The collapse of the MANTRA (OM) token has left traders reeling, with many going through vital losses. As analysts comb by the causes of the collapse, many questions stay.

BeInCrypto consulted trade specialists to establish 5 essential pink flags behind MANTRA’s downfall and reveal methods traders can undertake to avoid related pitfalls sooner or later.

MANTRA (OM) Crash: What Buyers Missed and Easy methods to Keep away from Future Losses

On April 13, BeInCrypto broke the information of OM’s 90% crash. The collapse raised a number of considerations, with traders accusing the group of orchestrating a pump-and-dump scheme. Consultants imagine that there have been many early indicators of hassle.

But, many ignored the dangers related to the mission.

1. MANTRA Pink Flag: OM Tokenomics

In 2024, the group modified OM’s tokenomics after a group vote in October. The token migrated from an ERC20 token to the native L1 staking coin for the MANTRA Chain.

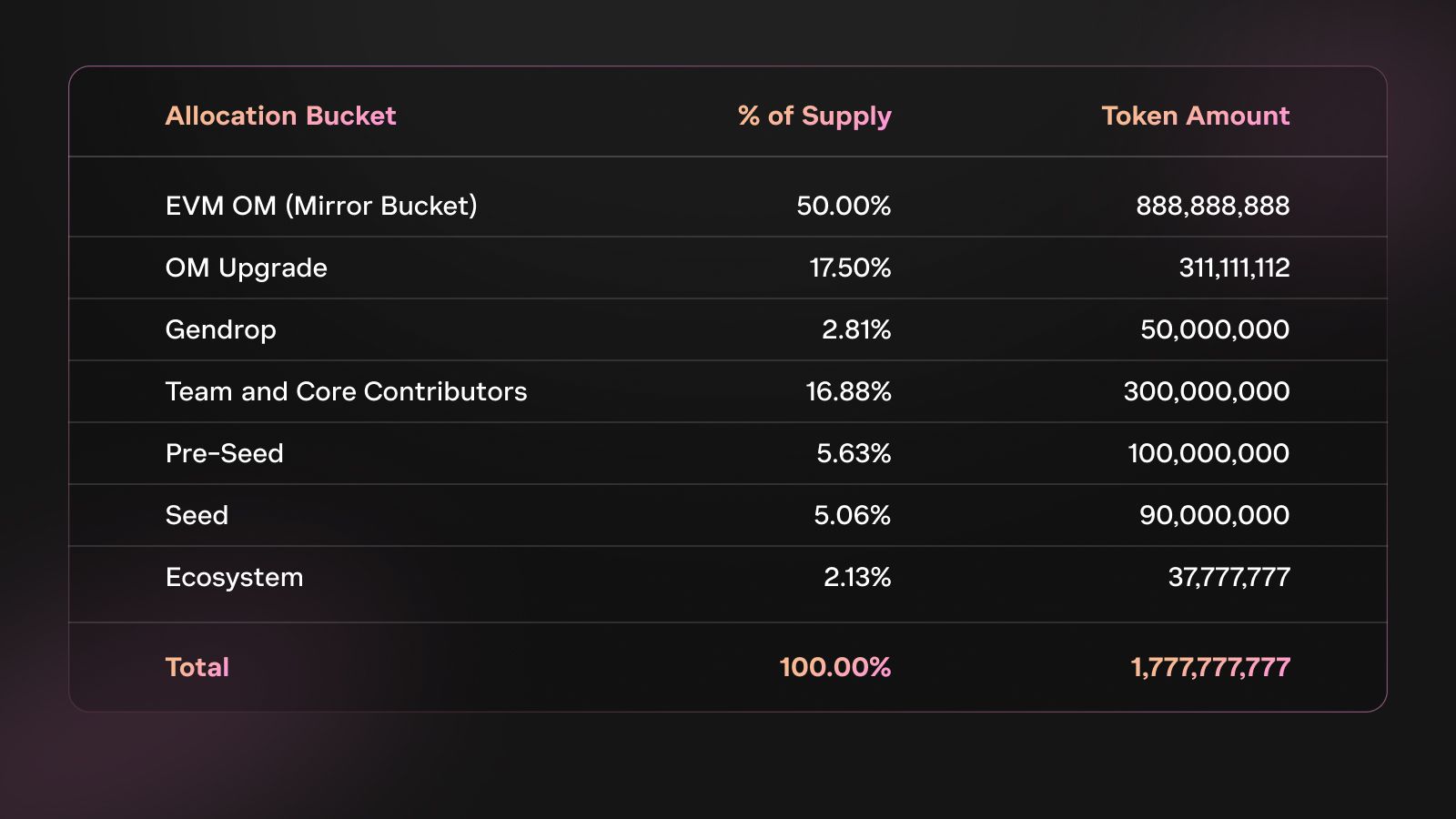

As well as, the mission adopted an inflationary tokenomic mannequin with an uncapped provide, changing the earlier arduous cap. As a part of this transition, the full token provide was additionally elevated to 1.7 billion.

