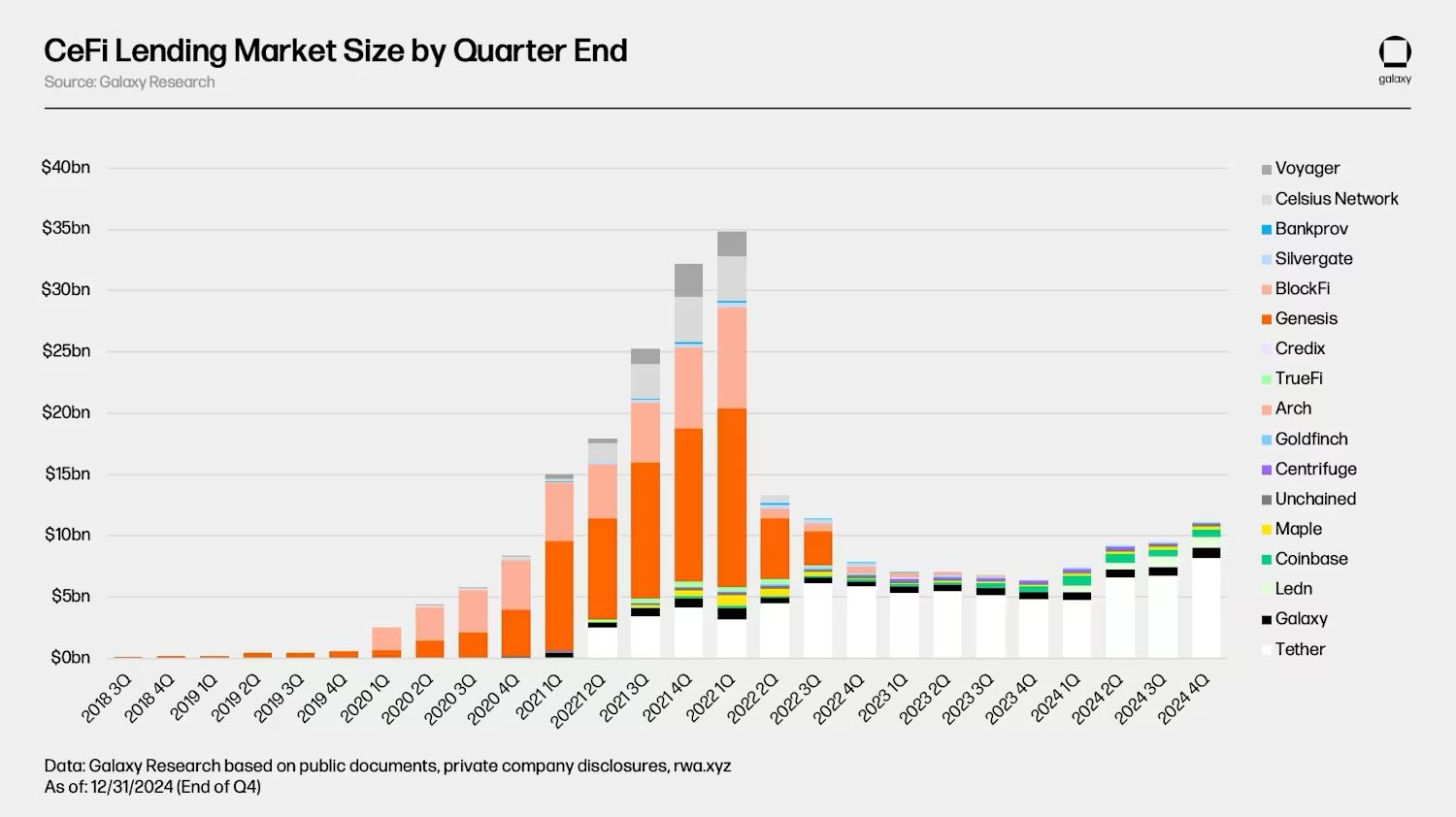

Stablecoin issuer Tether is the most important centralized finance lender (CeFi) within the digital asset house, in line with new evaluation.

Zack Pokorny, a analysis analyst on the crypto funding big Galaxy Digital, notes that Galaxy and the Bitcoin (BTC) lending agency Ledn had been the second and third-largest lenders, respectively.

Mixed, Tether, Galaxy and Ledn’s mortgage ebook totaled $9.9 billion on the finish of the fourth quarter of 2024, comprising almost 89% of the CeFi lending market and 27% of the entire crypto lending market. Coinbase, the highest US crypto alternate, had the fourth-largest mortgage ebook.

Alex Thorn, Galaxy’s head of analysis, says the entire CeFi mortgage ebook dimension on the finish of final 12 months was $11.2 billion, a 68% lower from the 2022 all-time excessive of $34.8 billion.

