- Canary Capital has filed for a staked TRX ETF with the SEC.

- Regardless of the ETF submitting, Tron is dealing with robust bearish sentiment.

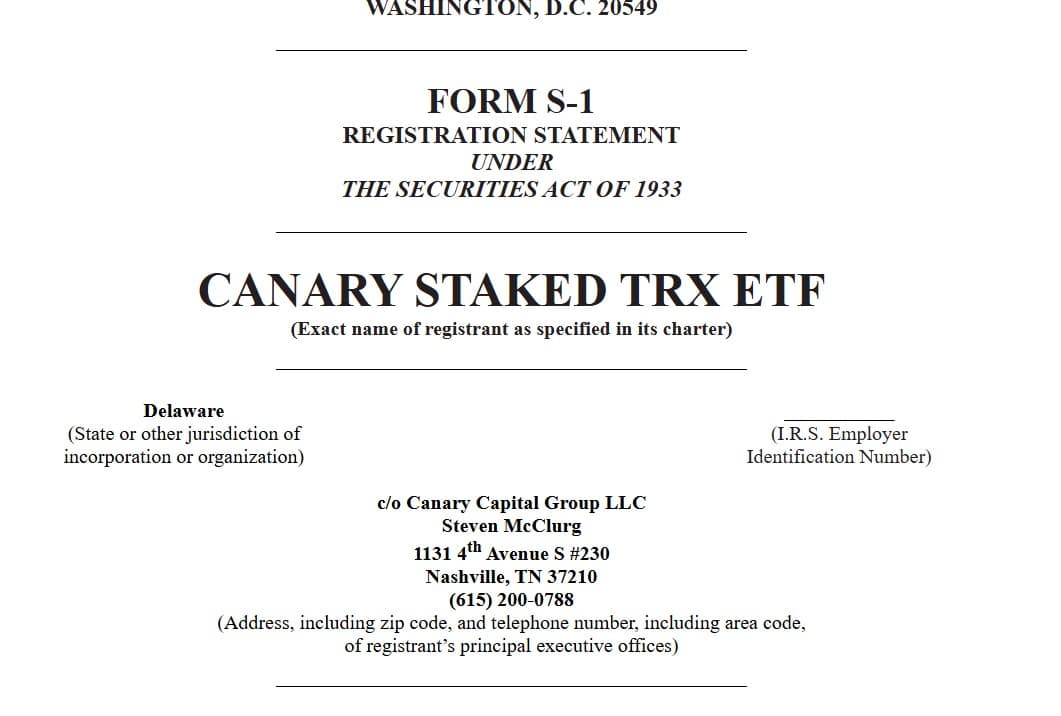

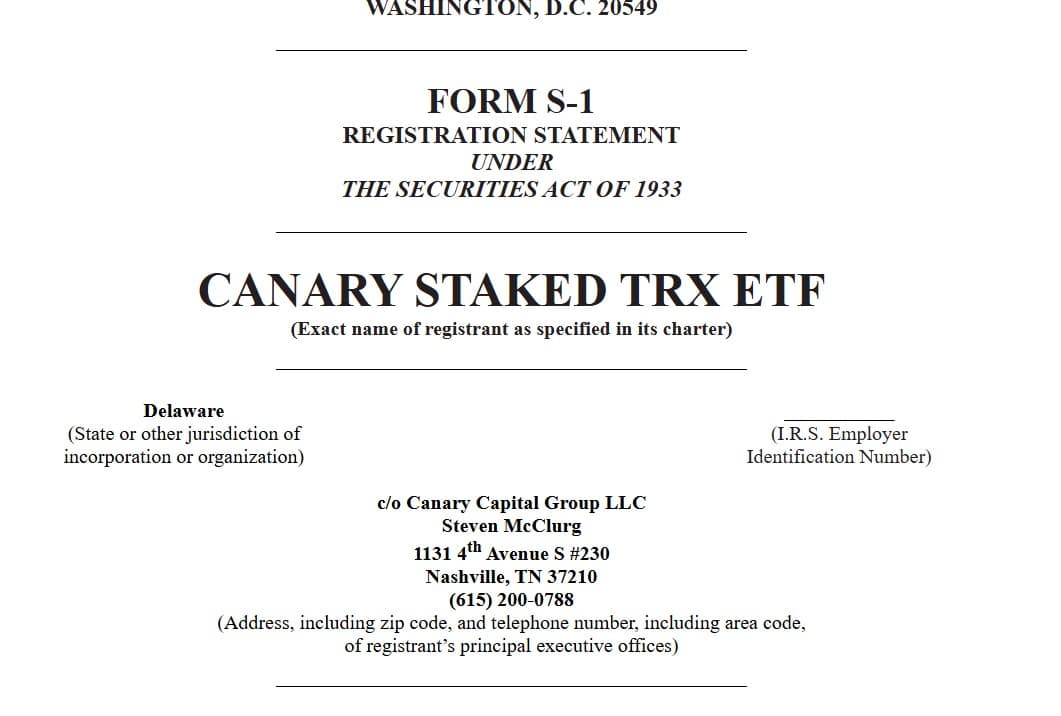

As per studies, Canary Capital, a United States asset supervisor, has filed to record an ETF holding Tron’s native token TRX. In keeping with the agency, the proposed product is named Canary Staked TRX ETF.

