Solana (SOL) is up 20% over the previous seven days, supported by sturdy technical indicators and rising on-chain exercise. Its Ichimoku Cloud and BBTrend charts each level to bullish momentum, with pattern energy and volatility on the rise.

On the identical time, Solana is reclaiming the highest spot in DEX quantity and dominating protocol price rankings throughout main DeFi apps. With a current golden cross on the EMA traces, SOL now appears to be like set to check key resistance ranges if momentum holds.

Solana Indicators Paint A Bullish Image

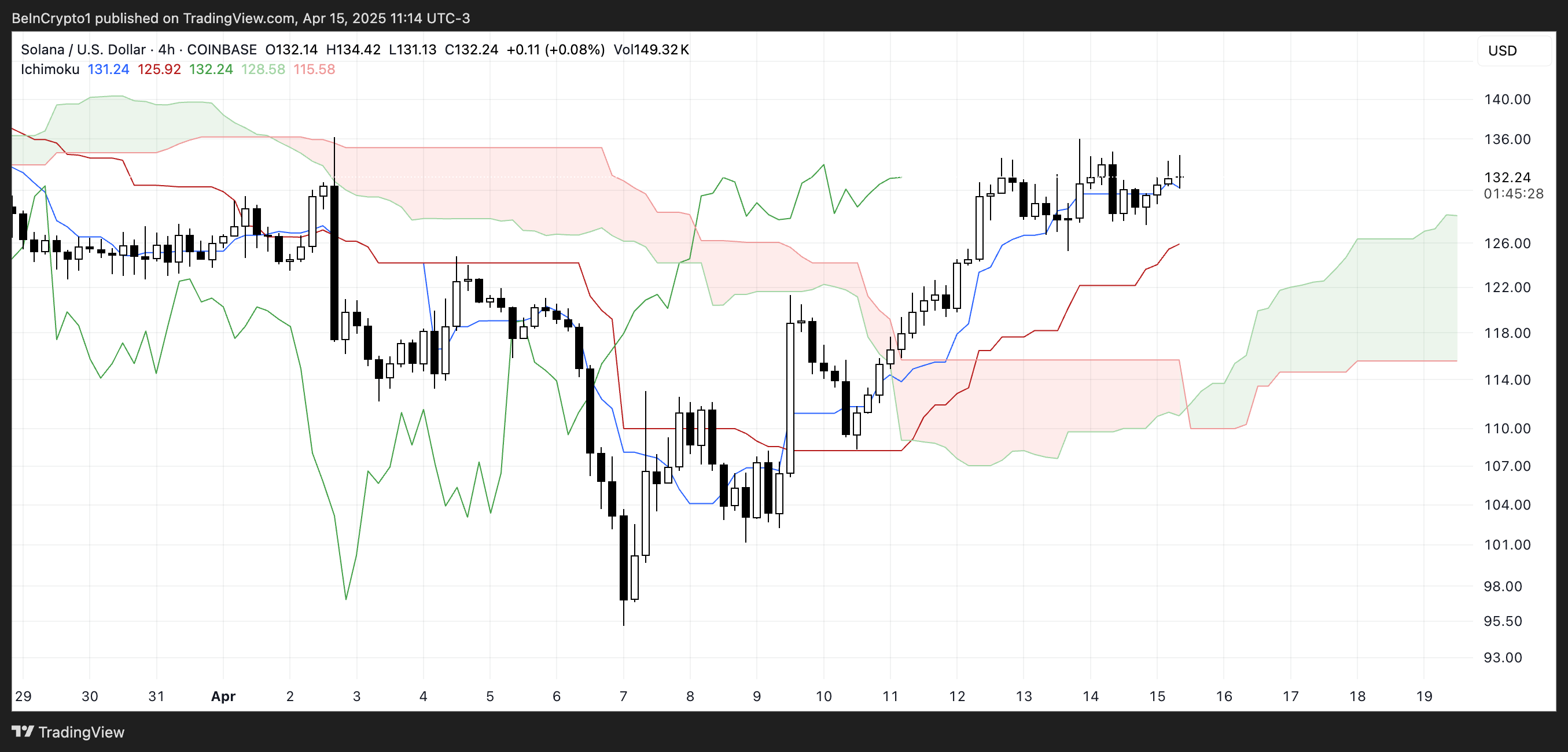

Solana Ichimoku Cloud chart exhibits a transparent bullish construction, with value buying and selling above each the Tenkan-sen and Kijun-sen. This alignment signifies sturdy short- and medium-term momentum, with patrons sustaining management.

The Kumo forward is inexperienced and steadily increasing, which helps the continuation of the present uptrend. The gap between the worth and the cloud additionally provides the pattern some room earlier than any potential weak point units in.

