- Bitcoin is holding robust as international markets stay extremely attentive to tariffs

- U.S authorities may purchase Bitcoin utilizing income from tariffs

For the reason that re-election of Donald Trump, crypto adoption has develop into one of many administration’s main agendas. The truth is, President Trump has promised to make america the crypto capital of the world. These days although, the query of the best way to elevate income to build up crypto belongings, particularly Bitcoin [BTC], has taken heart stage.

The Trump administration has now come out with a plan to lift income for Bitcoin acquisition. Throughout an interview, Bo Hines, Govt Director of Digital Property, mentioned that the U.S authorities could purchase Bitcoin utilizing tariff income. Other than tariff income, the federal government can also be contemplating revaluing gold certificates on the U.S treasury and utilizing the additional funding to purchase extra Bitcoin.

With increased tariffs, the Trump administration is aiming to lift extra income from exterior governments. If such income is channeled into Bitcoin, the federal government may purchase a substantial quantity. Value declaring, nevertheless, that monetary markets and the broader crypto market have reacted fairly in a different way to those tariff episodes.

How is Bitcoin reacting to tariffs?

In response to Santiment, Bitcoin continues to point out resilience as international monetary markets stay extremely reactive to shifting tariff bulletins from the Trump administration.

Though volatility arising from tariffs remains to be affecting Bitcoin, on-chain information revealed that the cryptocurrency has been exhibiting relative power.

