- Solana’s buying and selling efficiency is thrashing ETH recently, and the SOL/ETH ratio simply hit a report shut.

- Some merchants suppose a $300 breakout might be subsequent, pointing to chart patterns from Ethereum’s 2021 run.

- However falling community charges and DEX volumes recommend Solana’s going through a tricky uphill battle until consumer exercise picks up massive time.

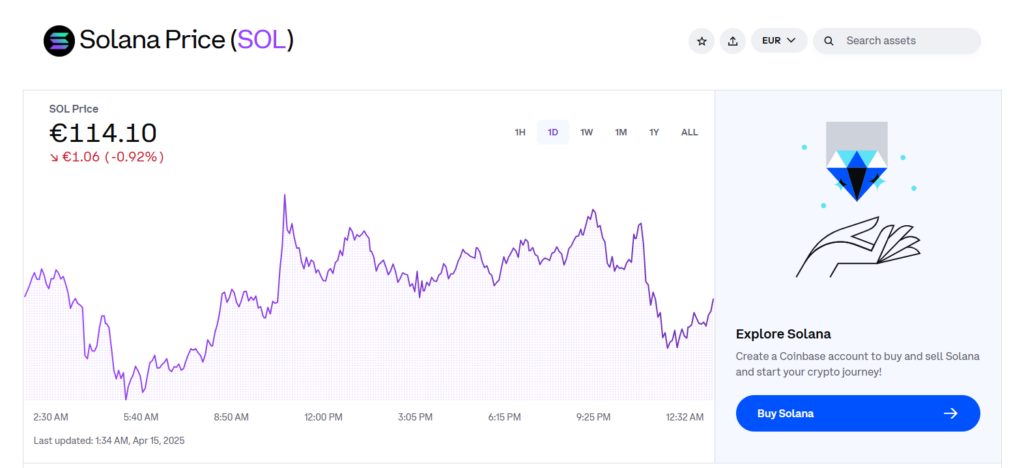

Solana‘s been on a little bit of a tear recently — up over 20% towards Ethereum in simply the previous week. Some merchants are even whispering a few potential breakout that would launch SOL to $300, a recent all-time excessive… if the celebrities align.

SOL/ETH Ratio Hits File Weekly Shut

On April 13, Solana hit a brand new milestone. The SOL/ETH ratio — mainly how a lot Solana is price by way of Ether — climbed to 0.080, its highest-ever weekly shut, in keeping with information from Cointelegraph Markets Professional and Binance.

Since April 4, the ratio’s been constantly making greater highs on the each day chart, a traditional signal that momentum’s constructing.

“Solana has closed its highest weekly shut towards Ethereum in historical past,” mentioned pseudonymous dealer Bitcoinsensus. “We may see continued outperformance of the Solana ecosystem.”

This type of motion echoes again to January, when the SOL/ETH ratio briefly hit 0.093 throughout a post-inauguration crypto surge after Trump took workplace once more. That rally noticed Solana push near $295.

Eyeing $300 — However Is It Practical?

A dealer often called BitBull dropped a futures chart that received people buzzing. He identified that SOL is now exhibiting an identical sample to what Ethereum did proper earlier than it blasted off to report highs again in 2021.

“Similar to Ethereum’s run in 2021, Solana is organising for a large transfer in 2025,” he claimed.

So yeah, in idea, the $300 mark isn’t off the desk. However—and it’s a giant however—technical charts don’t paint the complete image.

Onchain Information Says: Not So Quick

Regardless of the flashy value motion, the real-world utilization of Solana’s community is exhibiting cracks. On April 14, community charges tanked by greater than 97%, dropping to underneath $900K from over $35 million again in January. Yikes.

Similar goes for decentralized exchanges (DEXs) on the community. Platforms like Raydium and Pump.enjoyable have seen large slowdowns. DEX volumes on Solana slid all the way down to $2.17 billion on April 14 — a large 93% drop from their January peak.

So, even when the value charts are glowing inexperienced, Solana’s fundamentals want some severe gas to again one other massive transfer.