Bitcoin has soared to new heights in 2024, but the thrill that when accompanied these milestones is surprisingly lacking. As a substitute of untamed rallies and viral buying and selling crazes, the present market feels nearly businesslike—extra calm than chaos.

Gone are the times when a flood of small traders would ship costs parabolic at each new excessive. On-chain developments affirm that the retail crowd, normally represented by short-term holders chasing fast income, is nowhere to be seen this time round.

What’s modified? Not like the wild days of simple stimulus and rock-bottom rates of interest that fueled the final main bull run, immediately’s atmosphere is formed by tighter financial coverage and extra cautious capital. Rates of interest stay elevated, central banks are pulling again assist, and cash is flowing rather more selectively into the crypto house.

In the meantime, the true power behind this 12 months’s rally has come from institutional gamers. The launch of spot Bitcoin ETFs opened the doorways for giant funds {and professional} traders to quietly take the reins. Their method is a far cry from the impulsive trades of retail consumers; establishments deploy capital in measured tranches and deal with long-term positioning relatively than short-term hype.

This transition is apparent in how Bitcoin is shifting. The manic power that when outlined crypto rallies has given option to a extra measured, even subdued advance. There’s much less drama—fewer spikes in volatility, but in addition fewer waves of panic-selling or shopping for. Worth strikes really feel deliberate, and the bull run is progressing with a form of quiet confidence.

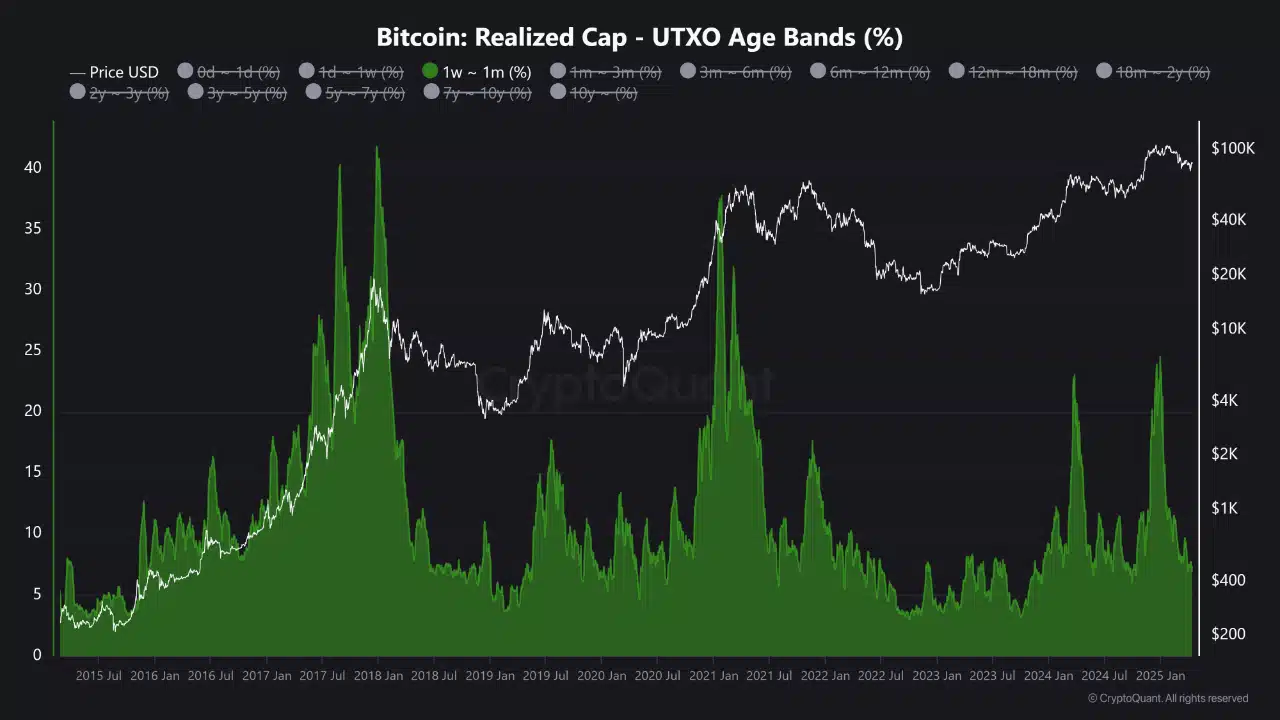

Blockchain knowledge reinforces the story. In earlier cycles, large jumps in cash shifting inside the 1-week to 1-month vary signaled frenzied retail exercise close to market tops. In 2024, that sample is essentially absent—many of the provide is held by skilled, long-term holders who aren’t speeding to promote.

Reasonably than a frenzied crowd chasing each tick, Bitcoin’s new period appears extra like a boardroom than a stadium. And for some, this affected person, disciplined ambiance might be the healthiest signal but for the digital asset’s maturity.