Nonetheless, the transfer wasn’t with out drawbacks. In accordance with Jean Rausis, co-founder of SMARDEX, tokenomics was some extent of concern within the OM collapse.

“The mission doubled its token provide to 1.77 billion in 2024 and shifted to an inflationary mannequin, which diluted its authentic holders. Complicated vesting favored insiders, whereas low circulating provide and large FDV fueled hype and value manipulation,” Jean Rausis instructed BeInCrypto.

Furthermore, the group’s management over the OM provide additionally raised centralization considerations. Consultants imagine this was additionally an element that would have led to the alleged value manipulation.

“About 90% of OM tokens had been held by the group, indicating a excessive degree of centralization that would probably result in manipulation. The group additionally maintained management over governance, which undermined the mission’s decentralized nature,” mentioned Phil Fogel, co-founder of Cork.

Methods to Shield Your self

Phil Fogel acknowledged {that a} concentrated token provide isn’t at all times a pink flag. Nonetheless, it’s essential for traders to know who holds giant quantities, their lock-up phrases, and whether or not their involvement aligns with the mission’s decentralization objectives.

Furthermore, Ming Wu, the founding father of RabbitX, additionally argued that analyzing this knowledge is important to uncover any potential dangers that would undermine the mission in the long run.

“Instruments like bubble maps may also help establish potential dangers associated to token distribution,” Wu suggested.