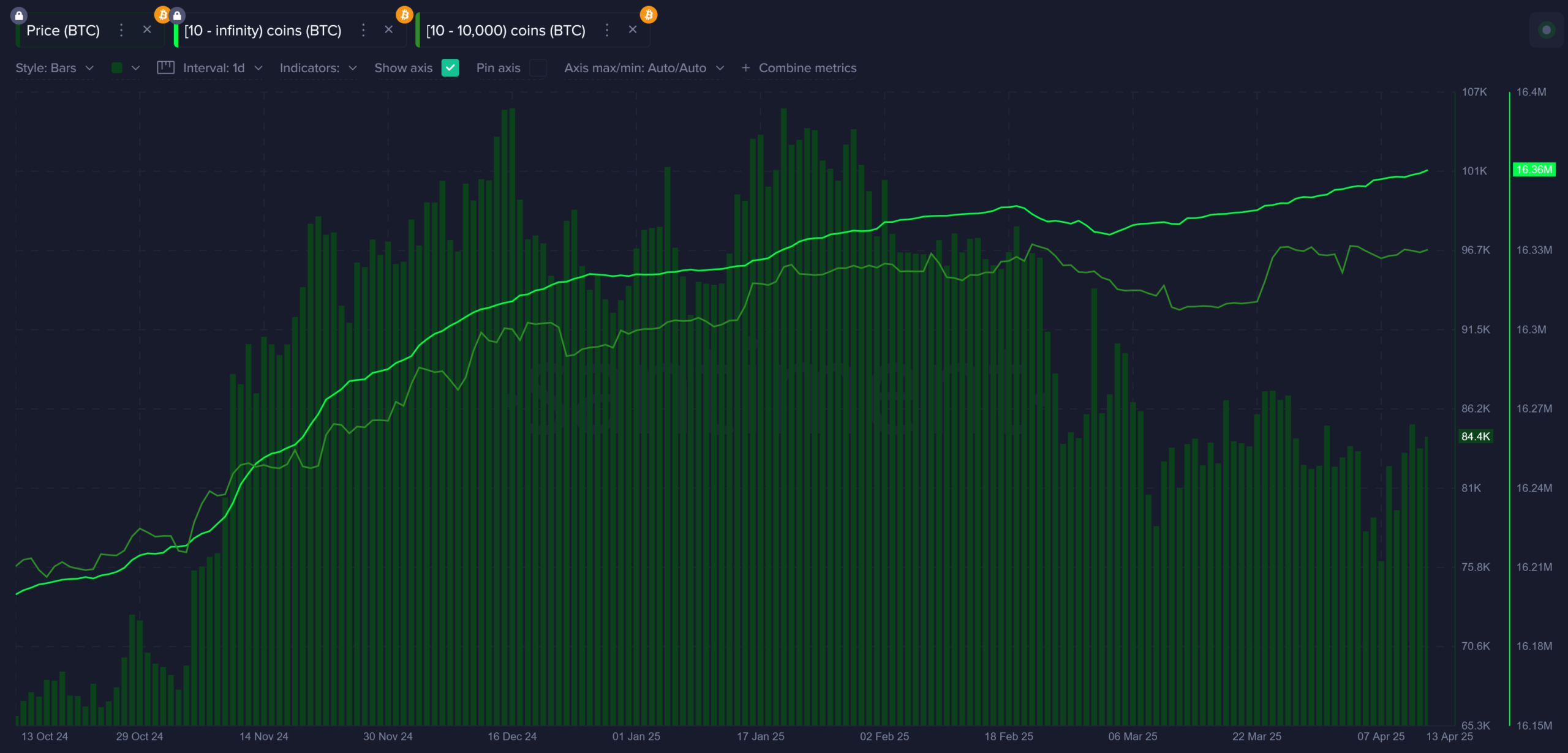

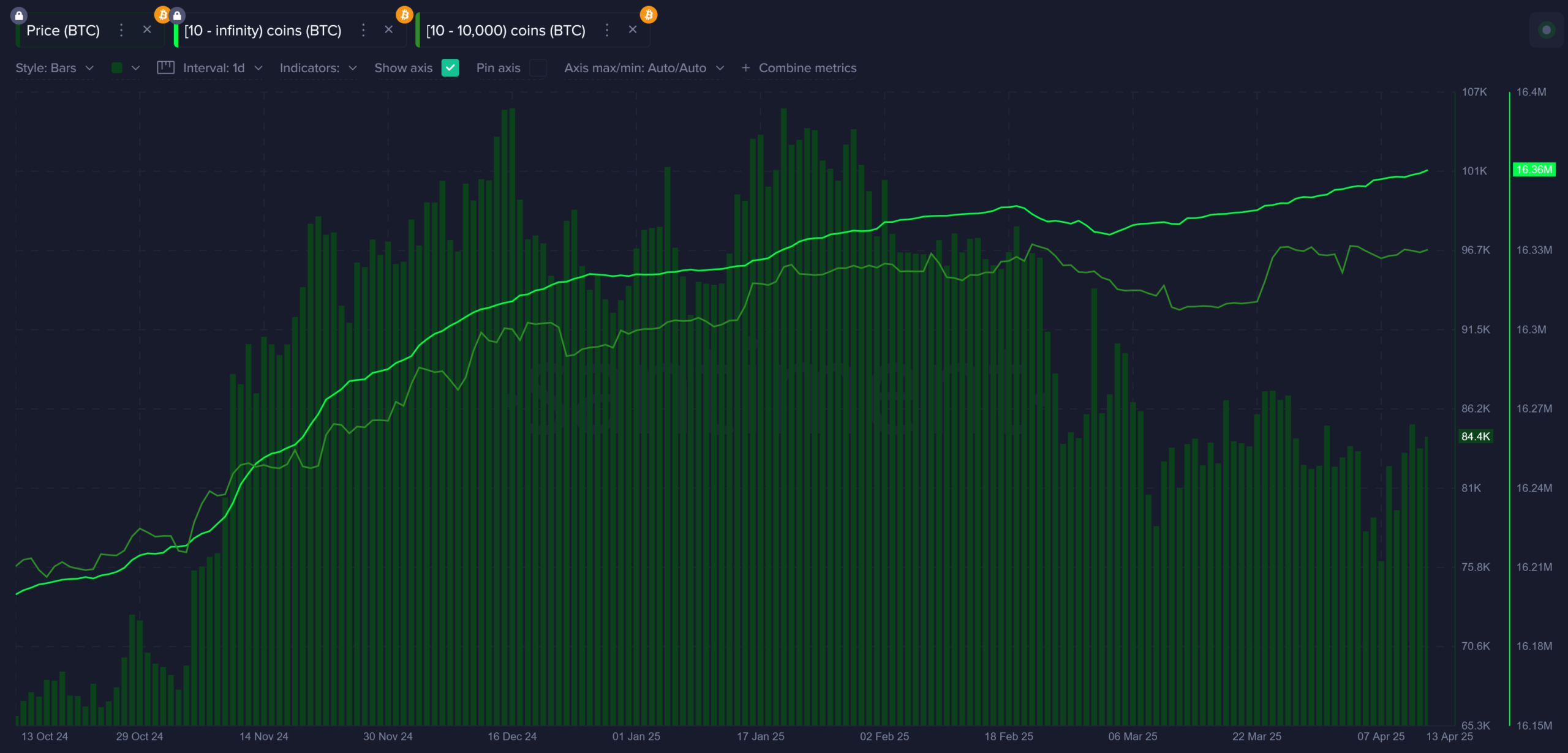

Supply: Santiment

For instance – Wallets with 10 or extra BTC have continued to rise in holdings, climbing to an all-time excessive of 16.36M BTC held.

Such a spike in sharks and whales recommended that enormous holders are bullish and is likely to be anticipating that Bitcoin will maintain agency on this interval of uncertainty.

