Given the elevated bullishness within the broader crypto panorama, Bitcoin is experiencing renewed upward momentum, pushing the flagship digital asset to key resistance ranges. BTC’s current upward efficiency has reignited optimism and curiosity within the sector. Nevertheless, this bullish sentiment appears to be fading amongst giant BTC traders.

BTC Whales Pulling Again On Lengthy Positions

Bitcoin’s renewed worth progress is receiving controversial reactions from traders and merchants. An insightful evaluation shared by FundingVest, an on-chain professional and verified creator on the X (previously Twitter) platform, has revealed a bearish sentiment amongst Bitcoin whale traders.

Within the X put up, the professional highlighted that whale-long positions have been lowering whilst BTC’s worth witnessed a surge to the $86,000 threshold. This surprising flip of occasions amongst whale merchants suggests a possible shift in conviction or a strategic retreat as a result of present market bearish strain that has elevated the volatility of digital belongings.

Moreover, the change in conduct is perhaps a sign that institutional confidence in BTC is fading, elevating considerations about its current uptrend. In accordance with the professional, the event implies that massive traders is perhaps on the point of go brief or shut off their lengthy bets.

Though the whales are banking on a pullback, retail traders, usually considered small merchants, appear to be growing their lengthy publicity. FundingVest noticed the shift in investor conduct after investigating the Bitcoin Whale vs Retail Ratio, an important metric for figuring out BTC’s buying and selling exercise.

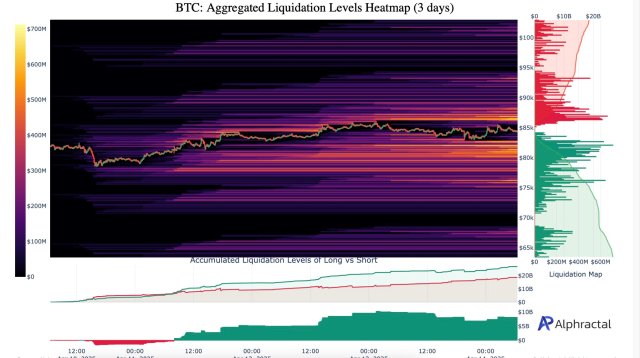

The important thing metric exhibits a surge in retail exercise as these merchants have gotten extra energetic whereas whales are stepping again. Nevertheless, when trying on the 3-day heatmap chart, a rise in lengthy positions and accumulation in each instructions may be noticed.

Such a improvement units the stage for potential volatility and strengthens the case for a contrarian technique. In the meantime, it’s extra doubtless that the market will enhance when lengthy positions have been fully flushed out. FundingVest has drawn consideration towards some brief positions that had been closed final week, which he believes ought to be taken into consideration in the course of the interval.

Demand For Bitcoin Gaining Traction

BTC’s current upswing has sparked curiosity within the flagship asset as obvious demand grows slowly. Kripto Mevsimi reported in a quick-take put up on the CryptoQuant platform that Bitcoin Obvious Demand has begun to get better from deep damaging territory within the 30-day timeframe, suggesting a attainable shift in market conduct. Though that is bullish, the on-chain professional believes it’s too quickly to think about the event as the beginning of a brand new bullish development, highlighting the same situation in 2021.

Regardless of a short stabilization or rebound in worth, demand stayed damaging or near zero for months in 2021. In the meantime, it was not till after extended consolidation {that a} significant structural restoration emerged. The present rebound could also be vital, however it’s extra doubtless a pause in strain than a transparent indication of accumulation or a macro backside.

Featured picture from Adobe Inventory, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.