- 61.91% of prime merchants have been discovered to be shorting SHIB.

- Merchants have been over-leveraged at $0.0000117 on the decrease aspect and $0.00001245 on the higher aspect.

Shiba Inu [SHIB] seems bearish and is poised for a value decline.

At the moment, the general cryptocurrency market sentiment stays unsure as a consequence of notable volatility in prime belongings, making merchants and buyers hesitant to take part in memecoins.

Amid this, SHIB recorded a value decline of three.50%, at press time, over the previous 24 hours and was buying and selling close to $0.0000119.

Throughout the identical interval, its buying and selling quantity dropped by 17%, indicating decrease participation from merchants and buyers.

This ongoing lower suggests waning curiosity within the memecoin amongst each particular person merchants and establishments.

Shiba Inu’s technical evaluation and upcoming ranges

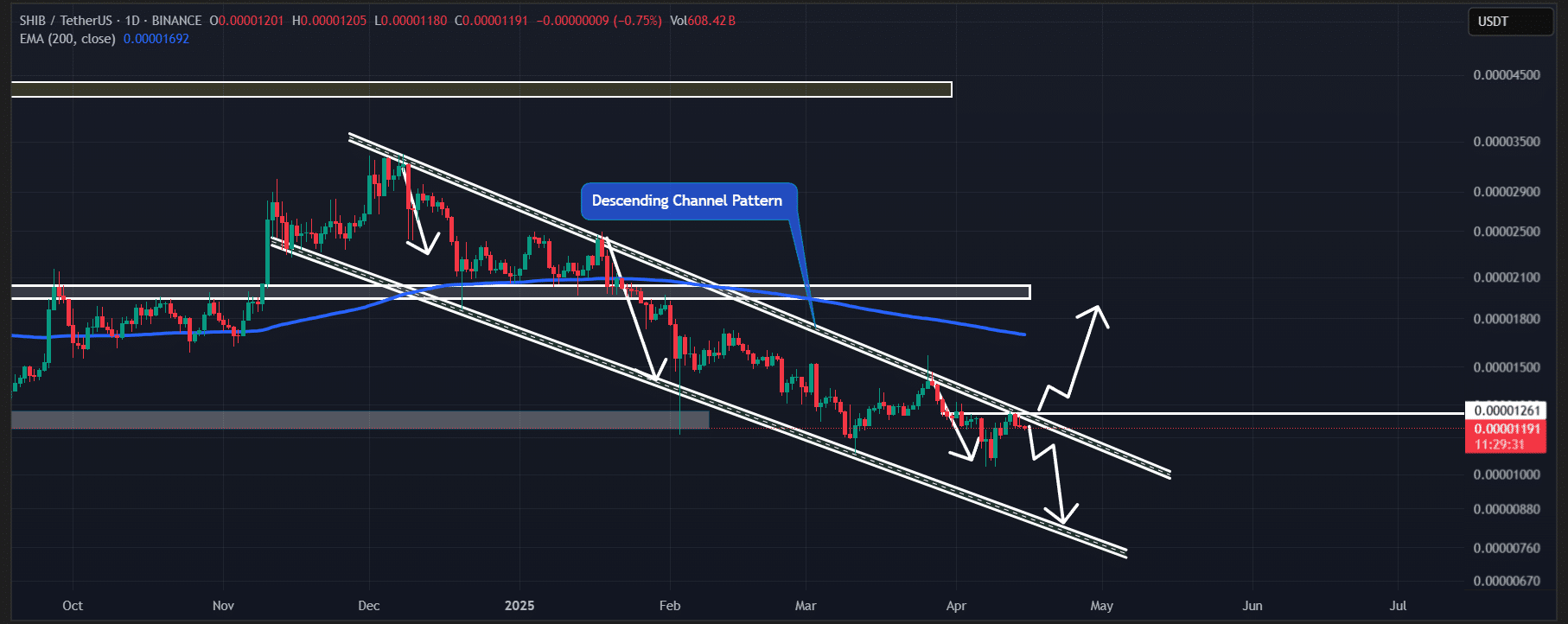

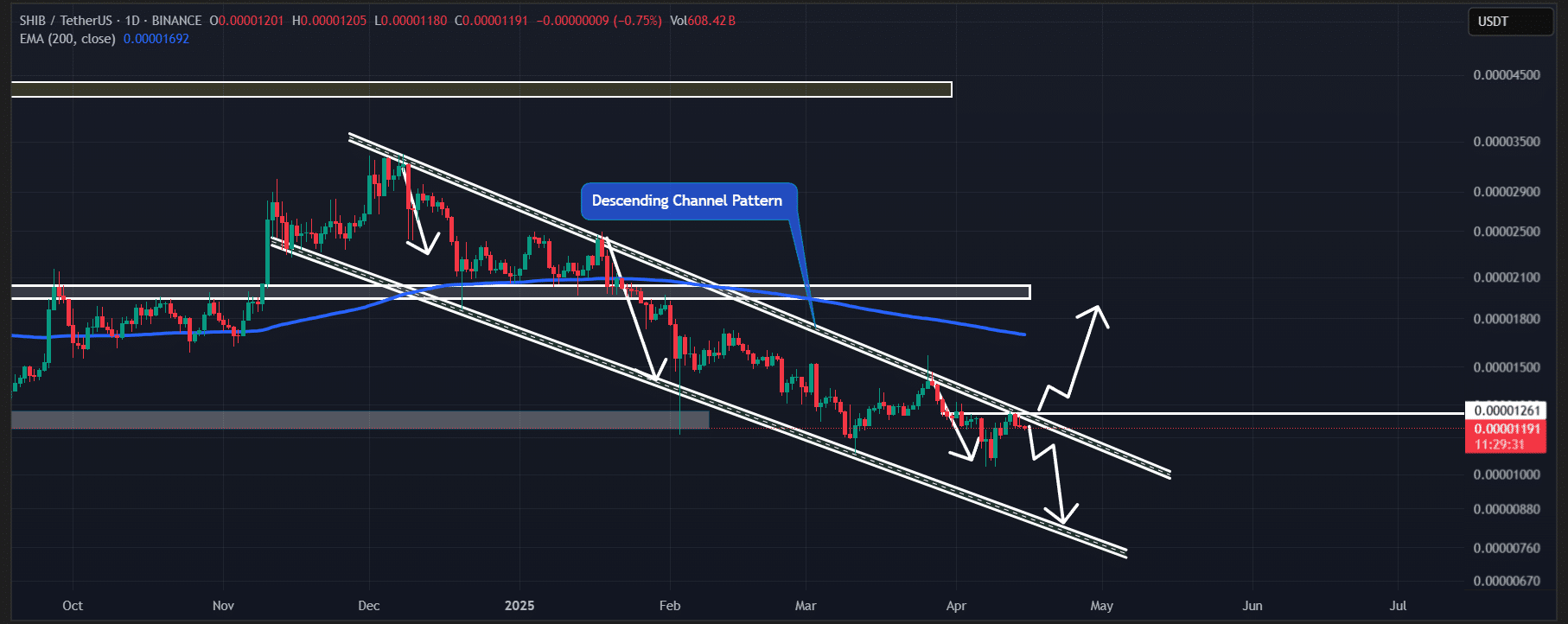

AMBCrypto’s technical evaluation reveals that SHIB has adopted a bearish descending channel sample since December 2024.

Throughout this era, it has persistently shaped decrease highs and decrease lows, reflecting a downward pattern.

Not too long ago, SHIB tried to interrupt out of this sample amid a broader market restoration. Nevertheless, it failed to take action.

On the time of writing, the memecoin was hovering close to the higher boundary of the channel. This stage has traditionally triggered value reversals.

Supply: TradingView

