Welcome to the US Morning Crypto Information Briefing—your important rundown of a very powerful developments in crypto for the day forward.

Seize a espresso to see what specialists say about Bitcoin’s (BTC) worth, with $90,000 in sight. World and regional liquidity is increasing, a development that has traditionally confirmed bullish for danger property like crypto.

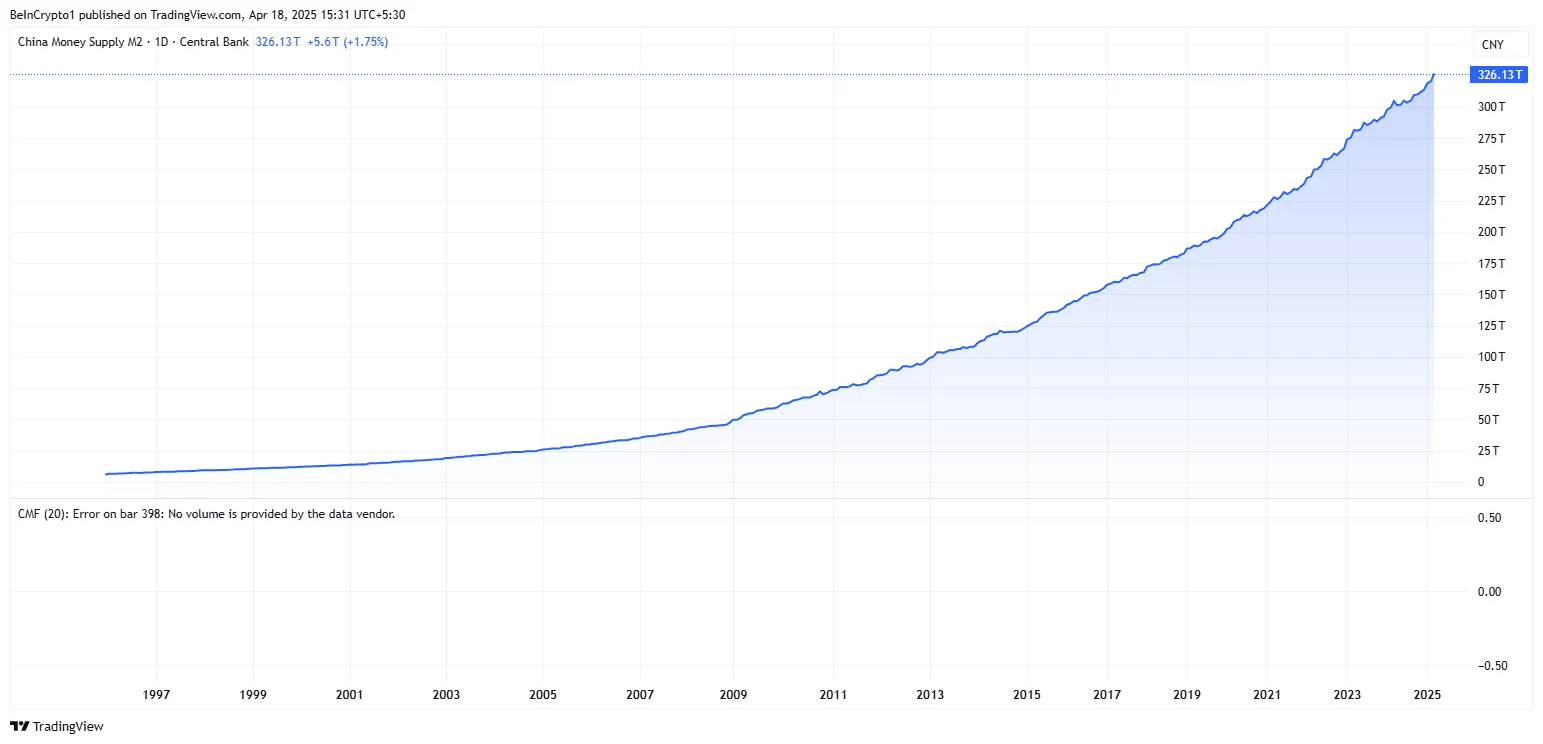

Will Bitcoin Observe As China’s M2 Cash Provide Rises?

