Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum is at present buying and selling at a essential resistance stage as bulls try and regain momentum and push for a contemporary excessive. The broader market stays below stress as world uncertainty escalates, largely fueled by ongoing commerce tensions between the US and China. Final week, US President Donald Trump introduced a 90-day tariff pause on all international locations besides China, intensifying considerations about an prolonged commerce battle that would destabilize world monetary markets.

Associated Studying

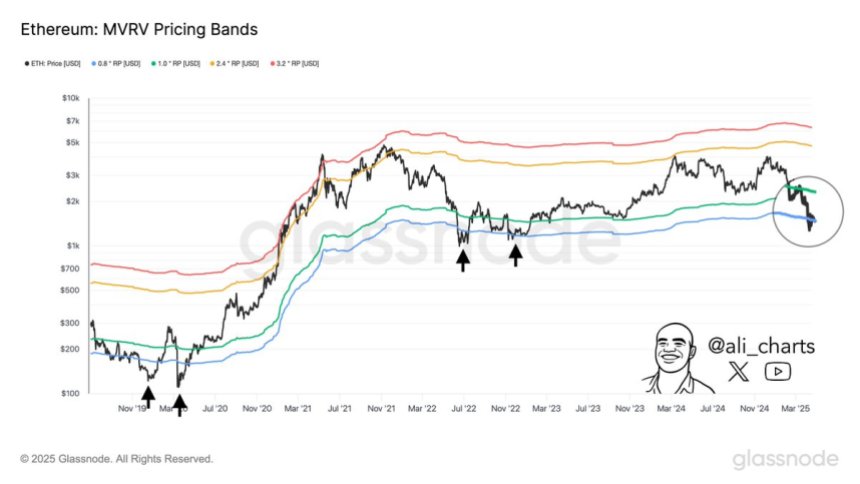

On this high-stakes setting, Ethereum’s worth motion is drawing shut consideration from traders and analysts. Prime crypto analyst Ali Martinez shared that traditionally, the very best Ethereum shopping for alternatives have emerged when the worth drops beneath the decrease MVRV (Market Worth to Realized Worth) Value Band—a stage that indicators potential undervaluation. Notably, ETH is now buying and selling exactly in that zone.

This alignment between technical circumstances and macroeconomic instability means that Ethereum could possibly be getting into a section of accumulation, with long-term traders seeking to capitalize on discounted costs. Nonetheless, sustained upward momentum will rely on whether or not bulls can overcome rapid resistance and whether or not macro circumstances enhance. The approaching days might show pivotal for ETH because it exams each technical and psychological thresholds.

Ethereum Dips Into Historic Alternative Zone

Ethereum is at present buying and selling beneath key resistance ranges after enduring a number of weeks of promoting stress and weak market efficiency. Since shedding the essential $2,000 help stage, ETH has fallen roughly 21%, a transparent indication that bulls have but to regain management. Broader macroeconomic pressures, particularly rising world tensions and unsure commerce circumstances between the US and China, have additional dampened market sentiment. These circumstances have pushed many traders to exit riskier belongings like cryptocurrencies, resulting in elevated volatility and decreased market participation.

Regardless of this downtrend, some analysts consider Ethereum could possibly be nearing a pivotal turnaround zone. Based on Martinez, top-of-the-line historic indicators for Ethereum accumulation has been worth motion dipping beneath the decrease certain of the MVRV Value Band—a metric that compares market worth to realized worth to evaluate whether or not an asset is over- or undervalued. Presently, Ethereum is buying and selling beneath that decrease band.

Martinez emphasizes that this positioning has sometimes preceded sturdy upside reversals, particularly in periods of utmost market pessimism. Whereas short-term volatility might persist, ETH’s entry into this zone might current a uncommon alternative for long-term traders to build up at traditionally discounted ranges—if market circumstances stabilize and sentiment shifts.

Associated Studying

ETH Stalls In Tight Vary

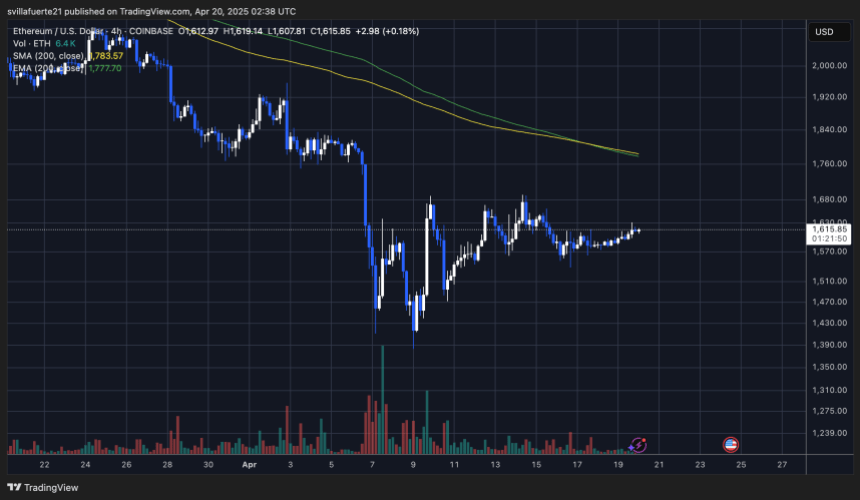

Ethereum is at present buying and selling at $1,610 after practically per week of low volatility and sideways motion. Since final Tuesday, ETH has remained locked in a good vary between $1,550 and $1,630, reflecting the market’s uncertainty and hesitation to take a transparent directional stance. This slim buying and selling zone highlights a interval of worth compression, typically a precursor to a bigger transfer in both route.

For bulls to regain momentum and shift sentiment, Ethereum should reclaim the $1,700 stage and push decisively above the $2,000 mark. These ranges not solely function key psychological boundaries but in addition characterize essential zones of earlier help which have now changed into resistance. A breakout above $2,000 would possible set off renewed shopping for curiosity and set the stage for a possible restoration rally.

Associated Studying

Nonetheless, if bearish stress builds and the $1,550 flooring is breached, Ethereum might rapidly check the $1,500 help zone. A breakdown beneath that stage would affirm additional draw back danger, probably accelerating sell-offs and deepening the present correction. Till a breakout or breakdown happens, merchants ought to put together for extra consolidation and volatility because the market awaits a macro or technical catalyst.

Featured picture from Dall-E, chart from TradingView