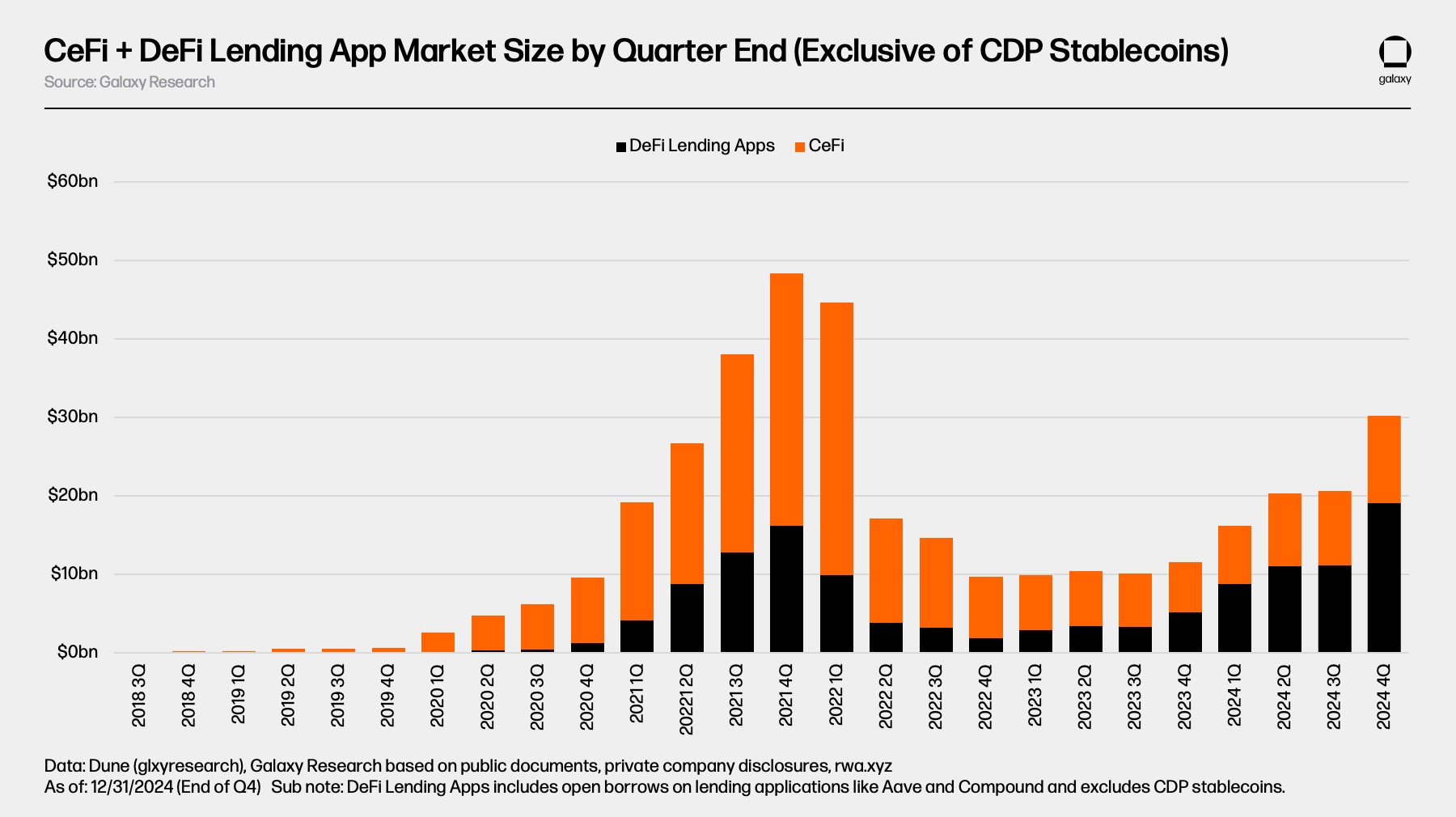

Decentralized finance (DeFi) represents a bigger lending sector, with $19.1 billion in open borrows throughout 20 lending purposes and 12 chains by the tip of 2024, in line with Pokorny.

The researcher notes that DeFi lending throughout these chains and purposes elevated by 959% for the reason that backside was set two years prior.

“DeFi borrowing has skilled a stronger restoration than that of CeFi lending. This may be attributed to the permissionless nature of blockchain-based purposes and the survival of lending purposes by the bear market chaos that felled main CeFi lenders. Not like the most important CeFi lenders that went bankrupt and not function, the most important lending purposes and markets weren’t all compelled to shut and continued to perform. This truth is a testomony to the design and threat administration practices of the massive on-chain lending apps and the advantages of algorithmic, overcollateralized, and provide/demand-based borrowing.”

Observe us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Worth Motion

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any losses you could incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney