|

Crypto’s college grooming rumors echo China’s ‘bare mortgage’ scandal

Main cryptocurrency exchanges are underneath hearth over allegations that they gave leveraged platform-locked funds to school college students in China to encourage speculative buying and selling. The controversy has drawn comparisons to the nation’s campus lending scandal practically a decade in the past, when college students burdened with debt had been supplied exploitative “bare loans” in alternate for nude footage as collateral.

Bruce Xu, co-founder of ETHPanda, claimed that centralized exchanges had been giving college students non-withdrawable trial funds for futures buying and selling. Earnings might be stored, and college students who posted high-return screenshots on WeChat had been reportedly supplied further rewards. Xu known as the mannequin a manner of grooming the following era of playing degens.

Crypto media outlet BlockBeats known as on all exchanges to halt any trial fund promotions concentrating on college students, describing the campaigns as exploitative of a financially inexperienced demographic.

Whereas many speculated that Bitget was concerned attributable to its February campus ambassador program, Xie Jiayin (Smith Tse), the alternate’s head of Asia, stated the initiative targeted on Web3 training and profession help, not buying and selling. He denied Bitget ever distributed trial funds to college students and stated this system was taken offline inside 16 hours attributable to public misunderstanding.

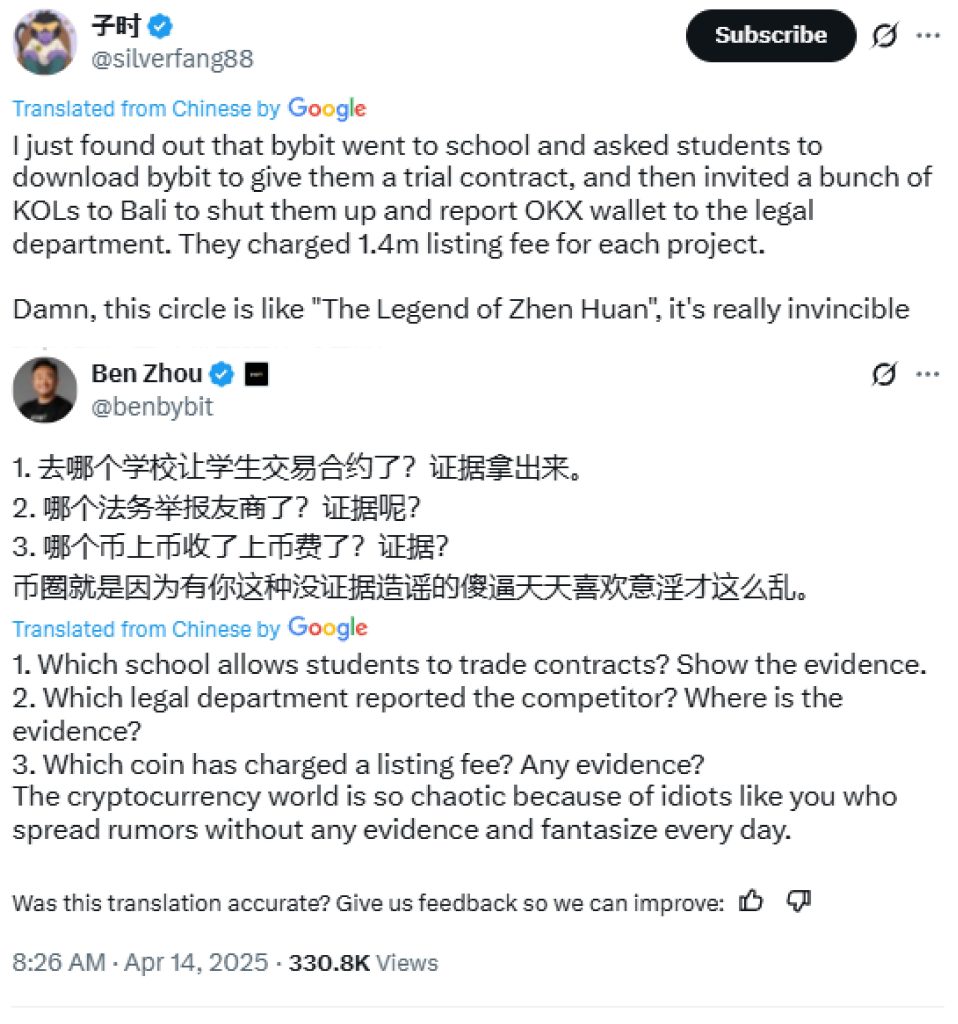

One X consumer accused Bybit of visiting universities and distributing trial funds. CEO Ben Zhou dismissed the claims, asking for proof and criticizing the unfold of unsubstantiated rumors within the crypto house.

BlockBeats in contrast the uproar to a fintech scandal in China round a decade in the past involving Qufenqi. Based in 2014, the corporate supplied installment loans to college students for electronics and different items, permitting them to make month-to-month funds with nothing greater than a scholar ID. The corporate bodily visited school campuses with cubicles and flyers to push its product.

