- TAO rallied 13%, reclaiming key help and boosting its market cap above $2.2B after bullish Nvidia information.

- Nvidia confirmed it’ll keep in China, lifting sentiment throughout AI-related crypto tasks.

- AI tokens like NEAR, ICP, and Arweave additionally jumped, posting features between 3% and 9% following the replace.

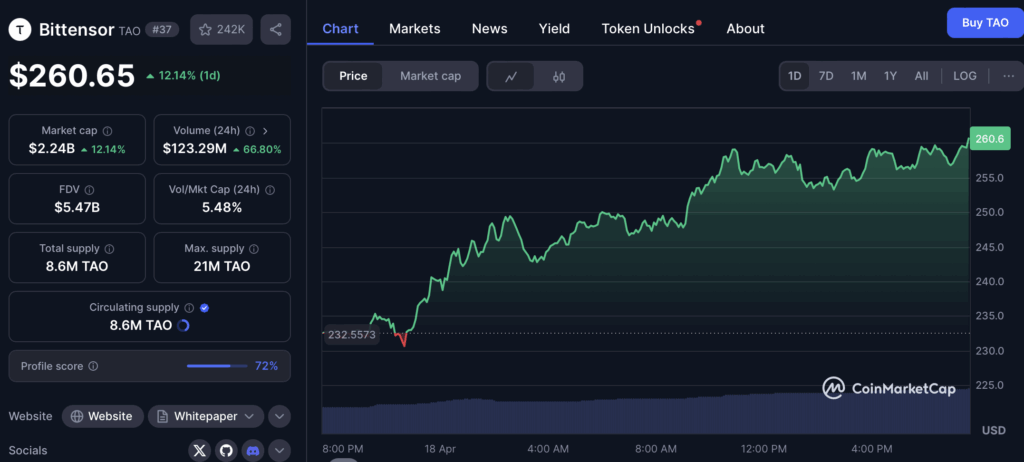

Bittensor’s native token, TAO, all of a sudden sprang to life on April 18, surging almost 13% and clawing its means again above a key help stage. The transfer additionally nudged its market cap over the $2.2 billion mark once more. What sparked the bounce? All indicators level to Nvidia’s surprising—and really public—recommitment to the Chinese language market.

TAO Pumps on Renewed AI Hype

Through the early Asian session, TAO hit an intraday excessive of $259.2, based on crypto.information. Buying and selling quantity wasn’t shy both—spiking greater than 42% to prime $113 million in simply 24 hours. That type of quantity doesn’t lie. Merchants are clearly waking again as much as the AI narrative.

The bullish spark got here after Nvidia’s CEO Jensen Huang made headlines with a high-profile go to to Beijing. Whereas there, he reportedly met with prime Chinese language commerce officers and guaranteed them that Nvidia wasn’t going anyplace. Huang emphasised that the corporate will “spare no effort” to develop merchandise that adjust to U.S. rules whereas persevering with to “unswervingly serve the Chinese language market.”

A Ripple Impact Throughout AI Tokens

The go to follows a tricky week for Nvidia, after the U.S. slapped contemporary export restrictions on its H20 chips—merchandise initially tailor-made to get round prior bans. Dropping entry to the Chinese language market may value Nvidia a staggering $5.5 billion, and the corporate’s inventory has already taken a 7% hit this week.

However crypto’s AI sector had different concepts.

Within the wake of Nvidia’s China pivot, AI-focused tokens noticed a robust bounce. Apart from TAO’s large bounce, Close to Protocol added 3.1%, Render and FET rallied round 4–5%, and Arweave outshined all of them with an 8.6% surge.

Why It Issues

Many of those tasks are constructing on AI and rely—instantly or not directly—on Nvidia’s {hardware} to run their fashions and infrastructure. So when Nvidia indicators energy and continuity, merchants see a inexperienced mild for AI tokens. TAO simply occurred to be first in line.