2. OM Worth Motion

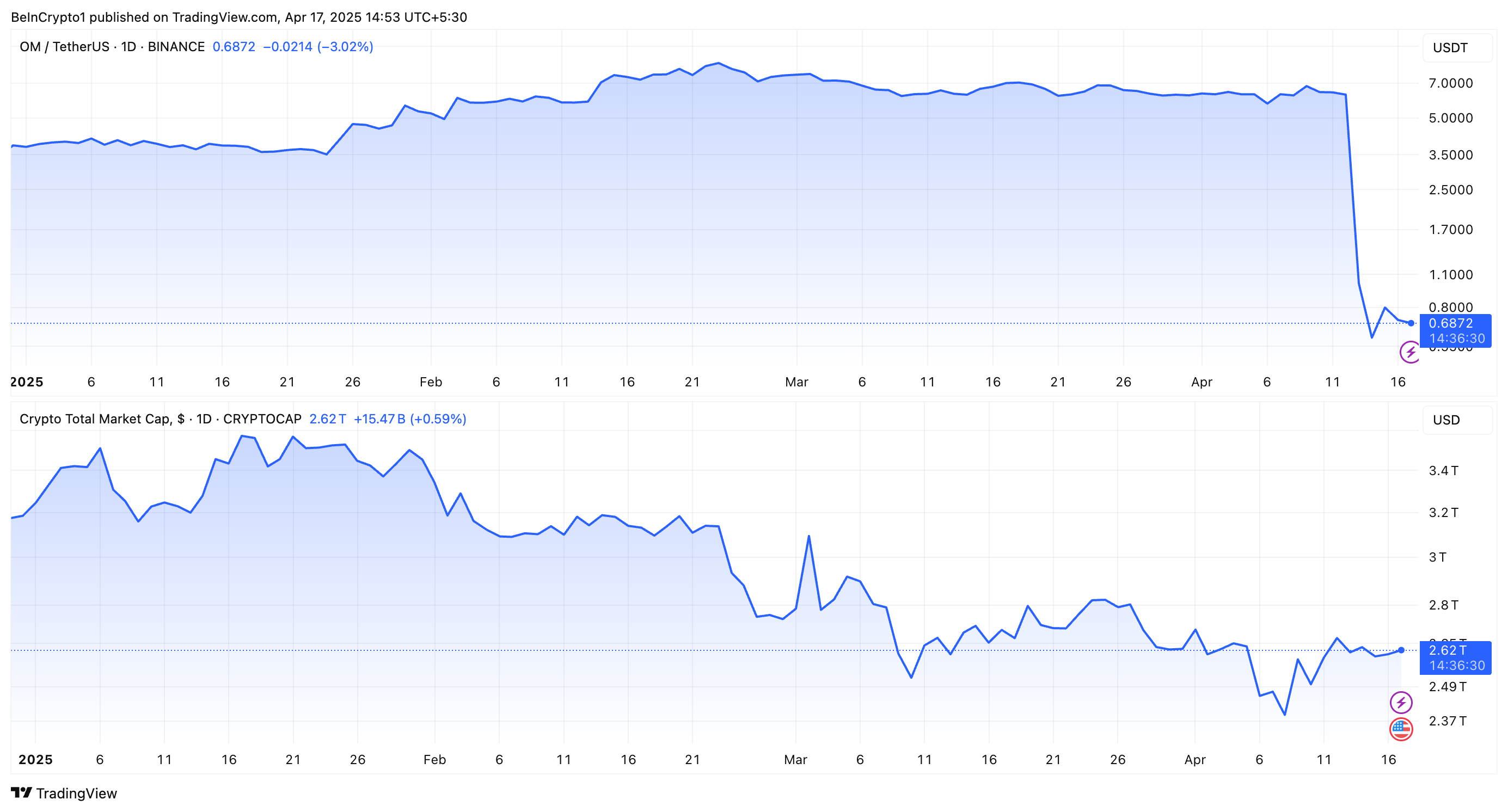

2025 has been marked because the yr of great market volatility. The broader macroeconomic pressures have weighed closely in the marketplace, with the vast majority of the cash experiencing steep losses. But, OM’s value motion was comparatively steady till the newest crash.

“The largest pink flag was merely the value motion. The entire market was happening, and no one cared about MANTRA, and but its token value someway saved pumping in unnatural patterns – pump, flat, pump, flat once more,” Jean Rausis disclosed.

He added that this was a transparent signal of a possible concern or downside with the mission. However, he famous that figuring out the differentiating value motion would require some technical evaluation know-how. Thus, traders missing the data would have simply missed it.

Regardless of this, Rausis highlighted that even the untrained eye might discover different indicators that one thing was off, finally resulting in the crash.

Methods to Shield Your self

Whereas traders remained optimistic about OM’s resilience amid a market downturn, this ended up costing them thousands and thousands. Eric He, LBank’s Group Angel Officer, and Danger Management Adviser emphasised the significance of proactive danger administration to keep away from OM-style collapses.

“First, diversification is vital—spreading capital throughout initiatives limits single-token publicity. Cease-loss triggers (e.g., 10-20% beneath purchase value) can automate harm management in risky situations,” Eric shared with BeInCrypto.

Ming Wu had an identical perspective, emphasizing the significance of avoiding over-allocation to a single token. The chief defined {that a} diversified funding technique helps mitigate danger and enhances total portfolio stability.

“Buyers can use perpetual futures as a danger administration instrument to hedge towards potential value declines of their holdings,” Wu remarked.

In the meantime, Phil Fogel suggested specializing in a token’s liquidity. Key elements embrace the float measurement, value sensitivity to promote orders, and who can considerably affect the market.

3. Undertaking Fundamentals

Consultants additionally highlighted main discrepancies in MANTRA’s TVL. Eric He identified a major hole between the token’s totally diluted valuation (FDV) and the TVL. OM’s FDV reached $9.5 billion, whereas its TVL was solely $13 million, indicating a possible overvaluation.

“A $9.5 billion valuation towards $13 million TVL, screamed instability,” Forest Bai, co-founder of Foresight Ventures, acknowledged.

Notably, a number of points had been additionally raised relating to the airdrop. Jean Rausis referred to as the airdrop a “mess.” He cited many points, together with delays, frequent modifications to eligibility guidelines, and the disqualification of half the members. In the meantime, suspected bots weren’t eliminated.

“The airdrop disproportionately favored insiders whereas excluding real supporters, reflecting an absence of equity,” Phil Fogel reiterated.

The criticism expanded additional as Fogel identified the group’s alleged associations with questionable entities and ties to questionable preliminary coin choices (ICOs), elevating doubts in regards to the mission’s credibility. Eric He additionally steered that MANTRA was allegedly tied to playing platforms up to now.

Methods to Shield Your self

Forest Bai underscored the significance of verifying the mission group’s credentials, reviewing the mission roadmap, and monitoring on-chain exercise to make sure transparency. He additionally suggested traders to evaluate group engagement and regulatory compliance to gauge the mission’s long-term viability.

Ming Wu additionally burdened distinguishing between actual development and artificially inflated metrics.

“It’s essential to distinguish actual development from exercise that’s artificially inflated by incentives or airdrops, unsustainable ways like ‘promoting a greenback for 90 cents’ could generate short-term metrics however don’t mirror precise engagement,” Wu knowledgeable BeInCrypto.

Lastly, Wu beneficial researching the background of the mission’s group members to uncover any historical past of fraudulent exercise or involvement in questionable ventures. This could be sure that traders are well-informed earlier than committing to any mission.

