Key Takeaways

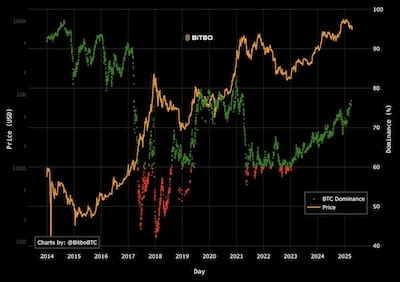

- Bitcoin dominance has risen to 63.80%, nearing a 4-year excessive.

- The final time BTC dominance was this excessive was January 2021.

- Ethereum-to-Bitcoin ratio has dropped to 0.01913.

Bitcoin is closing in on its highest stage of market dominance in additional than 4 years, reaching 63.80% as of April 15.

The metric, which tracks Bitcoin’s share of the entire cryptocurrency market capitalization, is approaching ranges final seen in January 2021.

Value efficiency

This rise comes as Bitcoin’s worth continues to defy international macroeconomic jitters and strikes nearer to reclaiming its “Liberation Day” excessive close to $86,000.

On the time of writing, BTC is buying and selling at $85,877, up 1.19% from yesterday.

Market comparability

The rise in dominance underscores Bitcoin’s relative power towards each different digital belongings and conventional fairness markets.

The Nasdaq 100, for instance, stays 5% beneath its comparable “Liberation Day” peak.

Altcoin efficiency

In the meantime, the Ethereum-to-Bitcoin ratio continues to say no, presently at 0.01913 — down 0.31% — highlighting weaker efficiency from different main cryptocurrencies.

Development components

Bitcoin dominance has been steadily climbing by means of 2024 and into 2025, boosted by a mixture of institutional demand, spot ETF inflows, and broader skepticism towards altcoins.

Community metrics

Present community knowledge additionally helps Bitcoin’s rising share of the market.

The seven-day common hashrate stands at 896 EH/s, and every day charges generated are 6.33 BTC, or about $536,017.

Market management

The continued climb in dominance has positioned Bitcoin because the clear chief within the digital asset area as buyers search stability amid international uncertainty, together with tariff tensions and fears of recession within the U.S.