- Stablecoins have turn out to be integral to mainstream finance, but many banks focus totally on the fundamental idea.

- Under are some essential features of stablecoins that banks should absolutely perceive.

Stablecoins, as soon as a distinct segment idea throughout the cryptocurrency ecosystem, have now positioned themselves as a essential participant in international monetary discourse.

The truth is, some analysts contend that these secure tokens might emerge as a formidable competitor to the U.S. greenback. In line with AMBCrypto, two key elements assist this speculation.

First, the increasing adoption of stablecoins for cross-border transactions, significantly within the settlement of important commodities like crude oil and agricultural items.

Second, and most critically, the rising worldwide momentum, significantly throughout the G20 economies, for the event of a decentralized or non-USD different.

Consequently, stablecoins – most notably Tether [USDT] – have reached a market capitalization of $144.30 billion, positioning itself as a pacesetter within the evolving digital finance panorama.

Understanding stablecoins past hypothesis

For context, stablecoins are designed to take care of a 1:1 peg with property just like the U.S. greenback. In distinction to danger property, stablecoins exhibit a adverse correlation with broader market dynamics.

Merely put, an uptick in stablecoin dominance indicators a capital reallocation away from risky property, indicating a flight to liquidity. Inside this framework, stablecoins operate as a de-risking instrument.