The Chikou Span is positioned above the cloud and candles, confirming bullish affirmation from previous value motion. So long as Solana stays above the Kijun-sen and the cloud stays supportive, the pattern bias stays upward.

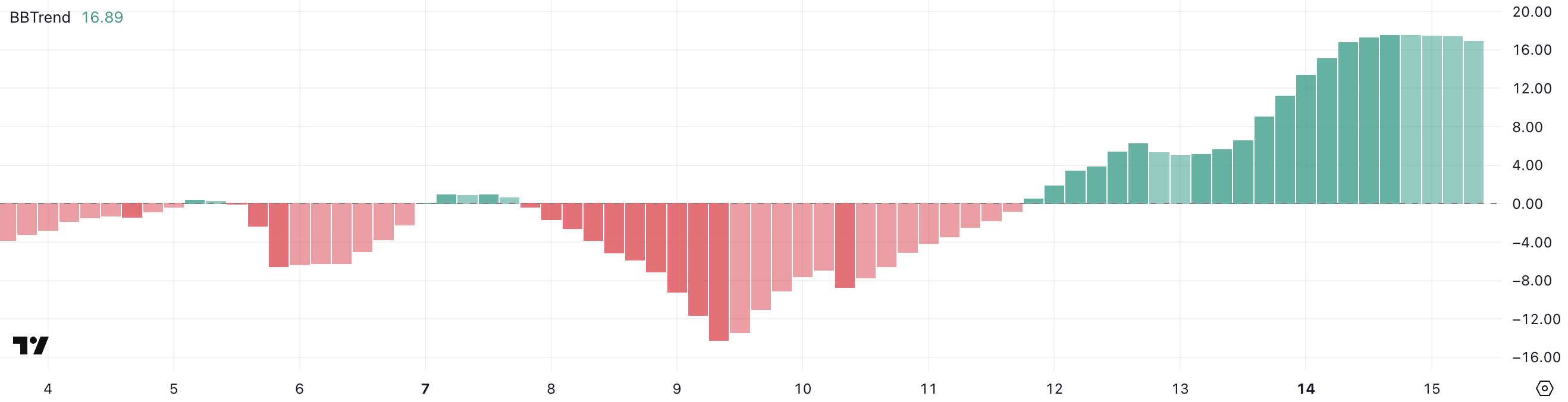

Solana’s BBTrend is presently at 16.89, exhibiting a robust enhance from 1.88 two days in the past, although barely down from 17.54 yesterday. This sharp rise signifies that volatility and pattern energy have not too long ago expanded considerably.

The BBTrend, or Bollinger Band Pattern indicator, measures the energy of a pattern primarily based on how far value strikes away from its common vary. Readings above 10 usually sign a robust pattern in movement, whereas decrease values mirror a range-bound or weak market.

With SOL’s BBTrend holding close to elevated ranges, it suggests the asset remains to be in a robust trending section. If it stays excessive or rises once more, it may help additional upward motion—however a gentle decline may trace at a slowing pattern or consolidation forward.

SOL Volumes and Apps Are On The Rise

Solana is firmly reestablishing its dominance within the decentralized trade (DEX) area, pulling forward of Ethereum and BNB in day by day quantity.

Over the previous 24 hours, Solana recorded $2.5 billion in DEX exercise, marking a 14% enhance over the past seven days. That progress outpaces Base’s 10% and contrasts sharply with the declines seen on Ethereum (-3%) and BNB (-9%).

Extra impressively, Solana’s seven-day DEX quantity has surpassed the mixed quantity of Base, BNB, and Arbitrum.

Past buying and selling quantity, Solana can be main in protocol income era. Among the many high eight non-stablecoin protocols ranked by charges, 5 are instantly constructed on Solana: Pump, Axiom, Jupiter, Jito, and Meteora.

Pump stands out particularly, producing $2.73 million in charges in simply the previous 24 hours and $15 million throughout the previous week.

Can Solana Break Above $150 In The Subsequent Weeks?

Solana’s EMA traces not too long ago fashioned a golden cross, a bullish sign that always marks the beginning of a brand new uptrend.

This crossover suggests momentum is shifting in favor of patrons, with the potential for Solana value to quickly take a look at key resistance ranges.

If the present pattern holds, Solana may problem resistance across the $136 zone. A breakout there could open the trail towards greater ranges akin to $147, $160, and even $180 if bullish strain intensifies.

Nevertheless, if momentum fades, Solana could face a pullback towards the $124 help zone. A break under that might set off deeper draw back strikes, doubtlessly revisiting $112 and even $95 if promoting strain accelerates.

Disclaimer

In step with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.