Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

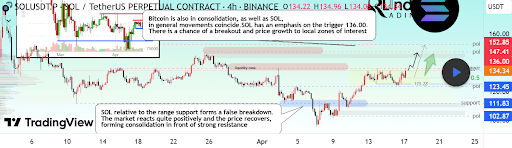

Solana is displaying indicators of pre-breakout conduct because it consolidates beneath an vital value threshold. Based on a brand new technical evaluation shared by RLinda on the TradingView platform, the $136 stage is at present a decisive resistance level, and Solana’s present buying and selling conduct suggests {that a} transfer above this stage may ignite a contemporary bullish push whilst the worldwide market state of affairs is bearish.

Solana Finds Stability After False Breakdown

The present construction of Solana’s value chart displays a notable restoration after what the analyst described as a false breakdown beneath the vary assist zone. This false breakdown refers back to the value crash between the final week of March and the primary week of April, throughout which the Solana value briefly broke beneath $100. Notably, this break beneath $100 got here as an extension of a decline run after a break beneath a key assist vary between $115 and $108.

Associated Studying

After briefly dipping beneath key assist, Solana shortly rebounded, and the market responded with renewed shopping for stress that despatched its value again above $130. Nevertheless, this push is beginning to decelerate, with resistance at $136 and a consolidation part between $130 and $136.

This consolidation vary is proving to be an vital zone for Solana’s bullish potential going ahead, in keeping with RLinda. This conduct is additional bolstered by liquidity dynamics. The analyst highlights a liquidity imbalance created by the current false breakdown, which may favor upward value motion as Solana bulls search to reclaim the higher zones above $136.

A sustained transfer above $136 may function the preliminary set off for a breakout, doubtlessly shifting short-term market sentiment in Solana’s favor. If this state of affairs unfolds, the transfer would offer technical affirmation of rising energy amongst patrons. This bullish potential is notable, whilst RLinda famous that the international market state of affairs is bearish.

Breakout Above $136 May Unlock Increased Value Targets For Solana

Talking of the bearish international market state of affairs, RLinda’s evaluation categorizes the native Solana setup as impartial, indicating that the value is in a spread slightly than exhibiting a definitive pattern. Crypto market dynamics additionally lend weight to the bullish outlook for Solana. Bitcoin, the dominant power within the crypto market, is itself present process consolidation and has been extremely correlated with Solana’s actions in current weeks. Ought to Solana handle to shut and consolidate above $136, the chart opens as much as a sequence of native targets, with the $140, $147, and $152 ranges changing into the next areas of curiosity.

Associated Studying

On the time of writing, Solana is buying and selling at $ 134.80, up 0.5% up to now 24 hours and 15.6% up to now seven days. Even when the outlook is bullish, minor corrections should still happen as this course of unfolds. In such a state of affairs, the Fibonacci 0.5 retracement, situated round $125.28, will present a cushion for value corrections. As such, any short-term dip from the present value stage could also be met with sturdy assist and accumulation on the Fib retracement. Different assist ranges are at $129, $123, and $111.

Featured picture from Adobe Inventory, chart from Tradingview.com