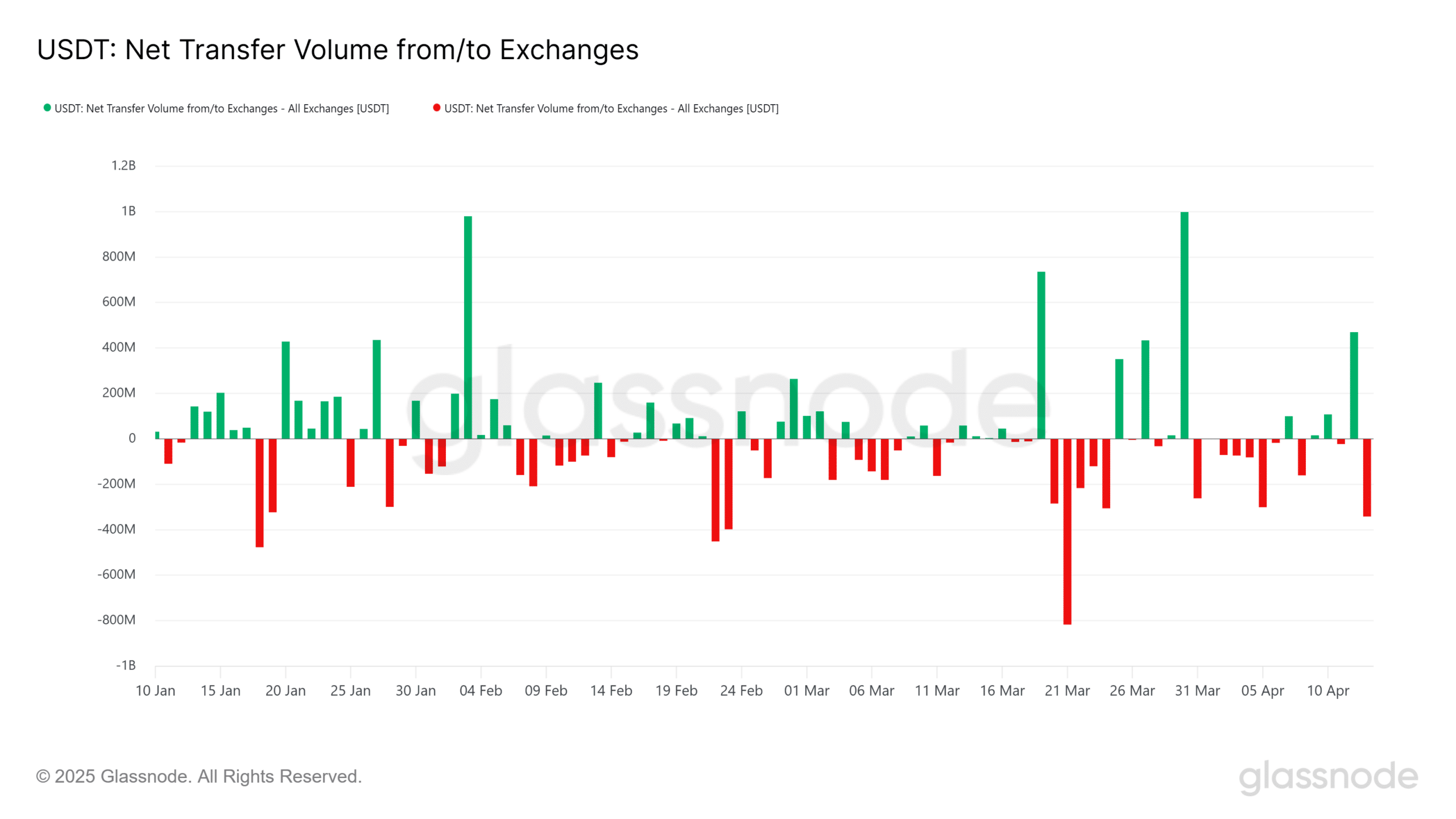

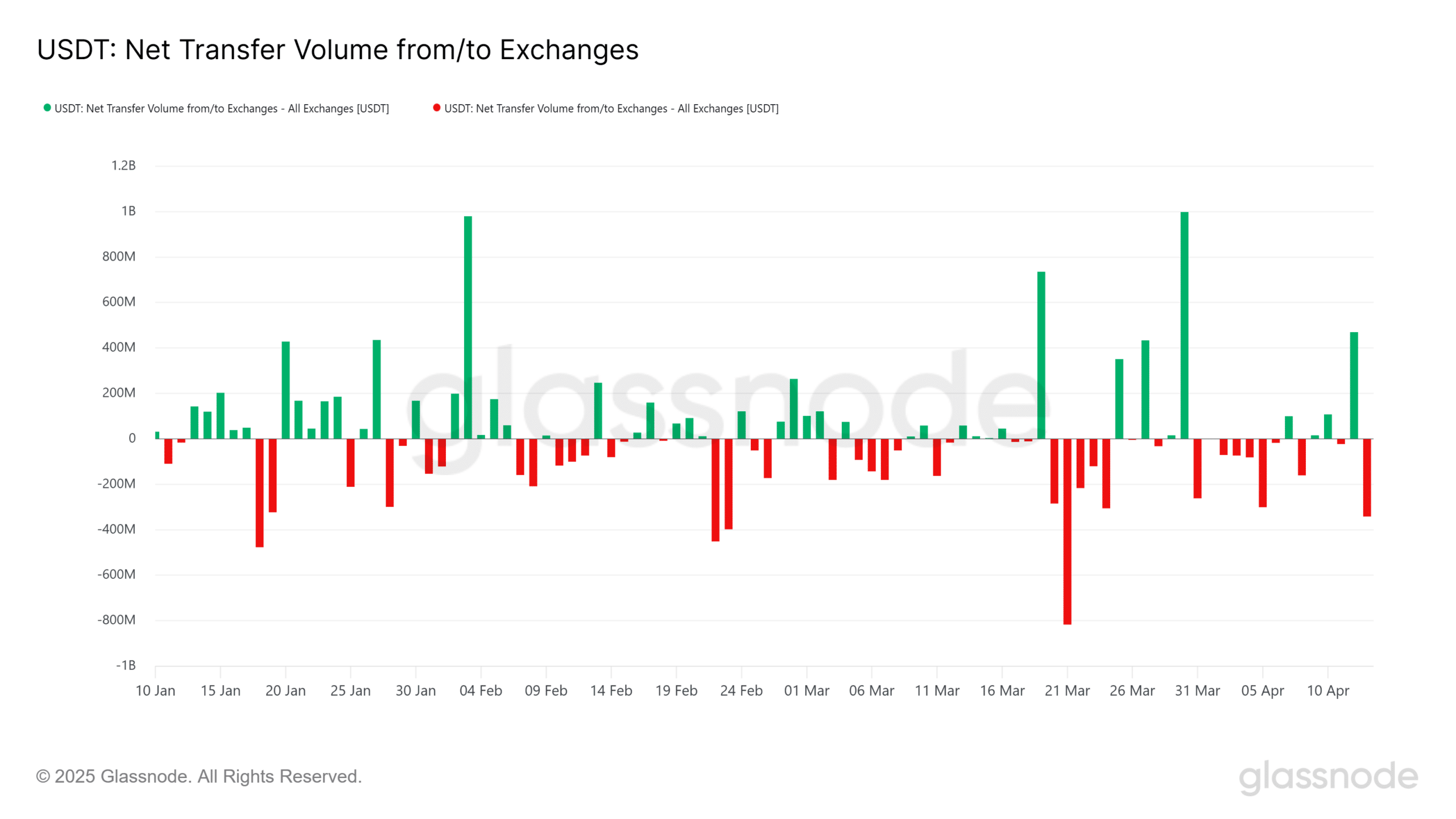

Illustratively, in the course of the 20–24 March window, USDT netflow chart printed pronounced red-bodied candlesticks, reflecting elevated accumulation.

This coincided with Bitcoin’s[BTC] parabolic transfer towards a neighborhood prime at $88k, adopted by a pointy corrective transfer to $81k.

Supply: Glassnode

Therefore, their inherent stability renders them much less speculative than different danger property. Nevertheless, many banks proceed to misread the strategic position of those secure tokens — usually lowering them to simplistic fiat proxies.

Because the monetary panorama evolves and decentralization positive factors structural relevance, beneath are some key features of stablecoins that banks ought to know.

Important realities banks should perceive

Clear oversight is essential for any asset class, however stablecoins face a fragmented regulatory panorama.

As an example, within the U.S., unclear jurisdiction between the SEC and CFTC creates confusion. The EU, in contrast, is transferring towards standardization with its MiCA framework.

In the meantime, Asia presents a combined image. This international divergence complicates cross-border operations. The truth is, as nations roll out their very own Central Financial institution Digital Forex (CBDC) pilots, stablecoins could face tighter guidelines transferring ahead.

Nevertheless it doesn’t cease there. Even in remittance companies, which require cross-border funds, banks should deal with regulatory hurdles to completely capitalize on this use case.

In conclusion, stablecoins provide important use instances within the banking sector, enhancing transparency and decentralization.

Nevertheless, for his or her potential to be absolutely realized, banks should set up strict regulatory oversight, streamline cross-border funds, and shift their perspective – viewing stablecoins not as speculative opponents, however as the way forward for mainstream finance.