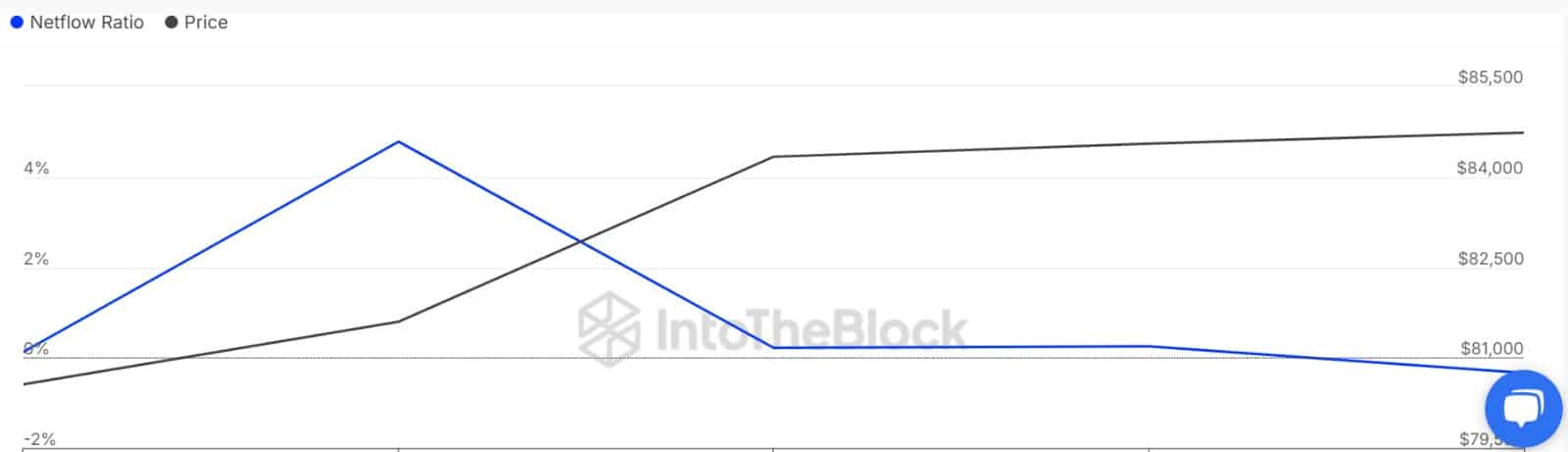

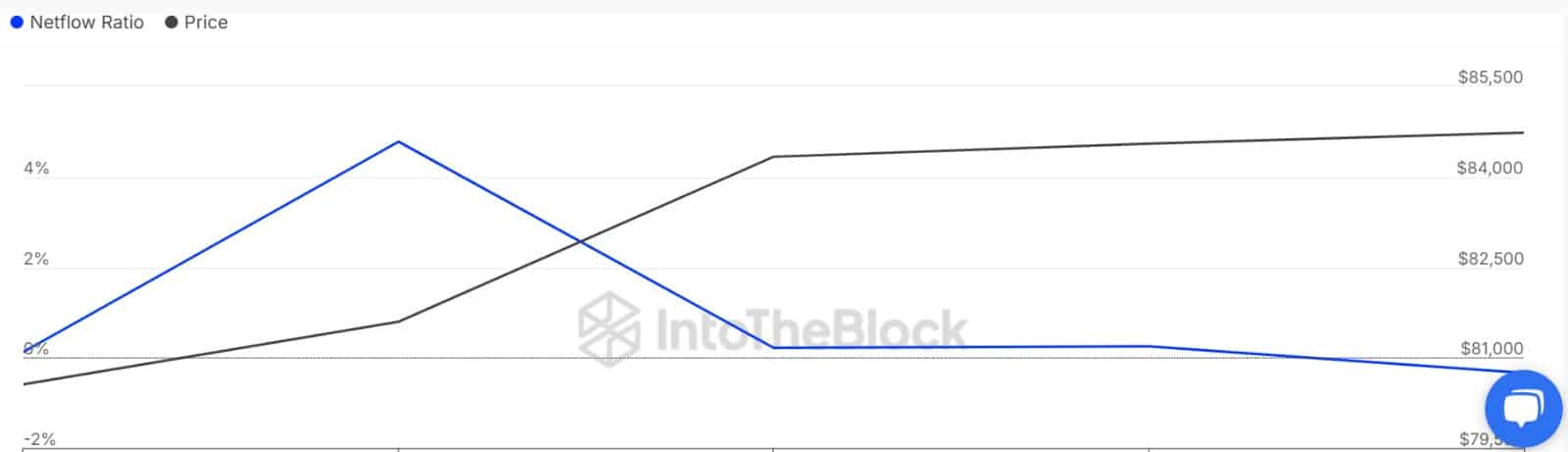

Supply: IntoTheBlock

Wanting on the massive holders’ netflow to trade netflow ratio, we are able to see that whales haven’t been promoting. The truth is, the whale circulate ratio to exchanges dropped to a weekly low of -0.34% – An indication of bullish sentiments amongst whales.

Moreover, the quantity of obtainable BTC sitting on exchanges remains to be dipping, as there are an increasing number of indicators of merchants holding on for the long term. Which means that regardless of market fluctuations arising from tariffs, Bitcoin holders and traders have continued to carry agency.

Supply: Santiment

This market conduct might be validated by the sustained decline within the sell-side threat ratio.

It fell all through April to 0.001. It recommended that traders, particularly long-term holders, are presently much less incentivized to promote. Thus, these traders count on the value to rise increased within the close to staff.

Supply: Checkonchain

Subsequently, channeling tariff income into Bitcoin will restore confidence to retail merchants and switch each market participant bullish.

This announcement is sweet information for BTC and will assist drive the value increased. Particularly as investor confidence within the administration returns.

What does it imply for BTC?

Whereas tariffs have negatively affected the monetary market, Bitcoin has held robust and rebounded strongly from a tariff-related dip.

Subsequently, with BTC holding robust in a time of uncertainty comparable to now, coverage readability over tariffs is an effective factor for the crypto. If the U.S authorities takes income from tariffs and begins to purchase Bitcoin, traders and holders alike will begin perceiving tariffs positively. Such a shift in sentiment will erode considerations inside the market.

If such a situation performs out, we may see main upsides. A shift in tariff-related sentiment will see Bitcoin reclaim pre-liberation day ranges of round $88,500. Nevertheless, if traders usually are not satisfied totally concerning the coverage, the crypto will proceed to consolidate between $83k and $85k.