The platform was quickly mired in controversy attributable to hidden charges and debt traps that left college students borrowing from one platform to repay one other. Native media investigations uncovered a a lot darker facet of campus loans, as some college students turned to black-market lenders to repay their debt. Determined school college students resorted to what’s generally known as bare loans, the place feminine college students had been requested to offer nude images or movies as collateral, with the specter of public publicity in the event that they didn’t repay. Some fell into irreversible debt spirals and repaid their debt with sexual favors. In essentially the most tragic instances, some had been pushed to suicide.

Corporations providing campus loans shut down following a regulatory crackdown in 2016 and 2017. Qufenqi ditched its campus lending mannequin and rebranded as Qudain and listed on the Nasdaq. However its adverse picture has broken its repute and its shares are down greater than 90% from their peak.

9 Chinese language scammers defraud 67,000 Indian males pretending to be Indian girls

A court docket in jap China’s Shandong Province has handed down jail phrases as much as over 14 years to 9 telecom fraudsters who defrauded 66,800 Indian males by pretending to achieve success Indian girls, in line with state-run newspaper Authorized Every day.

The fraud ring reportedly swindled 517 million rupees (over $6 million) from June 2023 to January 2024 in a pig-butchering-style scheme, utilizing translation instruments and chat apps to lure victims.

The ringleader, recognized by the surname He, confessed to receiving investments in Indian rupees and changing the proceeds into USDT, which had been then laundered into Chinese language yuan via third-party fee companies.

To make their personas extra convincing, the group used glamorous life-style images, like health selfies, journey pictures and different curated pictures, to pose as emotionally weak however financially profitable Indian girls. They geolocated their social media profiles to Indian cities and created a pretend firm to achieve victims’ belief.

This isn’t the primary time Chinese language scammers impersonated rich overseas girls to focus on males abroad. Based on the Chenzhou Web Police, two suspects had been busted in March 2024 for utilizing translation apps to defraud Turkish males via a pretend on-line procuring and rebate scheme, posing as wealthy Malaysian girls. They had been supported by a group of greater than 10 workers members and labored throughout Turkish enterprise hours, or from 3 p.m. to 1 a.m. native time.

The police quoted a staffer generally known as “Xiao A” saying: “I performed the character Lisa, a 31-year-old Malaysian-Chinese language lady, divorced, sweet-looking, lengthy hair, about 170 cm tall. She was a clothier together with her personal boutique in Malaysia and an Amazon storefront. She had her personal home and automobile.”

All staff posed as divorced girls of their early 30s with steady monetary backgrounds. The corporate offered a scripted four-day engagement plan to information conversations with targets.

Learn additionally

Options

Crypto Indexers Scramble to Win Over Hesitant Traders

Options

The way to shield your crypto in a risky market: Bitcoin OGs and specialists weigh in

Philippines SEC kicks off crypto sandbox to form future regulation

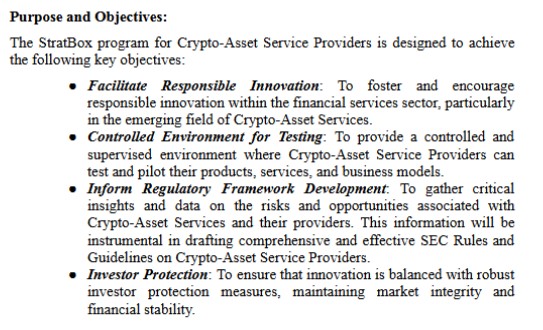

The Philippines Securities and Change Fee (SEC) has opened functions for its new Strategic Sandbox (StratBox) program, concentrating on crypto service suppliers seeking to take a look at merchandise underneath supervision.

The SEC stated in a press launch that the StratBox will supply a managed setting the place eligible entities can pilot crypto-related merchandise, companies, and enterprise fashions. The info gathered via the sandbox is anticipated to tell the eventual drafting of laws for the nation’s digital asset sector. Although targeted on crypto companies, this system can also be open to startups engaged on non-crypto monetary improvements.

The sandbox launch comes amid rising crypto and stablecoin exercise within the Philippines. Circle, the issuer of USDC, not too long ago partnered with GCash, the nation’s most generally used digital pockets, to combine USDC for its practically 100 million customers.

The GCash integration is especially noteworthy as the corporate eyes a possible public itemizing. In February, Globe Telecom CEO Ernest Cu confirmed that an IPO for GCash stays into consideration, although no timeline has been set.

Learn additionally

Options

How Chinese language merchants and miners get round China’s crypto ban

Options

Most DePIN tasks barely even use blockchain: True or false?

How South Koreans pump crypto costs tenfold

South Korean monetary regulators have referred a gaggle of people suspected of manipulating crypto costs to prosecutors whereas uncovering two new ways.

In a joint assertion on April 16, the Monetary Providers Fee (FSC) and Monetary Supervisory Service (FSS) stated the ways exploit core options of the crypto market, like 24/7 buying and selling and multi-exchange listings, to artificially inflate costs of sure tokens.

The primary, dubbed the “racehorse at X hour” methodology, entails front-running main purchases simply earlier than or after an alternate resets every day value change percentages. Relying on the platform, native exchanges typically reset at 00:00, 09:00, or 11:00. Suspects manipulated pumped token costs by accumulating giant portions of a cryptocurrency after which flooded the market with rapid-fire purchase orders as quick as two per second over a 20 to 30-minute window, creating the phantasm of shopping for momentum and luring in retail traders.

