XRP is up 22% previously seven days, with its value reclaiming floor above the $2 mark for the primary time in months. The rally has sparked renewed curiosity, with technical indicators flashing indicators of each power and warning.

Momentum has cooled barely, as proven by the RSI pulling again from near-overbought ranges, however the broader setup stays bullish.

XRP RSI Has Cooled After Nearing Overbought Ranges

XRP’s Relative Power Index (RSI) is at the moment at 60.5, marking a notable cooldown from yesterday’s 67.8.

This comes after a pointy rise from 34.7 simply six days in the past, indicating that XRP just lately went from oversold circumstances to near-overbought ranges earlier than pulling again.

The transfer suggests a fast shift in momentum that will now be stabilizing, probably reflecting short-term profit-taking after a powerful rally.

The RSI is a momentum oscillator that measures the pace and alter of value actions, usually on a scale of 0 to 100.

Readings under 30 are thought-about oversold, suggesting potential undervaluation or exhaustion in promoting strain, whereas readings above 70 point out overbought circumstances, usually signaling a doable correction or slowdown.

With XRP’s RSI now at 60.5, it sits in a neutral-to-bullish zone.

This stage might recommend that whereas the latest bullish momentum has cooled, there may nonetheless be room for upside if shopping for curiosity resumes — but it surely additionally means the asset is not in a super “undervalued” zone for contemporary entries.

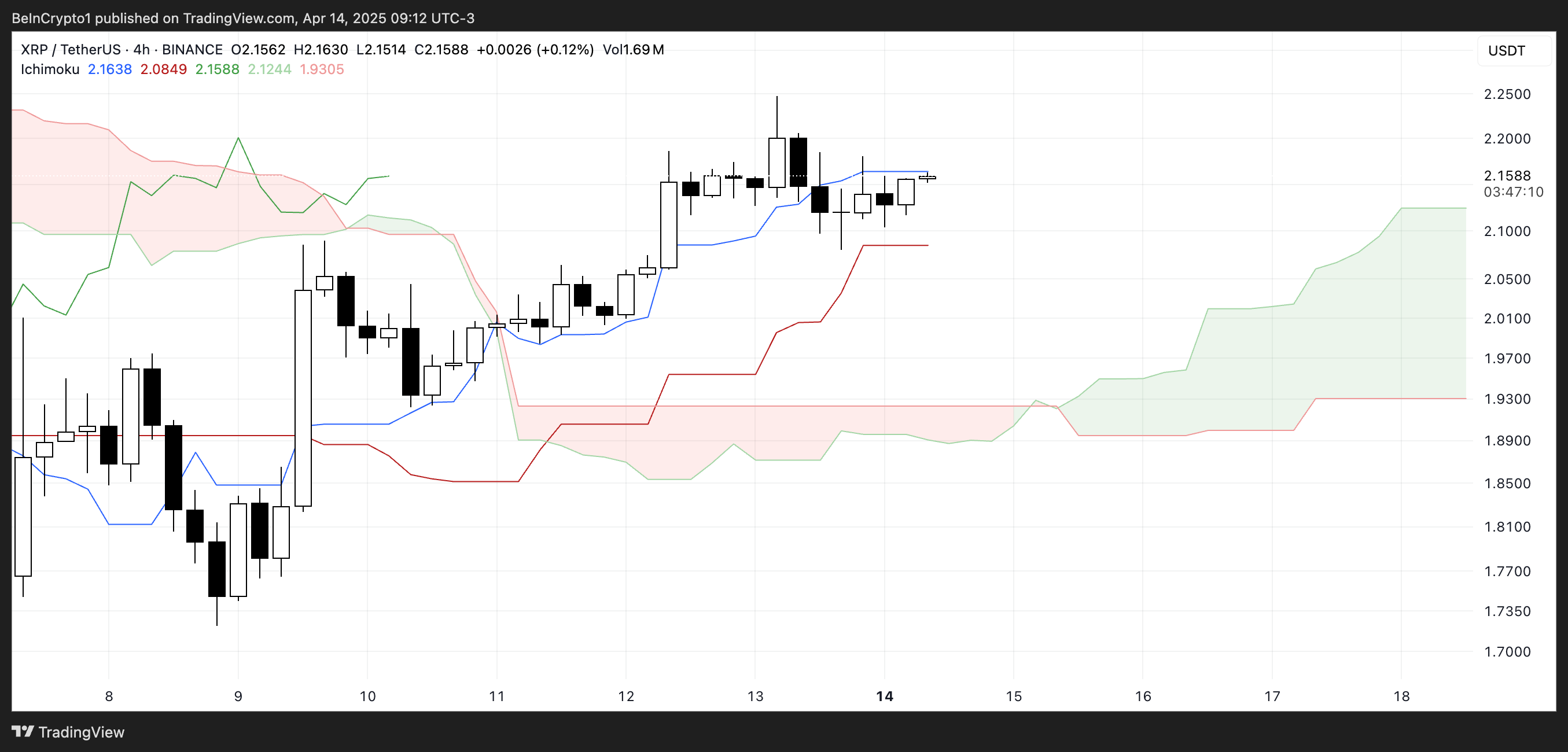

XRP Ichimoku Cloud Reveals a Bullish Setup

The Ichimoku Cloud for XRP at the moment exhibits a bullish setup, with the worth positioned above each the blue conversion line (Tenkan-sen) and the crimson bottom line (Kijun-sen).