If SHIB fails to interrupt the higher boundary of the descending channel sample once more, a 30% decline is feasible. The worth may drop towards the $0.0000084 stage, marking the decrease boundary of the sample.

Low buying and selling quantity will increase the danger of a sudden dip, particularly if broader market promoting stress intensifies.

Notably, SHIB was buying and selling beneath each the 50 and 200 Exponential Transferring Averages (EMA) on the day by day timeframe. This implies a powerful bearish pattern with no indicators of upward momentum.

The day by day chart signifies that SHIB may flip bullish below two circumstances. First, a sudden shift in market sentiment. Second, a day by day candle closing is above the $0.0000128 stage.

62% of prime merchants go quick on SHIB

Wanting on the present market sentiment, SHIB merchants look like closely betting on the bearish aspect, based on on-chain analytics agency Coinglass.

As of this writing, SHIB’s Lengthy/Brief Ratio stood at 0.615, indicating sturdy bearish sentiment amongst merchants.

The on-chain metric additional reveals that 61.91% of prime merchants are holding quick positions, whereas solely 38.09% maintain lengthy positions.

Supply: Coinglass

At press time, merchants have been closely leveraged at two key ranges: $0.0000117 as help and $0.00001245 as resistance.

Lengthy positions totaled $375K, whereas quick positions amounted to $952K, indicating a powerful bearish presence. This implies that quick sellers at the moment dominate the asset and will drive its value decrease within the coming days.