- Bitcoin’s realized market cap hit a file $872B, however gradual month-to-month progress (0.9%) and a pointy drop in realized income counsel low investor enthusiasm and cautious sentiment.

- Quick-term holders are principally underwater, with a realized value round $91,600 and an MVRV ratio under 1 — each pointing to potential promoting strain and potential shopping for alternatives.

- US merchants are exhibiting stronger demand than Korean merchants, whereas BTC trades in a decent vary ($85.4K–$82.7K) and faces resistance on the each day chart regardless of short-term help.

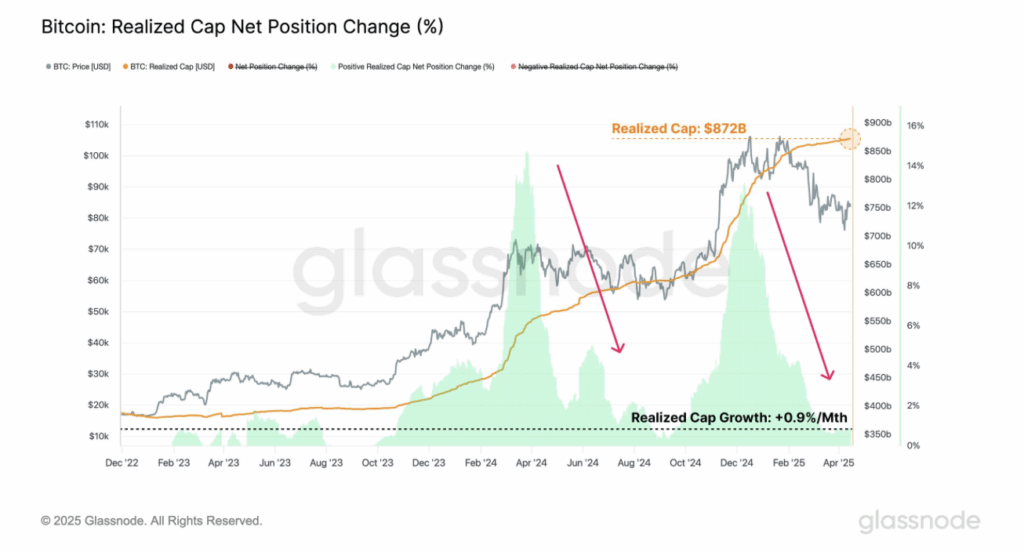

So, right here’s the factor — Bitcoin’s realized market cap simply hit an all-time excessive of $872 billion. Sounds bullish, proper? You’d suppose merchants could be buzzing. However in line with the information — not a lot.

Regardless of this milestone, sentiment throughout the board appears… properly, form of hesitant.

Buyers Aren’t Speeding In — Right here’s Why

In keeping with Glassnode, the month-to-month progress fee of Bitcoin’s realized cap has slowed to simply 0.9%. That’s not zero, however it’s undoubtedly not spectacular both. And for context — realized cap isn’t nearly hype or headlines. It measures the full worth of BTC based mostly on the worth it was final moved. So, it’s a extra grounded tackle how a lot cash’s really flowing in.

A slowdown right here? That sometimes screams “risk-off temper.”

Fewer new buyers. Much less motion from the present crowd. Persons are both chilling or taking part in it secure — most likely each.

Revenue-Taking’s Kicking In, and It’s Dragging Momentum

Glassnode additionally identified a 40% drop in realized revenue and loss. That’s an enormous dip. What it tells us is: lots of people both locked in income or ate losses — and now, they’re on the sidelines. Traditionally, these moments of saturation typically come proper earlier than a consolidation section.

Mainly, the market’s taking a breather — looking for its subsequent course.

Quick-Time period Holders Feeling the Warmth

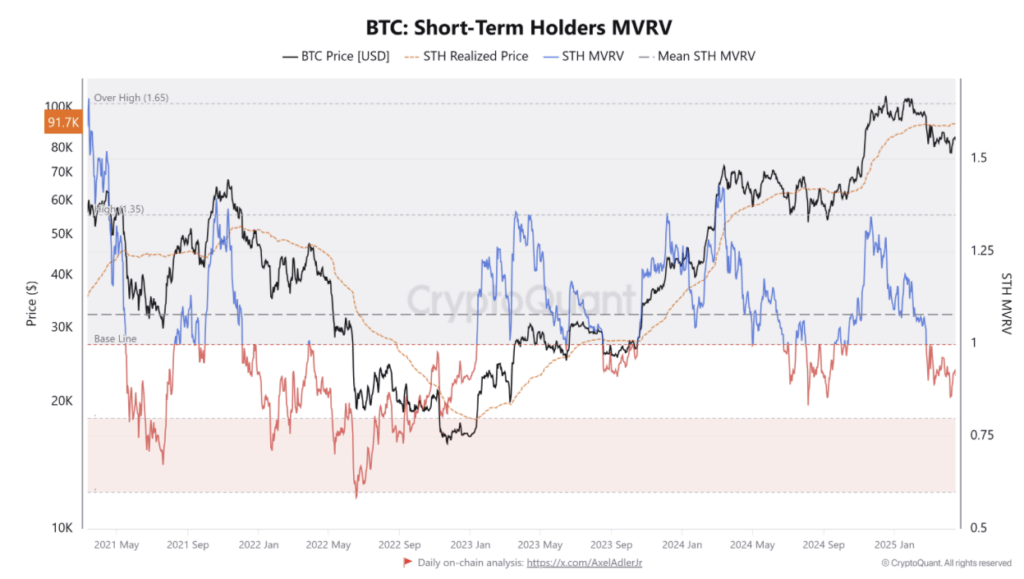

It will get much more fascinating (and barely uncomfortable) if you have a look at short-term holder information. CryptoQuant experiences the present short-term realized value is round $91,600 — which implies, with Bitcoin buying and selling under that, most of those newer holders are underwater.

If value retains hovering right here, a few of them may begin panic promoting to chop losses, including strain to the draw back.

On prime of that, Bitcoin’s MVRV ratio for short-term holders continues to be beneath 1. Traditionally, that’s been an indication that these merchants are holding at a loss — however mockingly, it’s additionally flagged shopping for alternatives up to now. Relies on your danger urge for food.

East vs. West: Diverging Dealer Sentiment

Right here’s a captivating angle — US vs. Korea.

Within the US, the Coinbase premium simply spiked, suggesting robust shopping for demand. That’s often a bullish sign — merchants there are feeling assured.

However over in Korea, it’s the alternative story. The Kimchi premium dropped throughout the latest dip, exhibiting much less retail curiosity from Korean buyers.

This mismatch in demand? You possibly can see it taking part in out within the charts. Bitcoin has been bouncing inside a fairly tight vary — between $85,440 and $82,750 — ever since April 11.

Combined Indicators from the Charts

On shorter timeframes, BTC continues to be holding up properly — it’s sitting above the 50-day, 100-day, and 200-day transferring averages on the 4-hour chart. So short-term merchants may nonetheless be within the sport.

However on the each day chart, those self same transferring averages? They’re performing as resistance — placing strain on any bigger bullish transfer.

So proper now, Bitcoin’s caught on this bizarre center zone. Robust fundamentals, however nervous sentiment. Bullish construction, however cautious merchants.

Remaining Ideas

Bitcoin’s realized cap hitting a file excessive sounds nice on paper — however real-time investor habits tells a extra nuanced story. With short-term holders underwater and world sentiment cut up, BTC may have extra time (and perhaps a catalyst) earlier than making a decisive transfer.

Till then, merchants may need to keep nimble. The massive breakout could possibly be coming — however we’re not there simply but.