- Cardano’s FOMO premium is underneath strain, pushed by deteriorating on-chain fundamentals

- Is ADA at rising threat of coming into a broader distribution section?

Regardless of a 28% rebound from its $0.50 low, Cardano [ADA] stays pinned close to a key inflection level. Its current rally, whereas notable, may simply lack a robust follow-through.

Extra critically, ADA’s FOMO issue has been fading quick too. Particularly because it slipped from eighth to tenth by market cap, with the psychological hit being important.

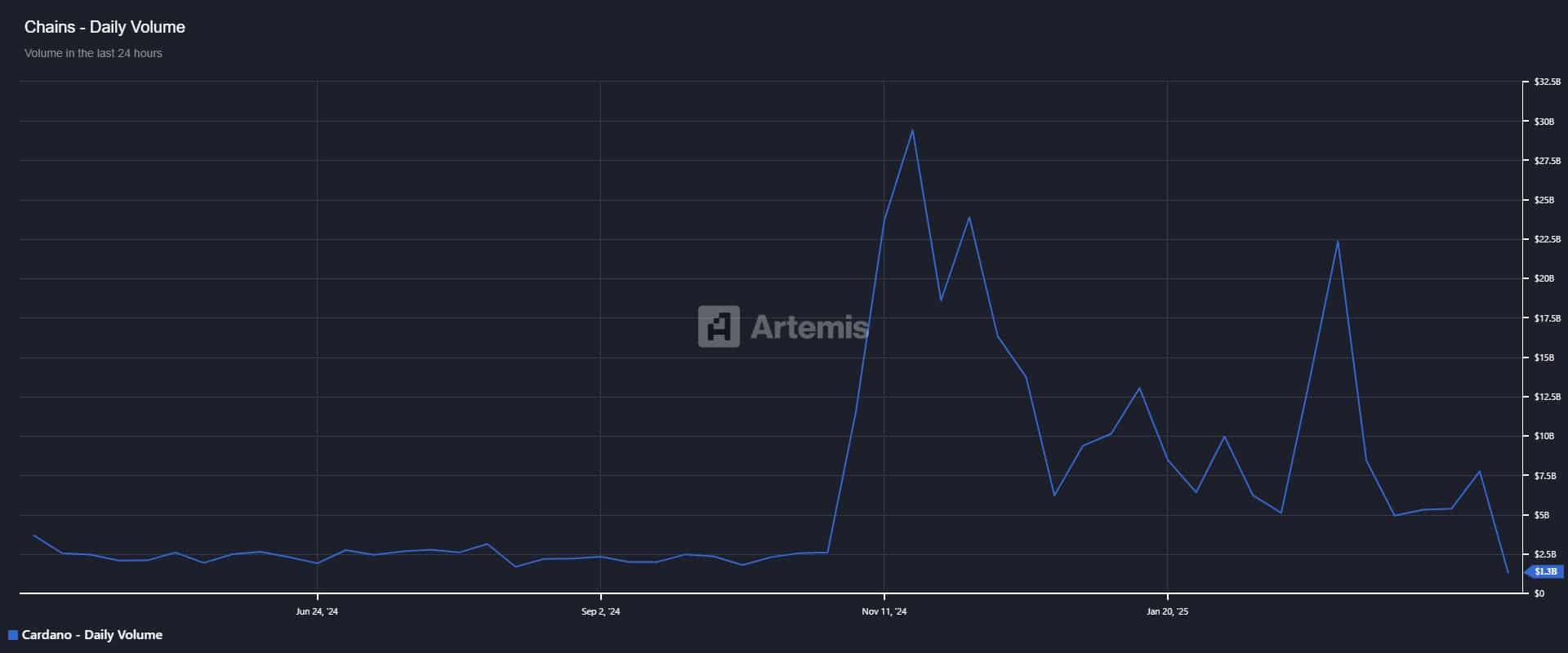

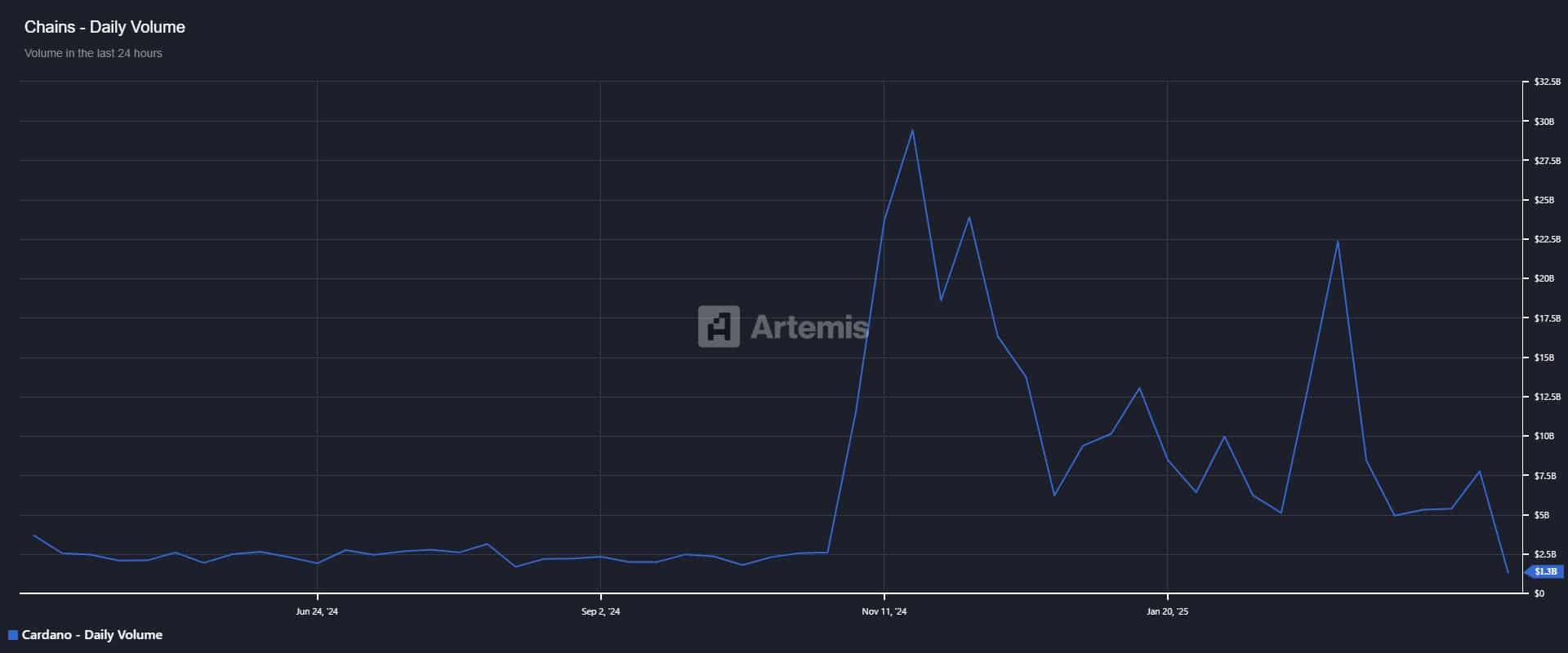

On-chain metrics confirmed this decline. Cardano’s community throughput has fallen to $1.35 billion, retracing to pre-election ranges. In actual fact, it’s down from the $7.80 billion peak recorded on 07 April.

Supply: Artemis Terminal

To place it merely, Cardano has ceded floor to rivals Tron [TRX] and Dogecoin [DOGE]. This has been pushed not by exterior power, however by its personal deteriorating fundamentals and lack of contemporary liquidity coming into the ecosystem.

With ADA’a structural assist underneath risk, the highlight now shifts to ADA’s long-term holders. Are HODLers starting to lose conviction or is that this only a shakeout earlier than reaccumulation?

Key LTH metrics for Cardano’s distribution threat

Curiously, Cardano’s present market worth is hovering across the similar ranges final seen in November – Roughly 5 months in the past.

This locations a good portion of Lengthy-Time period Holders (LTHs), who entered through the election-driven rally, at or close to their value foundation. In consequence, many are actually both sitting at breakeven or holding unrealized losses.

On this context, AMBCrypto examined whether or not Cardano is sliding right into a broader distribution section. Particularly as strain mounts on these LTHs to dump, somewhat than proceed HODLing in hopes of a market rebound.

