Federal Reserve Chair Jerome Powell signaled on Tuesday that crypto banking laws will probably be partially relaxed. He additionally made it seemingly clear {that a} near-term rate of interest minimize stays unlikely.

Talking on the Financial Membership of Chicago, Powell addressed mounting uncertainty stemming from commerce coverage and strengthened the central financial institution’s cautious stance.

Fed’s Powell Maitains a Hawkish Outlook

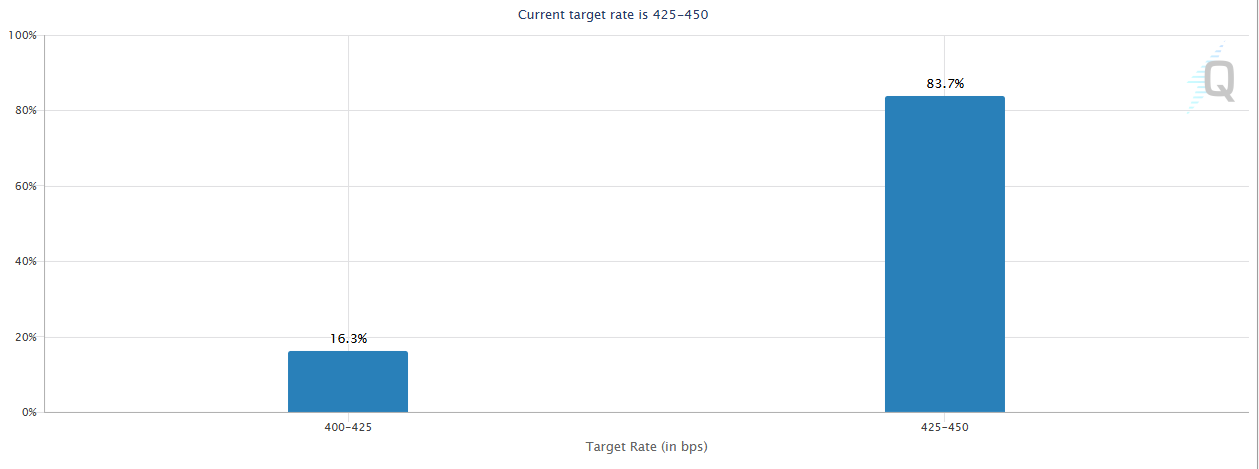

Powell’s remarks come as market expectations for a Could price minimize have collapsed, with CME FedWatch knowledge pricing in only a 16% probability. US equities dipped modestly following the speech. The fairness market presently displays investor disappointment over the dearth of dovish indicators.

“We should always not rush to decrease rates of interest,” Powell stated. “Now we have each cause to attend for extra readability earlier than contemplating any adjustments to Fed coverage.”

The crypto market, nonetheless, remained comparatively regular. Charge minimize optimism had already been priced out after final week’s hawkish FOMC minutes and cooler-than-expected CPI print.

Powell additionally supplied direct feedback on digital property.

“Cryptocurrency is rising in popularity. A authorized framework for stablecoins is a good suggestion.”

He added that the Federal Reserve helps enjoyable sure banking laws on crypto. The Feds agree that the sector is maturing and requires extra outlined oversight quite than constraint.

The twin message—no imminent coverage easing however a optimistic outlook for crypto regulation—was met with a muted response throughout digital asset markets.

Bitcoin hovered close to $84,500, displaying resilience regardless of risk-off sentiment in equities. Powell acknowledged that financial development had doubtless slowed in the beginning of 2025 and warned that Trump’s tariffs are a “key supply of uncertainty.”

He additionally famous the Fed just isn’t near ending quantitative tightening and will have to make troublesome coverage selections if inflation resurges.

Whereas the Fed reaffirmed its readiness to supply greenback liquidity to international central banks if wanted, Powell dismissed the concept of a Fed “put.” He stated the central financial institution’s independence is “a matter of regulation.”

For crypto markets, the regulatory tone was a silver lining in an in any other case hawkish macro atmosphere.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.