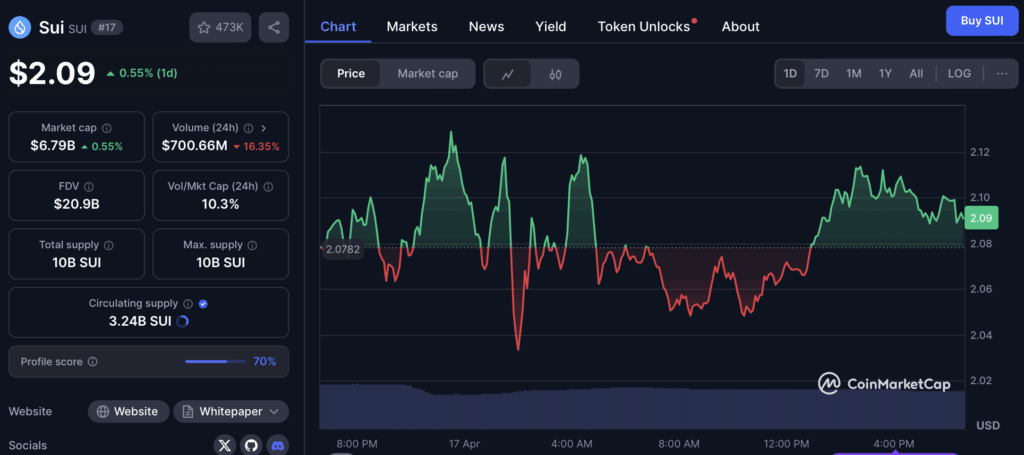

- SUI is consolidating close to $2 after a pointy drop from $5, with technicals displaying a possible breakout forming inside an ascending channel.

- Community fundamentals stay robust, with $1.22B in TVL, $250M+ in day by day DEX quantity, and $45M in annualized income supporting long-term confidence.

- Sentiment is cautiously bullish, and a breakout above key trendline resistance may set off the subsequent rally — however merchants are anticipating affirmation first.

SUI crypto has been using a bumpy wave in early 2025. After lighting issues up late final 12 months, it’s now caught underneath a troublesome resistance line and shifting sideways. Some merchants are feeling cautious, others are eyeing a breakout — and truthfully, each camps might need a degree.

Let’s dive into the mess and see what’s actually happening.

From $5 Highs to Hovering at $2 — What’s Up With SUI?

Up to now this 12 months, SUI has slipped into correction mode, chilling across the $2 mark after peaking near $5 not too way back. Should you’re trying on the 12-hour chart, the image’s clear — a stable downtrend is in play, however there’s a twist.

SUI appears to be coiling up inside an ascending channel, and in response to the outdated Elliott Wave believers, that massive transfer earlier may’ve accomplished a full wave cycle. In that case, we may be sitting close to the underside of the correction.

Key ranges to observe? $3.6 and $3.2 on the Fibonacci scale — each have acted as vital zones throughout this cool-off. If the value can keep inside this construction, we may see a springboard-type transfer quickly.

Fundamentals Are Holding Sturdy — Perhaps Even Too Sturdy to Ignore

Whereas the value has cooled, the community exercise positively hasn’t. SUI’s TVL is sitting at $1.22 billion, and day by day DEX quantity has cleared $250 million — that’s not small potatoes. Even higher, the protocol is clocking round $45 million in annualized income.

That sort of income often solely reveals up when individuals are really utilizing the chain, which… they’re. Between zkLogin, sponsored transactions, and native NFT integrations, SUI has stored its utility fairly sticky.

So even when the chart’s indecisive, the basics are screaming, “We’re not performed right here.”

Sentiment’s Warming Up — Simply Wants a Spark

Regardless of the chop, SUI’s up 5.8% over the previous week, outperforming cash like TON, which dropped round 4.6%. However zoom out, and it’s nonetheless down 4% as we speak, with quantity additionally slipping by 16% — so we’re on this bizarre area the place each worry and optimism are hanging within the air.

Lots of eyes are on one factor: that annoying trendline resistance. It’s been holding robust — however the extra SUI faucets it, the weaker it turns into. If worth can lastly pop above and keep there? That’s a clear breakout sign.

If not, we may see a short-term pullback to retest these Fib help zones.

SUI’s Acquired the Setup — However Can It Ship?

With its $6.8 billion market cap and rating among the many high 20 cryptos (thanks, CoinGecko), SUI’s not some underdog challenge attempting to show itself. It’s already confirmed so much.

The query now could be whether or not it’s bought the power — or the amount — to interrupt out of this consolidation and trip the subsequent leg up.

Closing Take

SUI isn’t screaming “purchase now,” nevertheless it’s whispering one thing shut. It’s bottoming out technically, constructing power underneath resistance, and backed by robust fundamentals. If the broader market companies up — and sentiment suggestions bullish — this may very well be a kind of strikes folks look again on considering, “Yep, that was the setup.”

Nonetheless… watch for affirmation. Breakouts with out quantity? Paper tigers. However with the suitable spark? SUI may shock everybody.