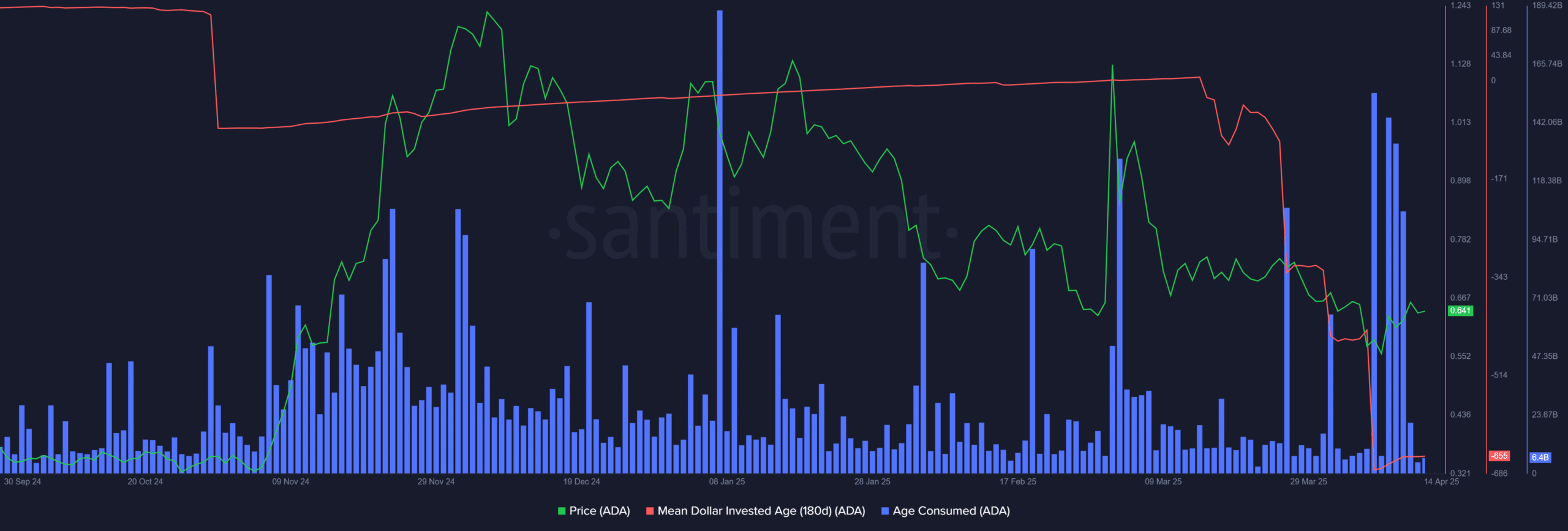

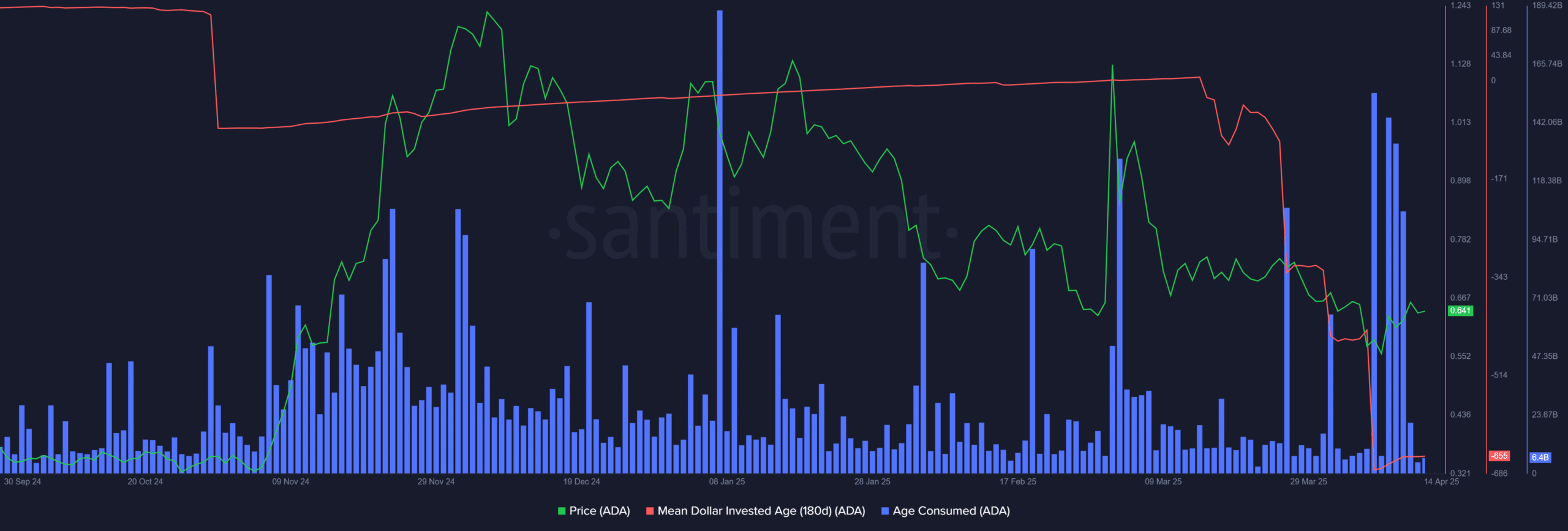

A key sign comes from the Imply Greenback Invested Age (MDIA) – 180 Days, a metric that captures the typical “age” of capital invested in ADA.

Since mid-March, MDIA has proven a pronounced downtrend, aligning with ADA’s failure to carry two important resistance zones. This drop appeared to point that older cash are being moved or bought – A basic hallmark of LTH distribution habits.

Supply: Santiment

Including additional weight to this thesis is the sharp spike in Age Consumed, a metric reflecting the motion of dormant cash. Elevated ranges right here instructed that long-held belongings are being reactivated, signaling strategic offloading by long-term holders.

The mixed decline in MDIA and surge in Age Consumed highlighted rising sell-side strain from conviction wallets – An unmistakable signal of distribution.

Extra critically, as older cash re-enter circulation and Cardano’s community fails to indicate strong accumulation, ADA is perhaps on the cusp of shedding its $0.63 assist.

A breakdown right here would doubtless set off a deeper correction, significantly if any market rebound proves short-lived.