This alignment signifies that short-term and medium-term momentum stays in favor of the bulls. The main span A (inexperienced cloud boundary) is above main span B (crimson cloud boundary), forming a inexperienced cloud forward—a basic signal of a bullish development continuation.

Furthermore, the worth has stayed above the cloud for a number of periods, reinforcing the constructive momentum.

Nevertheless, the narrowing hole between the Tenkan-sen and Kijun-sen, together with the flatlining of each strains, means that bullish momentum could also be pausing or weakening within the quick time period.

If the worth continues to consolidate sideways whereas staying above the cloud, it might point out a wholesome consolidation earlier than a possible continuation greater.

However a drop under the Kijun-sen may set off warning, as it will recommend a shift in momentum. For now, the general cloud construction stays supportive of a bullish bias until a deeper pullback pushes the worth again into or under the cloud.

Will XRP Rise To Take a look at $2.50 Quickly?

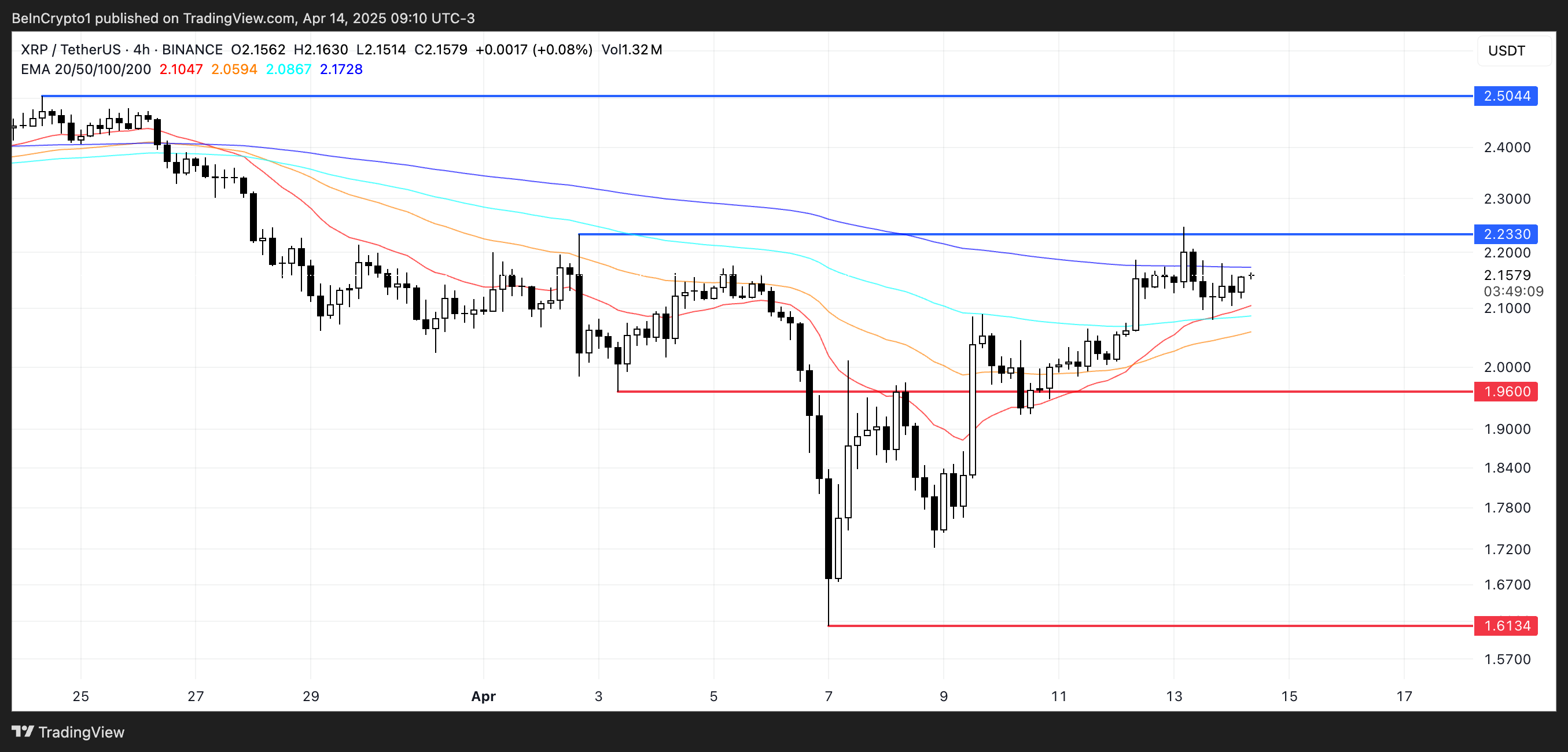

XRP’s EMA strains are tightening, hinting at a possible golden cross formation — a bullish sign that happens when the short-term EMA crosses above the long-term EMA.

This setup usually marks the start of an upward development, particularly when supported by sturdy quantity and constructive momentum.

If the Golden Cross confirms, it may act as a catalyst for the XRP value to push towards greater resistance ranges. The subsequent key space to observe is round $2.23.

A clear breakout above that stage may open the trail towards $2.50, as bullish merchants acquire confidence.

Nevertheless, the momentum wants to carry. If shopping for strain fades and XRP fails to maintain its climb, a pullback may happen, with $1.96 performing as the primary key help to observe.

A breakdown under this stage may shift sentiment bearish within the quick time period, probably dragging the worth down towards $1.61.

Disclaimer

Consistent with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.