- Whale exercise has cooled off, with day by day BTC outflows dropping from 800K to 300K, pushed extra by capitulation than confidence.

- Miners are underneath stress, offloading 15K BTC amid shrinking margins and excessive hashrates, contributing to the market’s instability.

- CryptoQuant sees low sentiment, with its Bull Rating caught at 20, suggesting Bitcoin might keep range-bound until accumulation and sentiment sharply enhance.

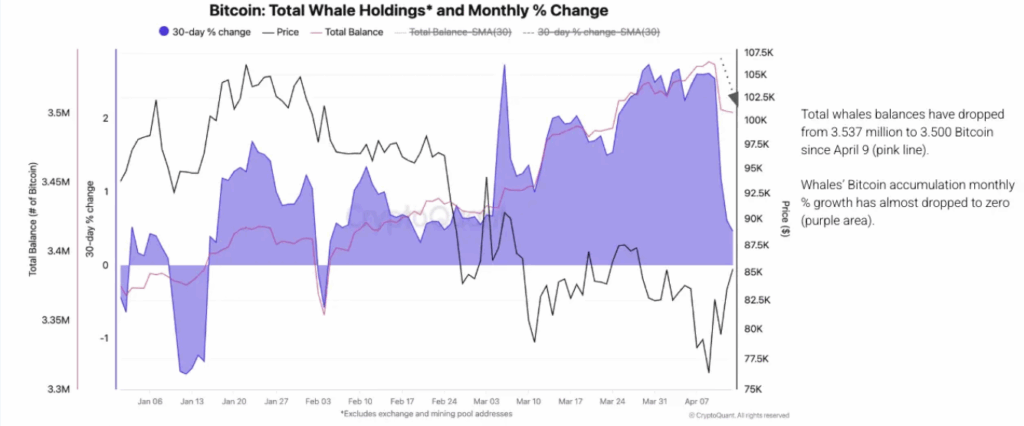

Issues aren’t wanting tremendous vibrant for Bitcoin currently. Based on a brand new report from CryptoQuant, day by day outflows from main BTC holders — the whales — have dropped considerably, sliding from round 800,000 BTC in late February to simply 300,000 now. However earlier than you assume that’s bullish, maintain on. Analysts say this isn’t due to stronger conviction… it’s extra like capitulation. They’re simply finished holding for now.

Whales have been realizing losses ever since BTC slipped underneath $80K. Over the previous week alone, their collective stash has shrunk by roughly 30,000 BTC. Not precisely confidence-inspiring.

Accumulation Slows, Miner Exercise Spikes

Zooming out a bit, the larger image doesn’t provide a lot consolation both. CryptoQuant’s dashboards present that the month-to-month accumulation charge has slowed to 0.5% — the weakest tempo since Feb. 20. That’s a great distance from the buildup bursts we noticed earlier within the yr.

Miners, in the meantime, appear to be feeling the warmth. On April 7, about 15,000 BTC was moved out — the third-largest miner outflow to this point in 2025. Why? Revenue margins are thinning. In late January, miner profitability sat at a wholesome 53%. Now? It’s down to simply 33%, squeezed by an all-time excessive hashrate and, yeah, fairly lame transaction charges.

Sentiment? Nonetheless Bearish

CryptoQuant’s Bull Rating Index — a form of “temper tracker” for the market — is sitting at 20. That’s… low. And worse, it’s been underneath 50 for 58 out of the final 60 days. The one different time that’s occurred just lately? The tail finish of the 2022 bear market. So, not precisely reassuring.

The analysts additionally pointed to macro jitters, notably the continuing U.S.-China tariff tensions. Apparently, whales have a tendency to tug again throughout instances of commerce uncertainty — and this appears no totally different. When danger urge for food fades, so does accumulation.

What Now? Vary-Sure Doubtless, for a Whereas

At this stage, CryptoQuant’s outlook is obvious: till whales begin shopping for once more and miners sit back on the promoting, Bitcoin’s in all probability gonna keep range-bound. Possibly some little pumps right here and there, however they’ll be fragile — simply crushed by renewed promoting.

That mentioned, if BTC dips additional, whales might step in and scoop up the low cost. However don’t anticipate fireworks till the Bull Rating crosses 40. That will be the actual sign of a sentiment shift — however for now, it’s simply not there.

So yeah… possibly time to remain cautious. At the very least for a bit.