- Whale accumulation has slowed down as leverage rose, signaling high-risk positioning earlier than a breakout

- Ethereum burn charge dropped sharply too, weakening the community’s deflationary assist

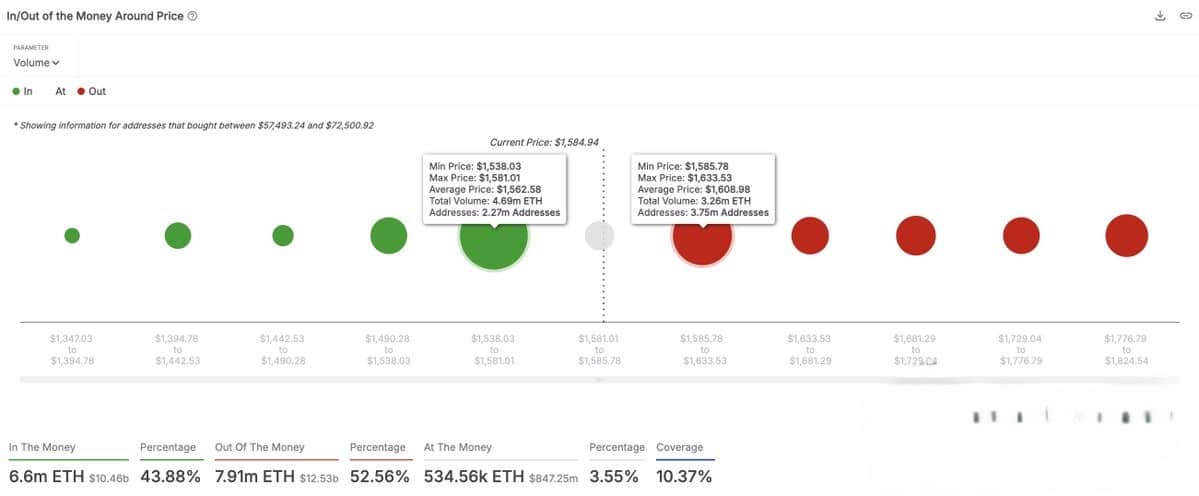

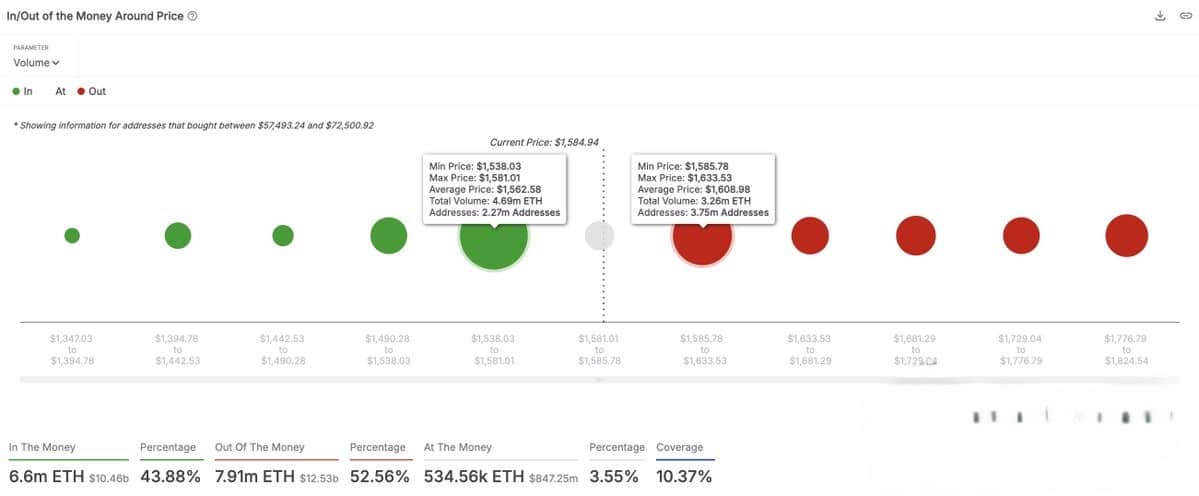

Ethereum [ETH], on the time of writing, gave the impression to be consolidating inside a crucial vary, buying and selling between two important provide zones of $1,540 and $1,630. In truth, on-chain knowledge revealed that over 7.9 million ETH held by addresses had been purchased inside this value vary, forming a high-stakes battlefield for bulls and bears.

The final 24 hours noticed minimal volatility on the altcoin’s charts, with ETH down by simply 0.37%. This tight compression prompt {that a} decisive breakout in both course may outline the following leg of its development trajectory.

For Ethereum, the IOMAP chart highlighted strong assist between $1,513 and $1,585, the place 6.6 million ETH is held “within the cash.” Quite the opposite, resistance could be constructing between $1,585 and $1,630, with 3.37 million addresses holding 7.91 million ETH at a loss.

These clusters clearly appeared to underline the place most market members could also be positioned, creating sturdy zones that ETH should overcome to maneuver meaningfully.

Supply: IntoTheBlock

Will the downtrend prevail as ETH exams mid-channel?

A better take a look at the technical construction revealed that ETH remains to be buying and selling inside a broad descending channel stretching again to January 2025. This downtrend has constantly suppressed bullish momentum, pushing ETH decrease every time it touches the higher resistance band.

These days, the worth motion has been flirting with the channel’s midline, exhibiting hesitation from each bulls and bears. Except consumers break above $1,630, the bearish construction will stay intact. The decrease boundary of the channel aligned intently with the $1,475 assist zone too.

If this bearish narrative positive factors momentum, this degree may act as the following crucial draw back goal. To place it merely, this value construction reinforces the importance of the $1,630-resistance performing as a possible pivot.

Supply: TradingView

Are whales and leverage merchants making ready for a significant transfer?

Whale exercise painted a blended image although. During the last seven days, massive holders netflows elevated by 10.76% – An indication of minor accumulation.

Nonetheless, the 30-day change highlighted a stark decline of 46.70%, confirming current heavy distribution. On a broader 90-day scale, netflows had been nonetheless barely constructive, hovering at +1.77%.

Supply: IntoTheBlock

In the meantime, the estimated leverage ratio rose to 0.7009, up 1.01% within the final 24 hours.

This uptick hinted at rising speculative curiosity and rising leverage throughout exchanges. Due to this fact, if ETH breaks out of this vary, a volatility spike pushed by liquidations may comply with.

Is ETH dropping its deflationary energy?

The share of ETH charges burned has weakened considerably. The 7-day common burn charge dropped to 27.08% too, properly beneath the 90-day common of 42.38%. This drop mirrored decrease community exercise and demand, softening ETH’s deflationary stress.

Due to this fact, with no significant hike in on-chain exercise, bullish follow-through could battle to maintain any momentum on the charts.

Supply: IntoTheBlock

ETH is at a tipping level proper now. Value motion, on-chain clusters, and whale exercise all indicated {that a} main transfer could also be brewing. Nonetheless, the bearish construction, declining burn charge, and rising leverage prompt that bulls should act quick to keep away from any additional draw back.

A breakout above $1,630 may unlock targets at $1,860 and past. Nonetheless, failure to carry $1,540 could invite a pointy correction in the direction of $1,475.