Regardless of Bitcoin buying and selling decrease right this moment with a 2.5% dip, optimism stays excessive amongst long-term holders. The broader market continues to maneuver sideways, however a number of bullish developments are capturing consideration.

Over the previous week, Bitcoin has gained 8%, and whereas it stays comparatively flat over the previous month, it’s nonetheless up 34% during the last 12 months. These numbers reinforce the arrogance many traders have in Bitcoin’s long-term potential.

A number of key updates are contributing to the bullish sentiment. Bitcoin’s hash charge just lately hit an all-time excessive, signaling elevated community safety and powerful miner confidence—an encouraging signal forward of the following halving occasion.

In the meantime, the state of Florida is exploring plans to incorporate Bitcoin in its reserves as a hedge in opposition to inflation and to say monetary sovereignty.

On the similar time, Babylon is making strides in Bitcoin DeFi by introducing staking rewards with out the necessity for wrapped tokens, providing extra simple entry to passive revenue alternatives.

On the institutional entrance, Semler Scientific has filed to boost $500 million to buy further Bitcoin, highlighting a rising pattern amongst corporations allocating capital to digital belongings. Traditionally, Bitcoin has outperformed the S&P 500 for 14 consecutive years, making it an more and more engaging retailer of worth.

There’s additionally hypothesis that the U.S. could take into account shopping for Bitcoin utilizing tariff revenues underneath a possible Trump administration, including to the narrative of Bitcoin’s increasing function in fiscal technique.

Supply – 99Bitcoins on YouTube

Bitcoin Value Prediction

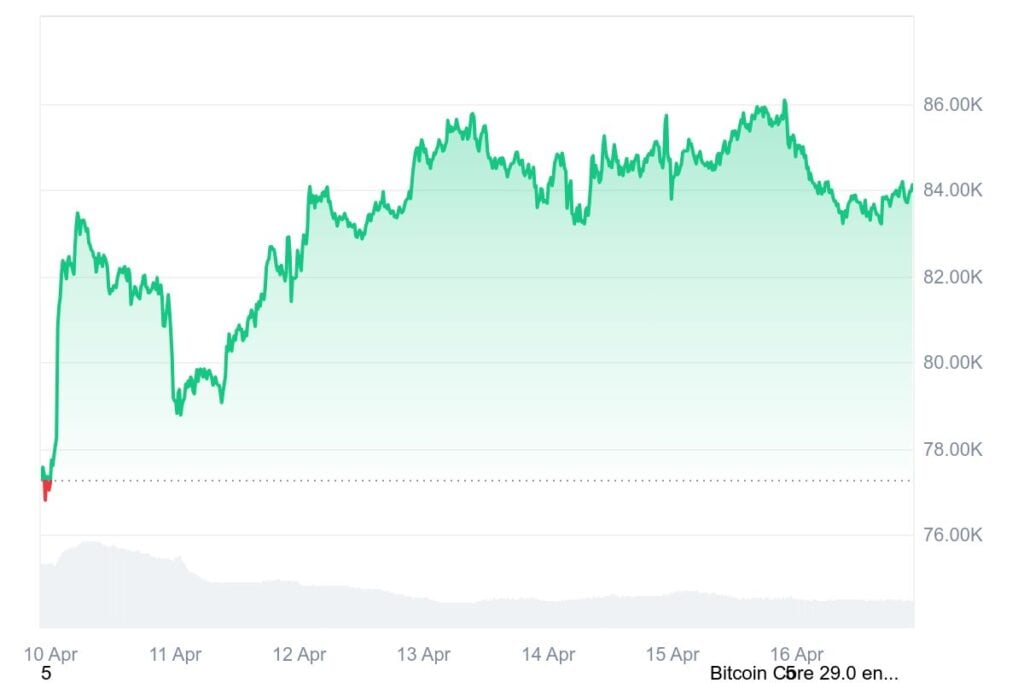

Bitcoin skilled vital value motion just lately, with the market exhibiting indicators of elevated volatility. The worth briefly dropped beneath the important thing $84,000 degree, indicating potential bearish momentum within the quick time period.

Whereas fundamentals akin to bond yields and volatility indexes stay comparatively steady, uncertainty persists round international financial situations and commerce dynamics, particularly between the US and China.

Trying forward, a key focus can be on the $84,000 to $84,400 vary. If Bitcoin fails to reclaim this zone as assist, it’s more likely to proceed its decline towards the following assist ranges round $82,800 and probably between $81,500 and $80,600.

Though the short-term outlook seems bearish, the broader construction nonetheless gives vital assist, suggesting the pullback could stay inside a wholesome consolidation vary.

Capitalizing on Bitcoin’s Subsequent Huge Transfer: The BTC Bull Presale Affords Distinctive Advantages for Holders

As international financial tensions simmer—notably round U.S.–China tariffs—the opportunity of decision may carry reduction to markets. Traders are watching intently, hopeful that easing commerce tensions will function one other catalyst for Bitcoin’s subsequent upward transfer.

On this context, the BTC Bull (BTCBULL) presale stands to capitalize on Bitcoin’s upward momentum by providing holders a novel alternative to revenue from Bitcoin’s value appreciation by passive revenue and airdrops, additional solidifying its attraction as a high-potential asset throughout a interval of financial restoration.

The idea behind BTC Bull revolves round rewarding holders straight in Bitcoin, providing a novel mix of meme coin hype with tangible utility. Traders who maintain $BTCBULL tokens are eligible to obtain periodic Bitcoin airdrops, particularly when Bitcoin’s value hits key milestones.

Every $25,000 improve in Bitcoin’s worth triggers a provide burn or direct Bitcoin airdrop to long-term holders, introducing deflationary stress that might profit value appreciation over time.

What makes the BTC Bull notably attractive is its alignment with staking incentives, albeit with barely decrease rewards—87% estimated—than another meme cash within the house.

This barely conservative staking method seems to be balanced by the mission’s aggressive use of burn mechanisms and airdrop allocations, with 15% of the tokenomics put aside for milestone-triggered burns and 10% for airdrops.

These elements level to a long-term sustainability mannequin as an alternative of short-term pump-and-dump dynamics typically related to meme tokens.

BTC Bull additionally appears related to a broader ecosystem involving Greatest Pockets, a platform praised for permitting traders to see their presale tokens straight of their pockets—a characteristic not generally discovered in lots of crypto launches.

This accessibility mitigates confusion and complaints about visibility throughout ICO phases, offering a extra seamless consumer expertise. These alignments counsel an rising meme coin bull market, as extra instruments are developed to streamline mission creation and investor participation.

Total, BTC Bull isn’t simply attempting to experience Bitcoin’s coattails. It gives a compelling utility by its hybrid mannequin of staking and actual Bitcoin rewards, wrapped in a meme coin narrative that faucets into retail pleasure.

With a transparent technique of incentivizing holders, leveraging milestone-based rewards, and taking part in a broader pro-meme coin motion, it positions itself as extra than simply one other token in a crowded house—it goals to be a central participant in what could possibly be the following meme coin market surge.

Go to BTC Bull presale right here.