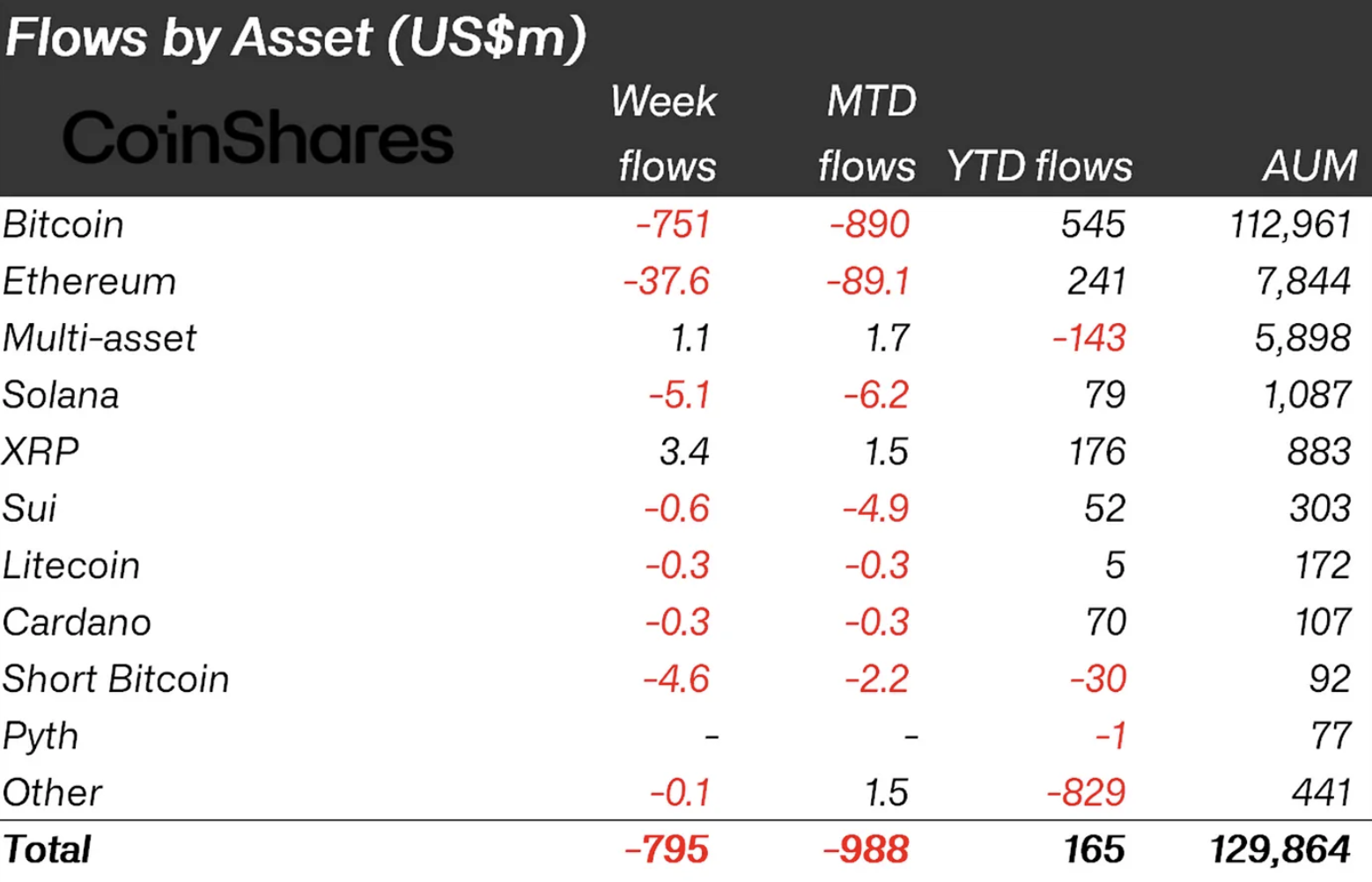

Whereas the digital asset funding area continued to lose capital for the third week in a row, posting $795 million in outflows and dragging the month-to-date determine near the billion mark, a couple of belongings managed to reject the pattern — and proper on the prime of that brief record was XRP, which attracted $3.4 million in inflows whereas virtually all the pieces else went the opposite manner.

That type of divergence doesn’t normally present up so clearly, particularly in every week like this the place damaging sentiment is kind of all over the place directly.

Flows have been down throughout international locations, down throughout suppliers and down throughout just about each main asset besides a handful of small altcoins — however XRP not solely prevented the hit, it led all non-Bitcoin tokens in web inflows, as reported by CoinShares.

In every week that noticed america pull $763 million out of crypto ETPs alone, that stands out.

The bigger market narrative has not modified a lot. Since early February, when outflows actually picked up, the sector has seen $7.2 billion pulled out, which has now worn out practically all the web positive aspects made earlier within the 12 months, bringing year-to-date flows to simply $165 million.

Bitcoin (BTC) once more noticed probably the most strain with $751 million in outflows, adopted by Ethereum with $37.6 million. Solana (SOL), Sui and Litecoin didn’t fare significantly better, all posting losses and even brief Bitcoin noticed outflows — suggesting bearish bets have been being unwound as effectively.

Nonetheless, regardless of the strain, the entire quantity of belongings underneath administration truly rose — not on account of inflows however due to a value rebound towards the tip of the week after the short-term tariff rollback gave the market some respiration room, pushing the determine again as much as $130 billion.