Bitcoin (BTC) simply made a transfer that’s arduous to disregard. After three failed makes an attempt to interrupt a cussed downtrend – January, February and March all stated “nope” – BTC formally cracked via on April 15, sending alerts throughout the crypto market that bulls may be waking up.

As of now, BTC is buying and selling round $85,844, up 1.48% on the day. However the true story? The liquidation information.

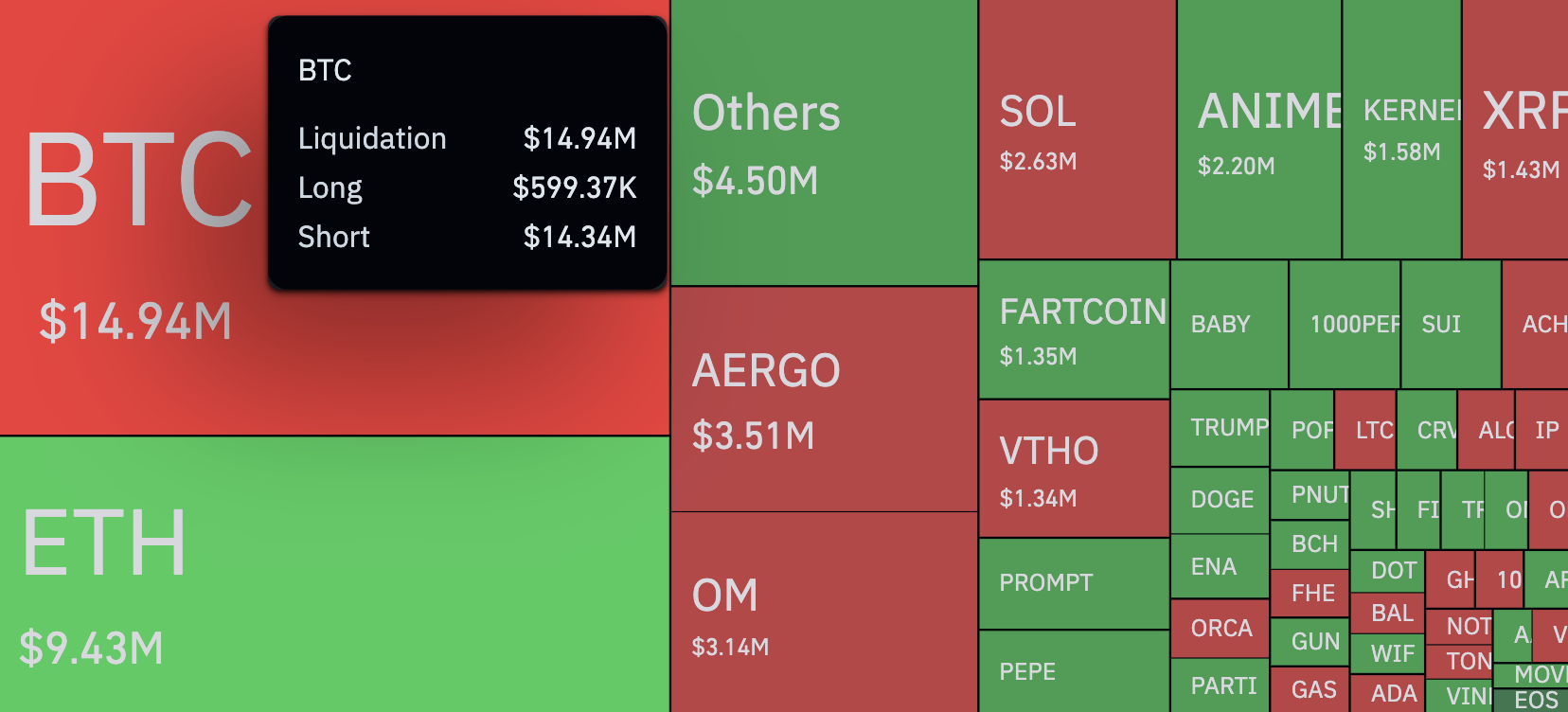

Over the previous 12 hours, $14.94 million in BTC positions had been liquidated, however solely $599,000 had been longs, whereas $14.34 million had been shorts. That’s a 2,131% imbalance – a large brief squeeze that has caught bears off guard.

Zooming out to the broader market, $57.43 million in complete positions had been worn out in the identical 12-hour window, with shorts taking the brunt – $33.61 million versus $23.82 million in longs. Throughout the final 24 hours, liquidation totals hit $188.37 million, with practically 92,000 merchants “rekt.” One commerce acquired hit arduous specifically, with a $3.43 million liquidation on OKX’s BTC/USDT pair, in response to CoinGlass.

What brought on the surge? As talked about, BTC had been testing a descending trendline for the reason that begin of the 12 months. In the present day it broke out cleanly, which means that bears might have overstayed their welcome.

Some merchants are saying that is the beginning of a bullish reversal, particularly since Bitcoin is holding robust above the breakout degree. Others assume this might simply be a brief squeeze with restricted follow-through.

On the finish of the day, this transfer is thrilling, however it is usually dangerous. Brief-term liquidations could cause large value swings, however they don’t assure long-term pattern adjustments.