- Toncoin’s breakout and Telegram backing have sparked a wave of optimism, with value hitting $2.98 and projections suggesting a 100x acquire may push it to $298, turning a $10K funding into $1M.

- Ecosystem momentum is constructing quick — with booming DeFi apps, gaming dApps, and AI integrations, plus $8.24B in Q1 switch quantity and cross-chain help from LayerZero and Wormhole.

- Targets like $100–$298 aren’t off the desk if adoption scales and institutional curiosity grows; even mid-range strikes ($10–$50) may yield stable returns for early buyers.

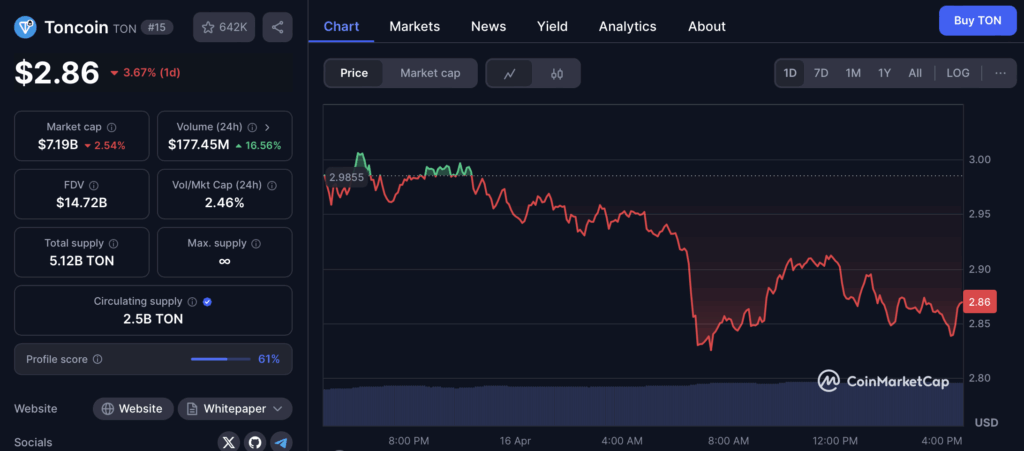

Toncoin’s been heating up once more, and in the event you’ve been watching the charts, you most likely observed that candy breakout from its lengthy, dragging downtrend. As of now, TON’s sitting comfortable round $2.98 — that’s a stable 5% acquire within the final 24 hours alone.

So, yeah… the massive query: is that this simply the beginning of one thing greater? Let’s crunch some numbers and play the “what if” recreation. Like, what would it not truly take for a $10,000 bag of TON to balloon into $1 million?

What the Numbers Say

Proper now, $10K will get you about 3,355 TON. In the event you’re aiming for that magical million-dollar payday, you’d want every TON token to hit $298. That’s a 100x transfer from the place it’s chillin’ as we speak.

Feeling a bit extra daring? Tossing $15K into the combination baggage you roughly 5,033 TON. That brings your million-dollar goal right down to a barely much less loopy $198.75 per coin.

Appears wild? Perhaps. Nevertheless it’s crypto. We’ve seen stranger issues.

Why This Isn’t Simply Hype: What’s Fueling TON?

First off, TON ain’t just a few development driving on vibes. It’s bought actual infrastructure — and a fairly large ace up its sleeve: Telegram. Backed by an enormous person base and precise adoption, this venture’s been quietly laying groundwork whereas others had been making noise.

In Q1 2025 alone, switch quantity exploded 319% year-over-year, climbing to $8.24 billion. Telegram’s founder Pavel Durov is again within the highlight, actively hyping TON, and the devs are placing in work each within the U.S. and Asia.

And the chart? Yeah, it’s telling a narrative too. After busting out of an extended wedge sample, TON flipped $2.80 into help — clear. The following zones? $3.50, $4.20, and possibly even $5.50 if patrons preserve stepping in.

The Ecosystem’s Catching Fireplace

DeFi’s popping off, with protocols like EVAA and Storm Commerce pulling in $110M+ TVL. In the meantime, video games like Cattea and Bombie? Thousands and thousands of customers. No joke. Then there’s TapSwap — a type of mini apps that’s going viral sooner than you’ll be able to say “airdrop.”

On prime of that, you’ve bought critical cross-chain motion. TON’s now plugged into LayerZero, Wormhole, and Axelar, which suggests liquidity is flowing in from over 100 different chains. Throw in AI-native instruments like Husky, and now you’re speaking a few community that’s doing far more than simply pumping tokens.

May TON Actually Hit $100–$298?

Positive, it’s a stretch. However is it inconceivable? Positively not.

For TON to hit $100+, it’ll want some critical wind at its again — assume institutional cash, mass adoption, and extra Telegram integration. But when that occurs? All bets are off.

Even a bounce to $10–$50 places you within the 3x to 15x return vary, which isn’t dangerous in any respect. And if TON retains rising like early Ethereum or Solana? That $298 mark won’t be so out-there in any case.

So whether or not you’re in for $10K, $15K, or simply watching from the sidelines, TON’s present momentum and ecosystem progress make it one to maintain an in depth eye on. The danger is actual, however so is the upside.