Knowledge reveals the Bitcoin Internet Taker Quantity has been extremely optimistic on Binance not too long ago, an indication that the bulls are placing up aggressive bets.

Bitcoin Binance Internet Taker Quantity Is Presently At A Notable Optimistic Degree

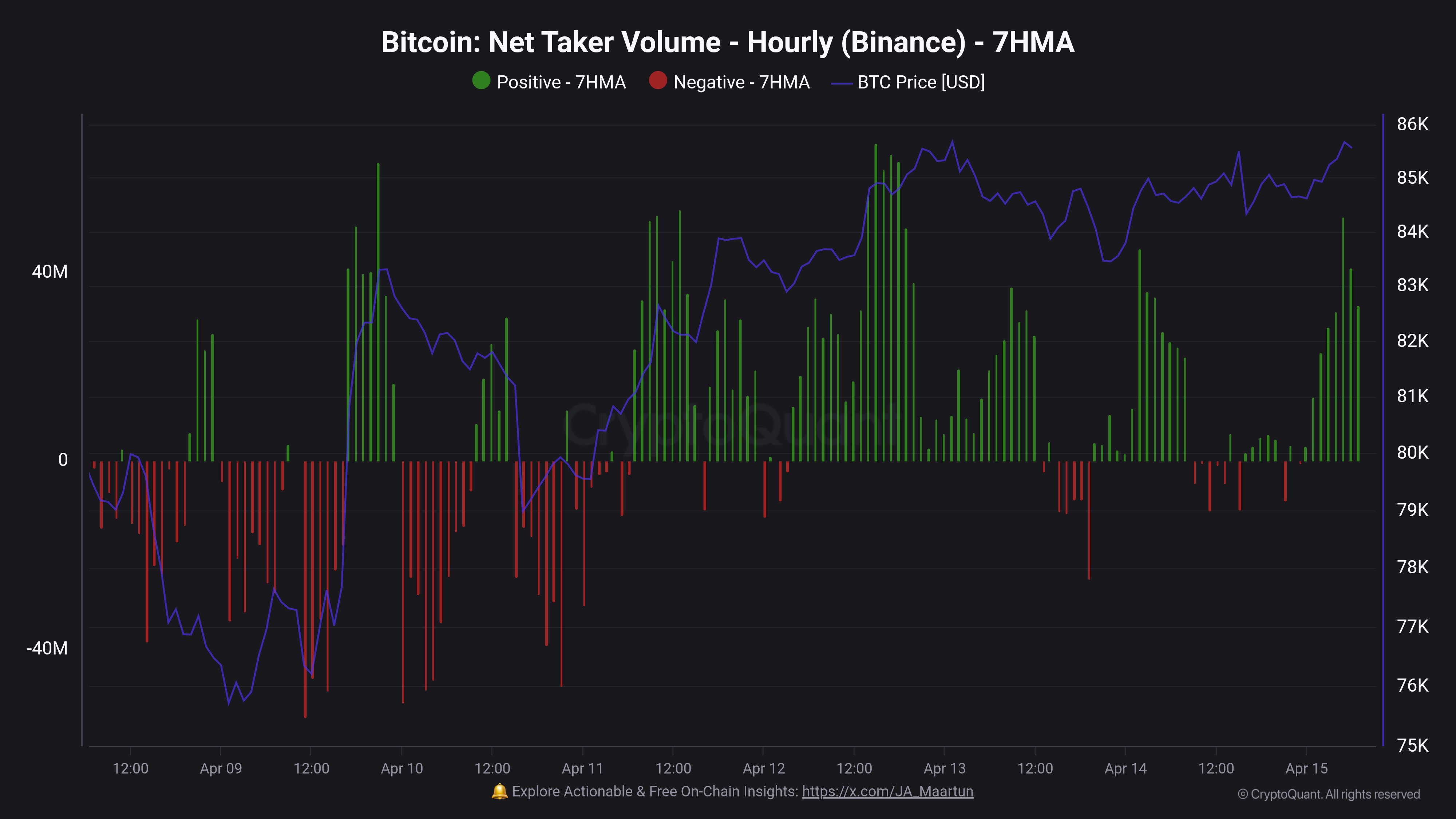

As defined by CryptoQuant neighborhood analyst Maartunn in a brand new publish on X, Bitcoin taker patrons have dominated the Binance platform throughout the previous couple of days. The indicator of relevance right here is the “Internet Taker Quantity,” which measures the distinction between the taker purchaser and taker vendor quantity on any given centralized alternate.

When the indicator has a optimistic worth, it means the taker patrons are outweighing the taker sellers on the platform. This sort of development implies a bullish sentiment is shared by nearly all of the customers.

However, the metric being beneath the zero mark suggests a bearish mentality is dominant on the alternate because the quick quantity is bigger than the lengthy quantity.

Now, under is the chart shared by the analyst that reveals the development within the 7-hour shifting common (MA) Bitcoin Internet Taker Quantity for the biggest alternate within the cryptocurrency sector: Binance.

As displayed within the above graph, the Bitcoin Internet Taker Quantity has largely remained contained in the optimistic territory since April eleventh. The metric’s inexperienced values haven’t been small, both, which suggests the futures customers have been putting some aggressive bullish bets on the platform.

The shift towards the optimistic sentiment on the alternate has come as BTC has been making restoration following the information of the 90-day pause on the tariffs for many nations.

Traditionally, Bitcoin has tended to maneuver within the path that the group least expects, so this bullish temper may very well show to be a nasty signal for the restoration rally. It solely stays to be seen, although, whether or not a high would now be hit or if the wager of those traders would repay.

In another information, the 30-day of the Bitcoin Market Worth to Realized Worth (MVRV) Ratio has hit the bottom degree in six months, as an analyst has identified in a CryptoQuant Quicktake publish.

The MVRV Ratio is an indicator that principally tells us concerning the profit-loss standing of the Bitcoin traders. From the chart, it’s obvious that the 30-day worth of this metric has plunged not too long ago, suggesting holder profitability has declined.

The identical degree as now was additionally reached at a few factors final 12 months and BTC shaped a backside throughout each of these cases. As such, it’s doable that this development may as soon as once more show to be bullish for the cryptocurrency.

BTC Worth

On the time of writing, Bitcoin is floating round $85,800, up greater than 8% within the final seven days.