- Whales have began shopping for extra Bitcoin, spending tens of hundreds of thousands on acquisitions over the previous few months.

- Market sentiment reveals these whales is likely to be holding the asset for the long run.

Bitcoin [BTC] has maintained a gentle threshold out there, shifting inside a decent vary and recording no vital acquire—solely as much as 1% up to now month.

New market perception means that sentiment might quickly shift, with Bitcoin doubtlessly rising in worth as whales proceed to build up the asset.

Whale curiosity in Bitcoin rises

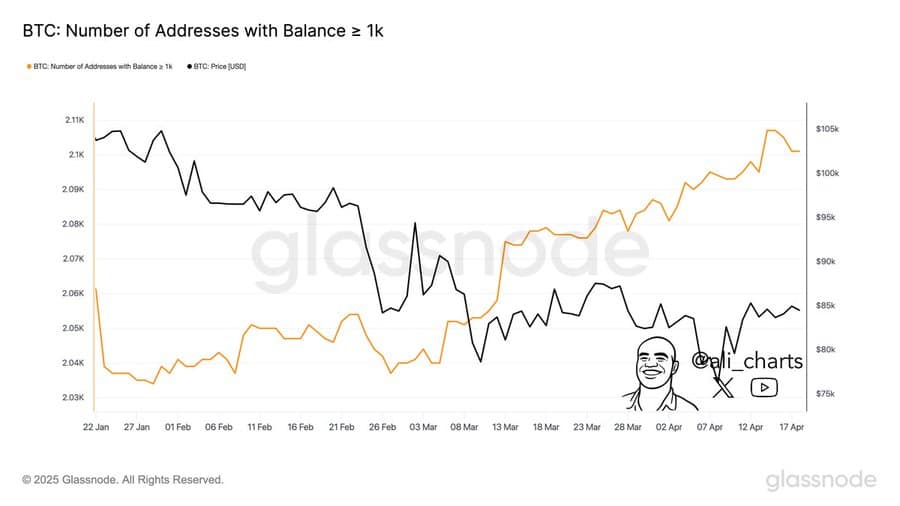

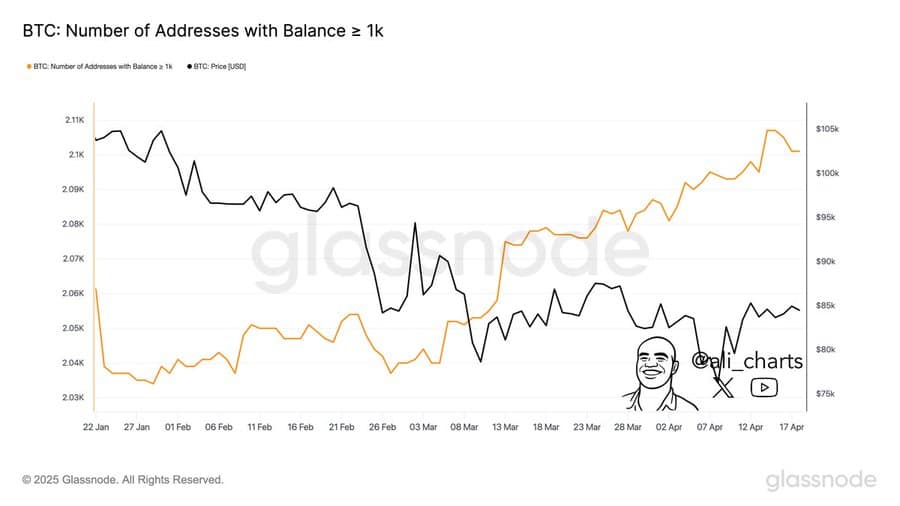

Whales, recognized to manage a good portion of any asset, have proven renewed curiosity in Bitcoin over the previous few months.

Since early March, evaluation reveals new whales have entered the market and began buying Bitcoin. To date, 60 of those buyers have every bought a minimum of 1,000 Bitcoin, totaling roughly $85 million.

Supply: Glassnode

Naturally, this inflow got here whereas BTC traded nicely beneath its all-time excessive, hinting at undervaluation within the eyes of enormous buyers.

This enhance in whale participation can be noteworthy given the general decline in crypto market liquidity.

In simply the previous two weeks, capital influx has dropped from $8.2 billion to $2.38 billion.

With shrinking funds coming into the market, belongings receiving liquidity grow to be extra attention-grabbing, as they’re prone to outperform others. Whale exercise in BTC confirms it could proceed to steer market beneficial properties.

Establishments and key whales are making strikes

Having stated that, it wasn’t simply whales shopping for the dip.

AMBCrypto evaluation recognized one whale profiting from Bitcoin’s current value decline to build up a major quantity of the asset.

In response to insights from Arkham Intelligence, a whale recognized as “Abraxas Capital Mgmt” has been actively buying Bitcoin.

Because the starting of April, this whale has grown its Bitcoin holdings from $2.8 million to $253 million, confirming robust investor bias towards the asset.

Curiously, underneath a distinct handle, this whale additionally holds one other $43 million in LBTC, bringing its complete to $296 million.

Supply: CoinGlass

Institutional buyers have additionally slowed their promoting and ended the week with inflows into Bitcoin ETFs (exchange-traded funds). Evaluation reveals this group purchased $106.90 million price of BTC by week’s finish.

If accumulation by whales and establishments continues, Bitcoin’s worth might rise, doubtlessly resulting in a rally.

Lengthy-term merchants are shopping for

To find out whether or not this accumulation is non permanent or sustainable, AMBCrypto examined the conduct of long-term holders.

Utilizing Bitcoin’s Coin Days Destroyed (CDD) metric which signifies whether or not long-term holders are promoting or holding, AMBCrypto discovered the latter to be true.

Supply: CryptoQuant

At the moment, the CDD trended close to zero—implying long-term holders weren’t promoting. The truth is, they’ve continued to carry their positions, even by market chop.

With whales accumulating, establishments rotating again in, and long-term holders staying put, Bitcoin has emerged as the first liquidity magnet in a drying market.

If these tailwinds persist, BTC might not simply maintain regular—it might be gearing up for its subsequent rally.