Key Takeaways

- John Bollinger says Bitcoin could also be forming a basic double backside close to $80,000.

- The %b indicator suggests a possible reversal, however affirmation remains to be wanted.

- Analysts say Bitcoin’s restoration might depend upon a Nasdaq rebound.

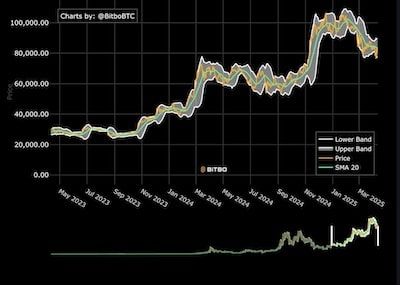

Bitcoin could also be forming a long-term worth ground close to $80,000, in accordance with John Bollinger, creator of the Bollinger Bands volatility indicator.

In an April 10 submit on X, Bollinger pointed to a possible “basic” W-bottom construction utilizing his proprietary %b metric.

He stated:

Basic Bollinger Band W backside establishing in $BTCUSD. Nonetheless wants affirmation.

The %b indicator measures closing costs in relation to Bollinger Band ranges and may establish reversal patterns.

A confirmed W-bottom usually consists of a worth dip beneath the decrease band adopted by a second, shallower dip—a construction Bitcoin seems to be mimicking on weekly charts.

Present chart knowledge lacks development shift affirmation

Regardless of this setup, each day by day and weekly charts present that no confirmed development reversal has occurred.

Bitcoin continues to trace the decrease Bollinger Band, with the 20-period easy shifting common appearing as resistance.

Cointelegraph knowledge confirmed that the BTC/USD day by day chart stays beneath development, suggesting warning for bulls.

Inventory market conduct mirrors Bitcoin setup

Jurrien Timmer, director of world macro at Constancy, famous that comparable dynamics are taking part in out within the S&P 500, which has dropped from 2 normal deviations above development to just about 2 beneath.

In the meantime, economist Timothy Peterson instructed {that a} full Bitcoin reversal might solely happen after the Nasdaq finds a backside, projecting an additional 10% drop within the tech-heavy index.