would improve the protocol’s safety and reliability. Slashing ensures that staked belongings are protected by discouraging behaviors like double-signing or downtime, which might undermine belief in EigenLayer’s restaking ecosystem.

The improve might additionally bolster confidence amongst customers who delegate their Ethereum (ETH) to operators, because it aligns incentives for trustworthy participation.

The Slashing Improve can also refine EigenLayer’s threat administration framework, probably attracting extra institutional curiosity in restaking.

By strengthening its infrastructure, EigenLayer goals to keep up its edge in aggressive staking, the place protocols like Lido and Rocket Pool additionally vie for dominance.

Neighborhood discussions on X spotlight anticipation for improved stability, although some customers speculate about short-term volatility in EIGEN token costs resulting from market reactions.

As of this writing, EigenLayer’s powering token, EIGEN, was buying and selling for $0.82. This represents a drop of over 2% within the final 24 hours.

However, this improve marks a pivotal step in EigenLayer’s evolution, reinforcing its function in Ethereum’s scaling and decentralization efforts.

Fluid Dynamic Charges Implementation

The Fluid ecosystem can also be among the many prime crypto information tales this week. The rising decentralized alternate is rolling out its dynamic charges implementation this week, a transfer anticipated to optimize buying and selling effectivity and enhance platform exercise.

“Lending, borrowing, and incomes buying and selling charges — multi function transfer? That’s what Fluid is unlocking. No idle belongings. No missed alternatives. Simply pure DeFi effectivity,” famous one consumer in a submit.

Not like static charge fashions, dynamic charges regulate in real-time based mostly on market situations, volatility, and li uidity. This ensures fairer pricing for merchants and incentivizes liquidity suppliers.

This method reduces slippage and enhances capital effectivity, making Fluid extra aggressive in opposition to established DEXs like Uniswap and Curve.

“… the ETH/USDC pool on Fluid has generated about the identical charges because the Uniswap pool. This occurred as a result of we analyzed LP efficiency throughout totally different charge tiers through the years, and the info confirmed that the 0.05% charge tier was too low for this pair. We’re planning to roll out dynamic charges quickly, however within the meantime, we’ve elevated the charge to 0.1%. Because of this, volumes dipped barely, however charges elevated considerably. With dynamic charges, we count on to seize much more quantity and generate much more charges,” wrote Fluid COO DMH in a latest submit.

The implementation might appeal to a broader consumer base by providing cost-effective trades throughout low-volatility intervals whereas sustaining stability throughout market spikes.

Nevertheless, the success of this rollout will rely on seamless execution and consumer adoption, as overly advanced charge changes might deter retail merchants.

KernelDAO Token Launch and S1 Airdrop

Additionally on the leaderboard on this week’s prime crypto information is KernelDAO, the mission behind Okay DAO. It’s launching its KERNEL token at present, April 14, accompanied by the Season 1 (S1) airdrop.

This crypto airdrop targets early supporters and group contributors. The token serves because the spine of KernelDAO’s decentralized ecosystem, enabling governance and incentive participation in its knowledge storage and computation community.

The S1 airdrop rewards customers who earned Kernel Factors or Kelp Grand Miles earlier than December 3, 2024. These assembly the 150-point threshold obtain a minimal of 100 KERNEL per eligible pockets.

This launch goals to distribute 10% of the entire token provide, fostering widespread adoption and group engagement.

KernelDAO’s concentrate on decentralized infrastructure positions it as a competitor to initiatives like Filecoin (FIL) and Arweave (ARV).

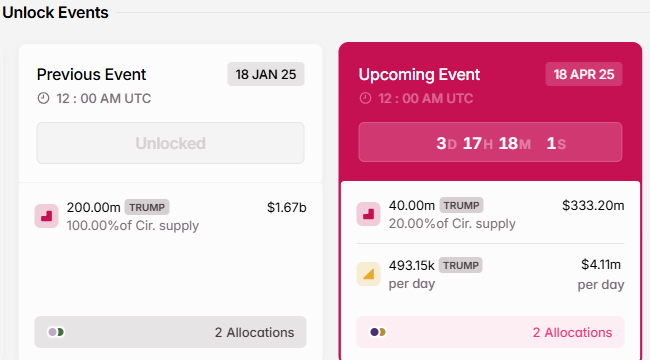

$332 Million Value TRUMP Unlocks

So as to add to the checklist, $332 million price of TRUMP tokens can be unlocked this week, introducing important liquidity to the market. Particularly, on Friday, April 18, the community will unlock 40 million TRUMP tokens, constituting 20% of its circulating provide.

The tokens can be allotted to creators and CIC Digital 1, an affiliate of the Trump Group that controls a good portion of TRUMP tokens.

Token unlocks usually result in value volatility as newly accessible tokens enter circulation, probably prompting sell-offs by early traders or speculators.

Whereas the TRUMP unlock might gas short-term value swings, it might additionally present alternatives for brand new traders to enter at adjusted valuations.

Voting Closes for Orca’s 25% Provide Burn

Orca, a Solana-based DEX, can also be among the many prime crypto information tales this week. Voting on the proposal to burn 25% of its complete token provide concludes at present.

“We’re now within the remaining stretch. Your vote could be the one which seals the way forward for ORCA staking, rewards & protocol progress. Vote earlier than 10:45 am ET April 14,” the community shared.

The mission goals to cut back its token provide to extend shortage, probably supporting long-term value appreciation and rewarding loyal holders.

Token burns are a typical DeFi technique to align incentives. Nevertheless, in addition they carry dangers if not paired with ecosystem progress.

The proposal has sparked energetic bate. Supporters argue it strengthens Orca’s worth proposition in opposition to rivals like Raydiu (RAY). In the meantime, critics warn of decreased liquidity for buying and selling pairs.

If accepted, the burn might improve Orca’s attraction to traders looking for sustainable DeFi initiatives. Nevertheless, its success will rely on Orca’s capacity to keep up excessive buying and selling quantity and innovate with options like concentrated liquidity swimming pools.

The vote’s end result will sign Orca’s strategic route and affect sentiment throughout Solana’s DeFi ecosystem.

“Onchain governance is going on,” Solana blockchain’s X account quipped.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.