As per the submitting, the stated funds intention to carry spot TRX and stake it to generate added yield. Via the ETF, traders can have regulated entry to staking rewards and market publicity.

If authorized, Canary Capital will handle the ETF operations and oversee its total efficiency.

Supply: Sec.Gov

Over the previous 4 months, in an try and capitalize on a pro-crypto SEC in the USA, there was an outpouring of submissions geared toward itemizing ETFs.

Because the begin of the Trump administration, U.S. regulators have obtained a number of filings.

Amidst this ETF frenzy, Canary has filed for numerous altcoin ETFs together with Litecoin [LTC], XRP, Hedera [HBAR], Sui [SUI], and Pudgy Penguins [PENGU].

Is an ETF the increase that TRX wants for restoration?

Whereas it’s anticipated for such excellent news to have a optimistic affect on value motion, that is but to be mirrored. Inasmuch, Tron stays in a powerful downtrend.

The truth is, on the time of writing, Tron was buying and selling at $0.24. This marked a 1.28% drop on day by day charts. On weekly charts, the altcoin has declined by 2.8%.

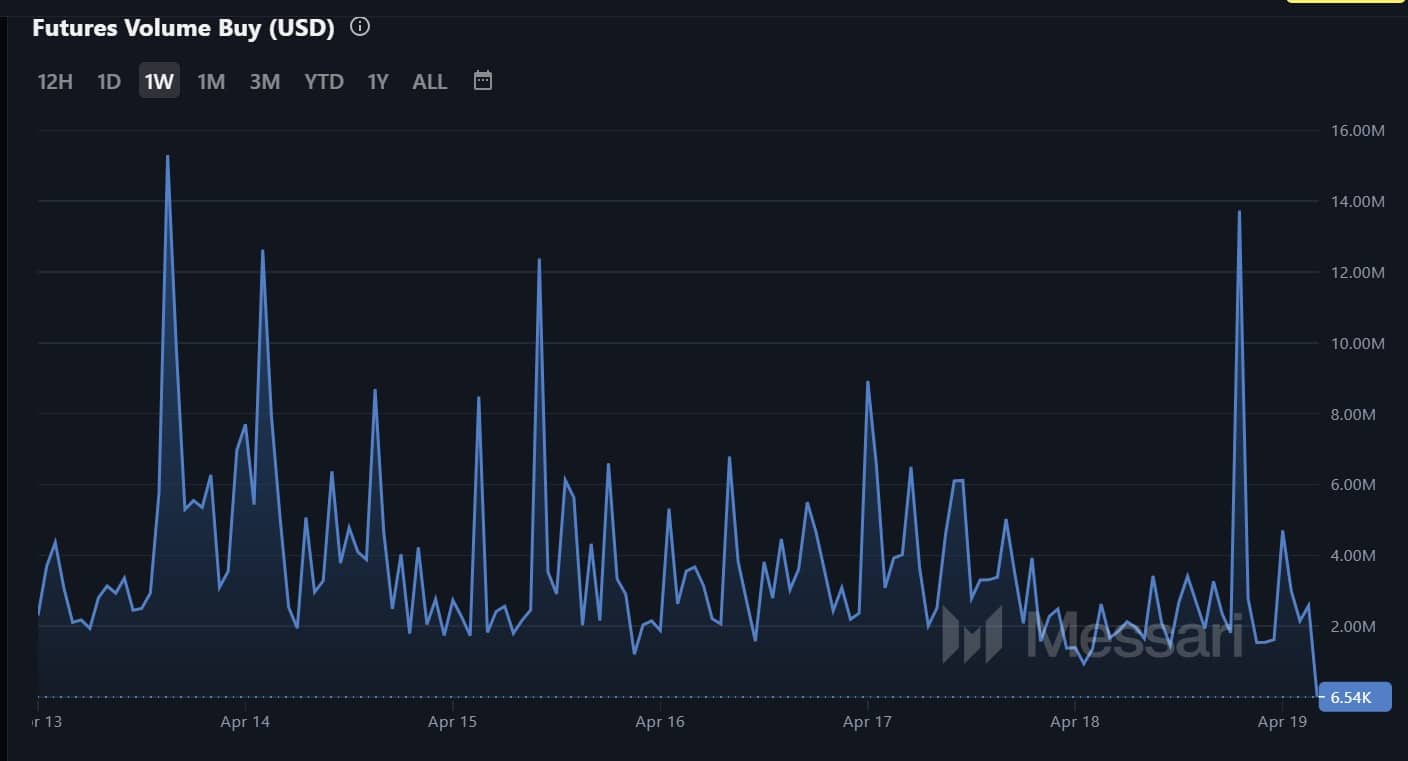

Amidst these losses is slowing demand and mounting bearish sentiments. For starters, Tron consumers have virtually disappeared from the market. Futures purchase quantity too has declined to a weekly low of $6.5k.