4. Whale Actions

As BeInCrypto reported earlier, earlier than the crash, a whale pockets reportedly related to the MANTRA group deposited 3.9 million OM tokens into the OKX alternate. Consultants highlighted that this wasn’t an remoted incident.

“Giant OM transfers (43.6 million tokens, ~$227 million) to exchanges days prior had been a significant warning of potential sell-offs,” Forest Bai conveyed to BeInCrypto.

Ming Wu additionally defined that traders ought to pay shut consideration to such giant transfers, which regularly act as warning alerts. Furthermore, analysts at CryptoQuant additionally outlined what traders ought to look out for.

“OM transfers into exchanges amounted to as a lot as $35 million in simply an hour. This represented an alert signal as: Transfers into exchanges are beneath $8 million in a typical hour (excluding transfers into Binance, that are usually giant given the scale of the alternate). Transfers into exchanges represented greater than a 3rd of the full OM transferred, which signifies a excessive switch quantity into exchanges,” CryptoQuant knowledgeable BeInCrypto.

Methods to Shield Your self

CryptoQuant acknowledged that traders want to observe the flows of any token into exchanges, because it might point out rising value volatility within the close to future.

In the meantime, Danger Management Adviser Eric He outlined 4 methods to remain up-to-date with regards to giant transfers.

- Chain Sleuthing: Instruments like Arkham and Nansen enable traders to trace giant transfers and monitor pockets exercise.

- Set Alerts: Platforms like Etherscan and Glassnode notify traders of bizarre market actions.

- Monitor Trade Flows: Customers want to trace giant flows into centralized exchanges.

- Test Lockups: Dune Analytics helps traders decide if group tokens are being launched sooner than anticipated.

He additionally beneficial focusing in the marketplace construction.

“OM’s crash proved market depth is non-negotiable: Kaiko knowledge confirmed 1% order ebook depth collapsed 74% earlier than the autumn. At all times test liquidity metrics on platforms like Kaiko; if 1% depth is beneath $500,000, that’s a pink flag,” Eric revealed to BeInCrypto.

Moreover, Phil Fogel underlined the significance of monitoring platforms like X (previously Twitter) for any rumors or discussions about doable dumps. He burdened the necessity to analyze liquidity to evaluate whether or not a token can deal with promote strain with out inflicting a major value drop.

5. Centralized Trade Involvement

After the crash, MANTRA CEO JP Mullin was fast guilty centralized exchanges (CEXs). He mentioned the crash was triggered by “reckless pressured closures” throughout low-liquidity hours, alleging negligence or intentional positioning. But Binance pointed to cross-exchange liquidations.

Curiously, specialists had been barely divided on how CEXs contributed to OM’s crash. Forest Bai claimed that CEX liquidations throughout low-liquidity hours worsened the crash by triggering cascading sell-offs. Eric He corroborated this sentiment.

“CEX liquidations performed a significant position within the OM crash, performing as an accelerant. With skinny liquidity—1% depth falling from $600,000 to $147,000—pressured closures triggered cascading liquidations. Over $74.7 million was wiped in 24 hours,” he talked about.

But, Ming Wu referred to as Mullin’s rationalization “simply an excuse.”

“Analyzing the open curiosity within the OM derivatives market reveals that it was lower than 0.1% of OM’s market capitalization. Nonetheless, what’s notably fascinating is that in the course of the market collapse, open curiosity in OM derivatives truly elevated by 90%,” Wu expressed to BeInCrypto.

In accordance with the manager, this challenges the concept liquidations or pressured closures induced the value drop. As a substitute, it signifies that merchants and traders elevated their brief positions as the value fell.

Methods to Shield Your self

Whereas the involvement of CEXs stays debatable, the specialists did handle the important thing level of investor safety.

“Buyers can restrict leverage to keep away from pressured liquidations, select platforms with clear danger insurance policies, monitor open curiosity for liquidation dangers, and maintain tokens in self-custody wallets to cut back CEX publicity,” Forest Bai beneficial.

Eric He additionally suggested that traders ought to mitigate dangers by adjusting leverage dynamically primarily based on volatility. If instruments like ATR or Bollinger Bands sign turbulence, publicity ought to be lowered.

He additionally beneficial avoiding buying and selling throughout low-liquidity intervals, akin to midnight UTC, when slippage dangers are highest.

The MANTRA (OM) collapse is a strong reminder of the significance of due diligence and danger administration in cryptocurrency investments. Buyers can decrease the chance of falling into related traps by rigorously assessing tokenomics, monitoring on-chain knowledge, and diversifying investments.

With knowledgeable insights, these methods will assist information traders towards smarter, safer choices within the crypto market.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.