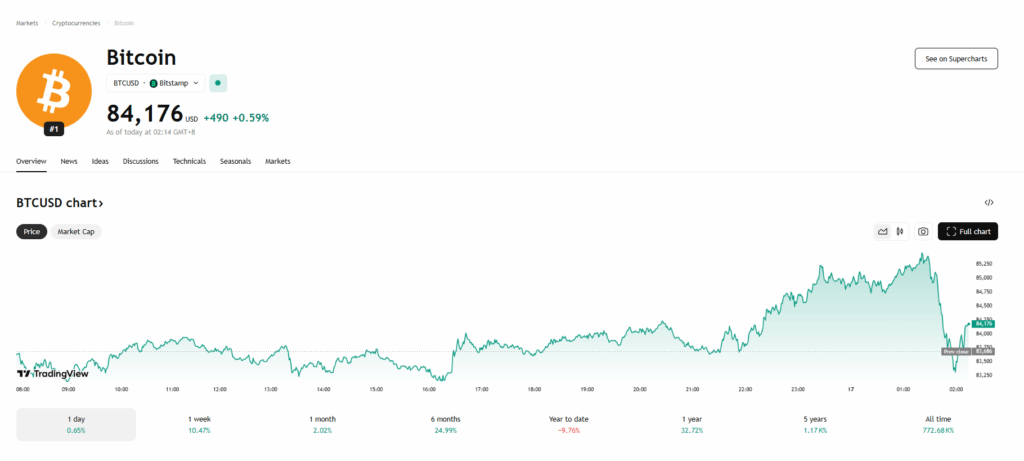

- Bitcoin’s rally towards $86K reversed quick after Fed Chair Powell warned of inflation and sluggish progress from Trump’s tariffs.

- Powell mentioned the U.S. might face stagflation, with inflation rising and the financial system slowing on the similar time.

- Following Powell’s remarks, Bitcoin dropped to round $83,700 and the Nasdaq slid 3.4% to session lows.

Bitcoin made a stable push towards the $86,000 mark earlier Wednesday, giving the market a little bit of optimism—till Jerome Powell stepped as much as the mic. The Fed chair, throughout a speech that landed proper in the course of U.S. afternoon buying and selling, had some fairly sobering phrases in regards to the financial path forward, particularly with President Trump’s newest spherical of tariffs kicking in.

“The dimensions of the tariff hikes thus far is… actually so much larger than what anybody anticipated,” Powell mentioned. “And yeah, the impression will likely be simply as outsized—count on extra inflation, slower progress, in all probability each.”

Yep, that previous chestnut: stagflation. Flashbacks to the ‘70s are creeping in once more, when excessive costs met low progress, and mainly no person was profitable.

Powell didn’t sugarcoat it. “We would discover ourselves in a spot the place our two predominant objectives—steady costs and max employment—are pulling in reverse instructions,” he added.

And the markets felt it straight away.

Bitcoin, which had been climbing properly earlier within the day, dropped round 2.5% virtually instantly after Powell’s feedback hit the wires. Final we checked, BTC was floating round $83,700—nonetheless above latest lows however clearly shedding steam, down about 1.5% over the previous 24 hours.

Wall Road didn’t fare any higher. Shares that have been simply beginning to bounce again acquired clipped exhausting. The Nasdaq sank 3.4% to hit its session low—not precisely the restoration of us have been hoping for.

So yeah, one speech was all it took to swing sentiment. Once more.