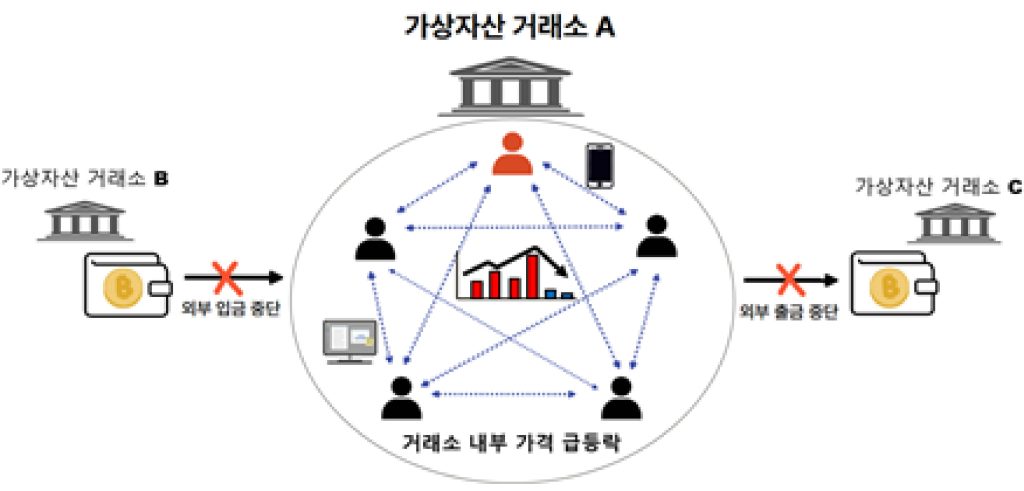

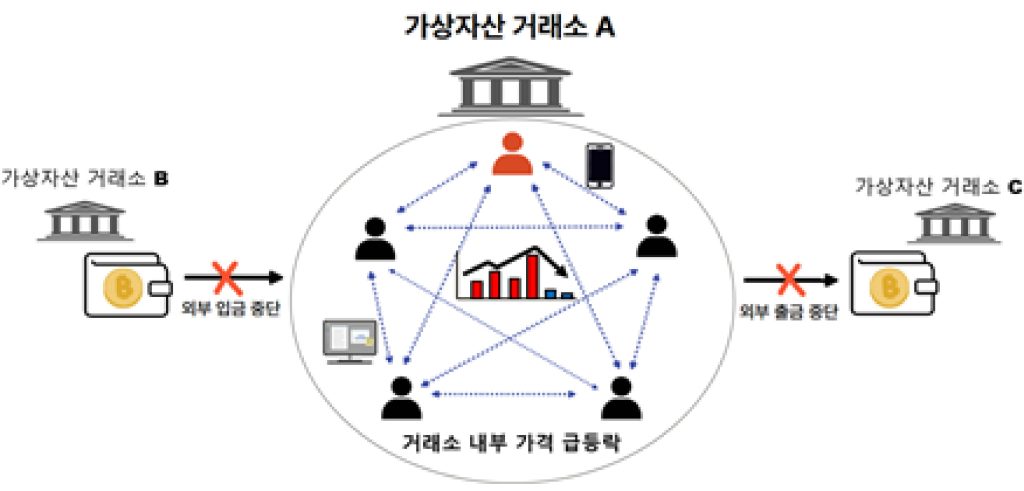

The second methodology, recognized regionally as “cage pumping,” takes benefit of conditions the place deposits or withdrawals of a token are suspended attributable to funding warnings. This cuts off arbitrage alternatives and constrains liquidity, permitting the unhealthy actors to execute manipulative trades to drive up costs on a single alternate. The surges then create a false sense of demand, engaging different merchants to purchase in earlier than costs ultimately collapse.

“Throughout manipulation durations, affected tokens surged as a lot as tenfold on a single alternate in comparison with others, solely to crash again down as soon as the exercise ended,” regulators stated, urging retail traders to be cautious of sharp value actions.

Such market manipulation is a violation underneath native crypto laws, carrying prison penalties of at the very least a yr in jail or fines starting from three to 5 instances the illicit revenue.

Subscribe

Probably the most participating reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist overlaying blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has coated Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.

Learn additionally

Hodler’s Digest

Ethereum completes Merge, Do Kwon faces arrest warrant and Bitcoin dives after rally: Hodler’s Digest, Sept. 11-17

Editorial Workers

7 min

September 17, 2022

The very best (and worst) quotes, adoption and regulation highlights, main cash, predictions and rather more — one week on Cointelegraph in a single hyperlink!

Learn extra

Hodler’s Digest

Is Bitcoin heading again to $90K? Solana ETFs, and extra: Hodler’s Digest, Nov. 17 – 23

Editorial Workers

7 min

November 23, 2024

A crypto dealer mulls over whether or not Bitcoin will retrace again to $90,000, Solana ETF filings flood in and extra: Hodlers Digest

Learn extra