Starknet (STRK) stays underneath strain, however indicators of stabilization are starting to emerge. Regardless of releasing 127.6 million tokens into circulation in its subsequent unlock, the venture is pushing ahead with adoption efforts, together with enabling STRK funds in 15,000 retailers worldwide.

Technically, the RSI is in impartial territory, and the CMF is displaying decreased promoting strain, hinting at a possible shift in momentum. Nonetheless, the EMA traces nonetheless mirror a downtrend, retaining the outlook cautious for now.

Starknet RSI Is Nonetheless Impartial

Starknet was one of the vital anticipated token unlocks of the third week of April, releasing 127.6 million STRK tokens value roughly $15.71 million into circulation.

Regardless of this main provide occasion, the venture is making an attempt to construct long-term utility.

Just lately, it introduced that STRK can now be used for funds in 15,000 retailers worldwide—a transfer aimed toward boosting adoption and real-world use circumstances.

From a technical perspective, STRK’s RSI is at present at 42.92, recovering from 37.29 yesterday however barely down from 44.76 earlier at the moment.

The Relative Power Index (RSI) measures momentum on a scale from 0 to 100, with readings above 70 sometimes indicating overbought circumstances and under 30 signaling oversold territory.

An RSI round 43 suggests neutral-to-bearish momentum, with sellers nonetheless sustaining some management. If RSI continues to climb, it may sign a shift towards a restoration, however for now, STRK stays in a cautious zone.

STRK CMF Exhibits Patrons Are Returning

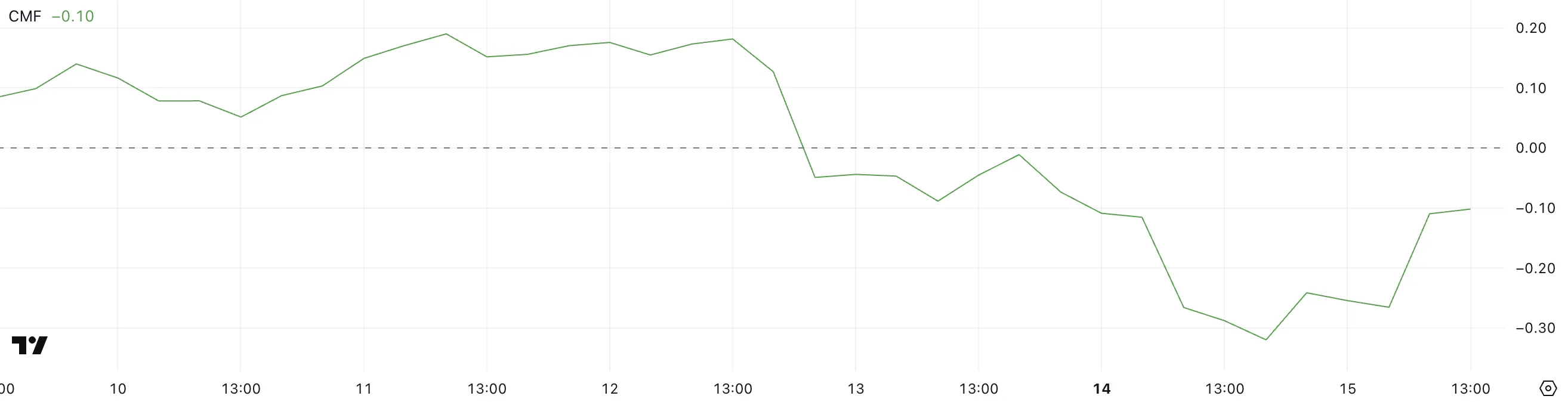

StarkNet’s Chaikin Cash Move (CMF) has improved to -0.10, up from -0.32 yesterday, signaling a discount in promoting strain.

The CMF is a volume-based indicator that measures the movement of cash into or out of an asset over time. It ranges from -1 to +1, with values above 0 indicating shopping for (accumulation) and under 0 indicating promoting (distribution).

Though nonetheless in adverse territory, the rise towards the impartial line means that bearish momentum is weakening. A CMF studying of -0.10 factors to average outflows, however the upward shift may trace at rising curiosity from consumers.

If this pattern continues and CMF crosses into optimistic territory, it could assist a short-term restoration in STRK’s value.

Will Starknet Fall Beneath $0.11?

Starknet’s EMA traces proceed to mirror a downtrend, with short-term averages positioned under long-term ones—a traditional bearish setup.

If this sample holds and promoting strain will increase, STRK may decline additional to check the assist stage close to $0.109.

Nonetheless, if momentum shifts and STRK manages to reverse the present pattern, it may start retesting key resistance ranges at $0.137 and $0.142.

A breakout above these zones could open the trail towards $0.158, signaling a stronger restoration.

Disclaimer

In step with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.