In keeping with information on TradingView, China’s M2 cash provide has reached a file $326.13 trillion, steadily surging to new file highs.

An increase in M2 indicators higher liquidity within the monetary system, suggesting extra money is usually in search of returns in riskier property like Bitcoin and altcoins or others, comparable to equities and actual property.

“China’s M2 cash provide simply hit 326 trillion. The cash printers are again on. Threat property are about to go parabolic.,” analyst Kong Buying and selling remarked.

Information on BGeometrics present that the worldwide M2 is rising, a development much like that seen in China’s M2 cash provide. Current spikes have taken each metrics to their respective peaks.

In opposition to this backdrop, analysts counsel a powerful upside could also be imminent for Bitcoin and altcoins. BeInCrypto contacted Brickken market analyst Enmanuel Cardozo D’Armas, who mentioned Bitcoin might retest $90,000 quickly.

“If China’s M2 retains rising, it might give Bitcoin a push upwards, based mostly on what we’ve seen earlier than. Proper now, Bitcoin’s at $85,000, and if M2 retains rising, we might probably see a retest of $90,000,” Enmanuel Cardozo D’Armas advised BeInCrypto.

This goal aligns with yesterday’s US crypto information, the place Blockhead Analysis Community (BRN) analyst Valentin Fournier highlighted the $90,000 goal for Bitcoin worth.

In the meantime, Cardozo D’Armas articulated that China’s M2 cash provide is projected to hit file ranges by the top of 2025. In his opinion, extra money floating round in China might imply extra folks prepared to speculate their money into riskier property like crypto, particularly now that China’s stance is shifting positively.

In keeping with the analyst, the $90,000 threshold is a crucial resistance stage, needed to overcome earlier than a run-up to the $100,000 milestone. Nevertheless, whether or not that is attainable by mid-year stays debatable amid macroeconomic jitters.

“However it’s not a certain wager, as there are loads of issues that might have an effect on the markets in the intervening time. If the Fed cuts charges in Could or June, as some anticipate, that might add extra gas. On the flip facet, if commerce tensions with China or crypto laws tighten once more, we’d not see these targets hit,” the Brickken market analyst added.

Certainly, there stay considerations about Trump’s tariff chaos and China’s retaliatory stance. Amidst these uncertainties, traders could delay allocating capital to high-volatility property till commerce tensions stabilize.

The macro context additionally features a hawkish Federal Reserve (Fed) stance from Jerome Powell, which dominated out any imminent price cuts.

Studies additionally point out that China is liquidating seized cryptocurrencies by means of personal companies to help native authorities funds amid financial struggles.

Cognizant of those elements, Cardozo D’Armas defined that whereas China’s M2 can contribute to Bitcoin’s upward momentum, particularly in bullish instances, it’s not the one factor crypto market contributors ought to take note of.

Regardless of the bullish prediction, merchants and traders ought to brace for macroeconomic headwinds, amongst different components, which might mood any near-term beneficial properties.

Charts of the Day

This chart suggests Bitcoin could observe China’s M2 development towards a worth surge.

This chart reveals a historic correlation the place rising M2 typically precedes altcoin worth surges.

“Altcoins don’t run till liquidity breaks out. It’s time,” crypto analyst TechDev quipped.

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

| Firm | On the Shut of April 17 | Pre-Market Overview |

| Technique (MSTR) | $317.20 | $316.25 (-0.30%) |

| Coinbase World (COIN) | $175.03 | $175.02 (-0.009%) |

| Galaxy Digital Holdings (GLXY.TO) | $15.36 | $15.12 (-1.51%) |

| MARA Holdings (MARA) | $12.66 | $12.68 (+0.16%) |

| Riot Platforms (RIOT) | $6.46 | $6.46 (+0.009%) |

| Core Scientific (CORZ) | $6.63 | $6.65 (+0.29%) |

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.