Such a drop means that traders presently lack the motivation to imagine in a possible uptrend. As such, there’s weak bullish conviction out there.

Supply: Messari

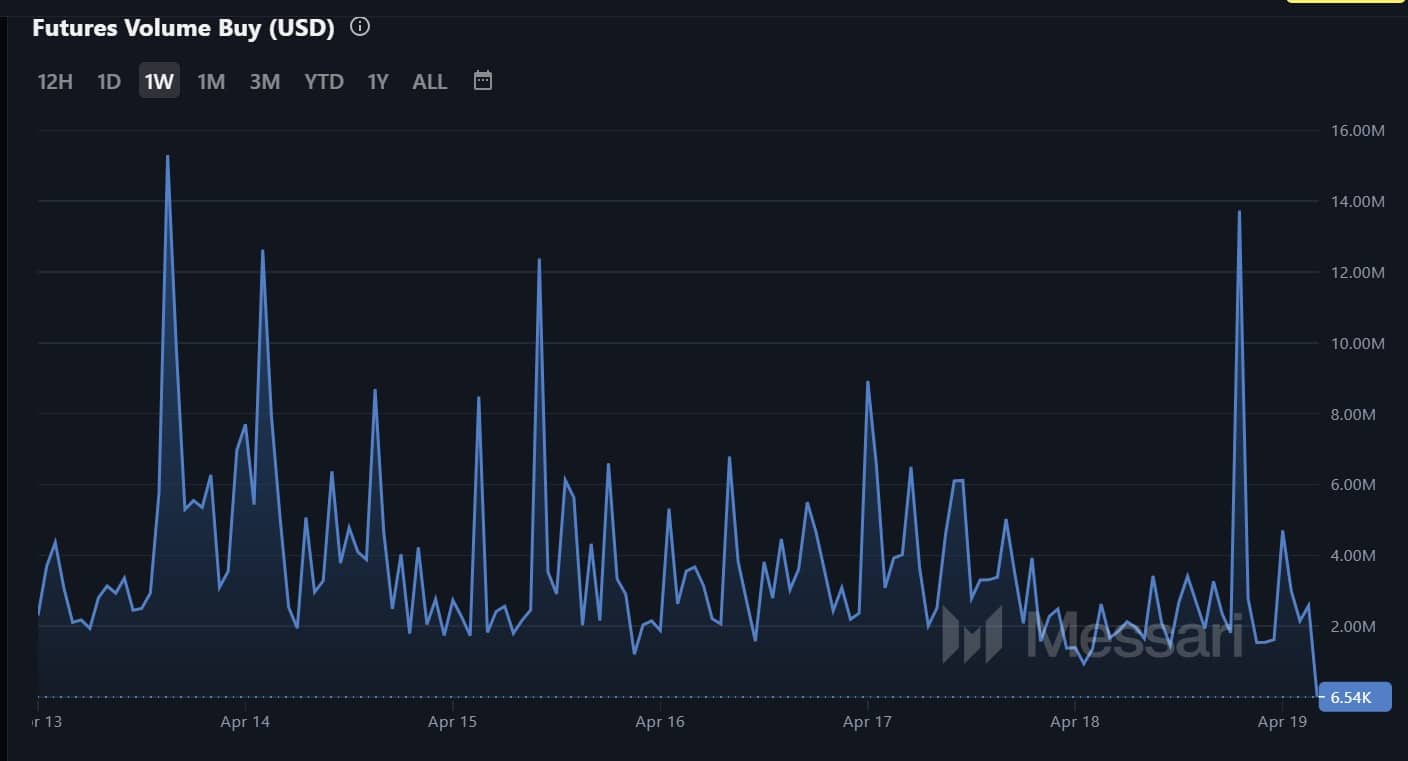

Per the Funding Price (Quantity Weighted), there was a decline in demand for lengthy positions, with the Funding Price holding at a month-to-month low inside unfavourable territory.

When the metric is about like this, it means that traders are aggressively shorting Tron as they count on costs to say no.

Supply: Messari

Due to this fact, an ETF could be a recreation changer for Tron and its native token. An ETF will create room for extra adoption as institutional traders enter the market, resulting in a better demand.

As of now, the submitting has not positively impacted TRX’s value motion. If the event is felt out there, we might see TRX reclaim $0.259.

Nonetheless, if the prevailing market sentiment holds, a drop to $0.23 is inevitable.