Bitcoin is about to shut one other week under the crucial $90,000 stage, fueling bearish sentiment throughout the market. Regardless of a short-term bounce earlier within the week, the lack to reclaim larger floor continues to fret buyers. World tensions stay elevated as US President Donald Trump intensifies his commerce conflict with China. Though a 90-day tariff pause was granted to all nations besides China final week, uncertainty lingers, and markets stay on edge. Commerce relations between the U.S. and China proceed to outline broader financial sentiment, affecting high-risk belongings like Bitcoin.

Volatility stays low, however many imagine that received’t final for much longer. High analyst Huge Cheds shared a technical chart on X exhibiting that Bitcoin’s 1-hour Bollinger Bands are actually tightening — a traditional sign {that a} main transfer could also be imminent. These “pinching” bands usually counsel compression in worth motion, typically previous a breakout or breakdown.

With BTC caught in a slim vary for a number of days, merchants are bracing for sharp motion in both path. Whether or not this upcoming transfer results in a bullish reversal or additional draw back stays unsure, however present situations counsel that volatility is ready to return within the coming periods.

Bitcoin Consolidates As Macroeconomic Tensions Form Market Outlook

Bitcoin is now intently monitoring the broader macroeconomic narrative, with the escalating commerce tensions between the US and China weighing closely on international market sentiment. The specter of a world recession is rising as each nations double down on tariff measures, creating an unstable setting for danger belongings. On this backdrop, Bitcoin has entered a consolidation section after enduring weeks of aggressive promoting strain and heightened uncertainty.

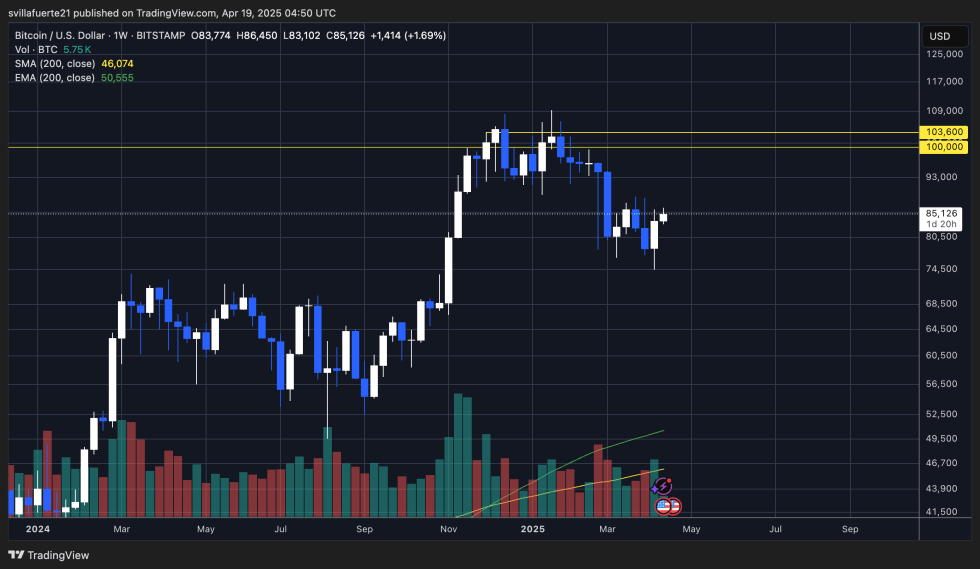

Presently buying and selling under $86,000 however holding agency above the $82,000–$81,000 help zone, BTC is navigating a decent vary with no clear path. Analysts are more and more divided: some warn that BTC might have already entered a bear market, pointing to the failed expectations of a bullish breakout this 12 months. The market’s lack of ability to reclaim key shifting averages has additional amplified these fears.

Nonetheless, there stays a pocket of bullish optimism. Many buyers imagine Bitcoin might rally above the $100,000 mark as soon as macro situations stabilize and capital returns to high-conviction belongings. Supporting this view, Cheds highlighted on X that Bitcoin’s 1-hour Bollinger Bands are actually “pinching,” a technical setup that usually precedes important worth strikes.

As volatility compresses and exterior financial elements dominate headlines, the approaching days might decide Bitcoin’s subsequent main leg.

Value Struggles Beneath $90K: Weekly Shut Looms

Bitcoin is at present buying and selling at $85,000 and is on observe to verify its seventh consecutive weekly shut under the $90,000 mark. This prolonged interval beneath a key psychological and technical resistance has intensified considerations amongst market contributors concerning the energy of the present restoration try. Bulls should reclaim the $90K stage rapidly to verify a shift in momentum and provoke a correct restoration section.

Failing to interrupt above this threshold would probably lead to continued weak spot, with a pointy retrace towards the $80K–$78K area extremely possible. The $90K barrier has grow to be an important pivot level, not just for short-term sentiment but in addition for outlining the broader development path. A decisive push above this zone, particularly with sturdy quantity and follow-through, might propel Bitcoin immediately towards the $95K stage, probably reigniting bullish momentum.

Nevertheless, with market volatility nonetheless muted and macroeconomic uncertainty urgent on investor sentiment, BTC stays range-bound and indecisive. Till consumers take clear management, Bitcoin’s worth motion might proceed to grind sideways or tilt decrease. All eyes now flip to the weekly candle shut as merchants await a breakout or breakdown that would outline Bitcoin’s trajectory within the weeks forward.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.