A wave of heavy sell-offs linked to the crew behind the Melania meme coin (MELANIA) has raised contemporary considerations about insider exercise inside the mission.

These actions have contributed to the token’s worth dropping to an all-time low, a staggering 97% down from its all-time excessive on Trump’s inauguration day again in January.

Heavy Insider Promoting Sends MELANIA to Historic Low

On April 19, on-chain analyst EmberCN reported that wallets tied to the mission offloaded practically 3 million MELANIA tokens.

In return, the crew acquired roughly 9,009 SOL, valued at round $1.2 million. The tokens had been offered by means of unilateral liquidity provisions added to the MELANIA/SOL buying and selling pair on Meteora.

This transaction is a part of a broader sample. Up to now three days, the MELANIA crew reportedly moved 7.64 million tokens, price about $3.21 million, from each liquidity and neighborhood wallets.

The crew systematically added these tokens to the identical liquidity pool and offered them for SOL inside a pre-defined worth vary. Out of the full, they offered 2.95 million tokens simply hours earlier than EmberCN’s disclosure.

“Up to now 3 days, the $MELANIA mission crew has continued to switch out 7.643 million $MELANIA tokens ($3.21M) from liquidity and neighborhood addresses, then added them to MELANIA/SOL one-sided liquidity on Meteora, promoting $MELANIA inside a set vary for SOL. Of which, 2.95 million $MELANIA tokens had been offered 7 hours in the past for 9,009 SOL,” EmberCN said.

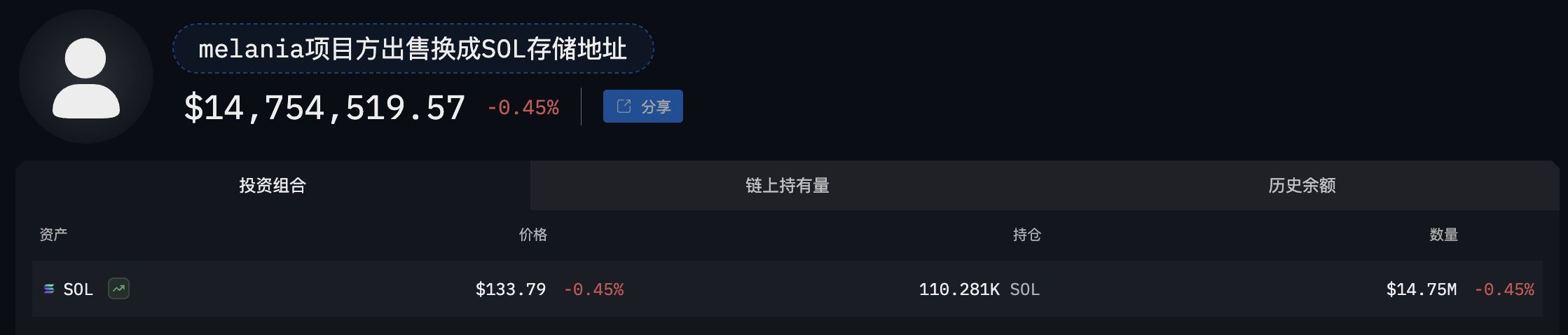

EmberCN additional identified that the mission’s crew has offered over 23 million MELANIA tokens up to now month. The tokens had been price roughly $14.75 million.

These repeated sell-offs have added weight to considerations over inside dumping—suspicions that first emerged in March.

On the time, blockchain analytics agency Bubblemaps reported uncommon actions of over $30 million in MELANIA tokens. Initially a part of the neighborhood allocation, the tokens seemed to be step by step transferred to exchanges with out clarification.

The agency linked these transactions to Hayden Davis, a co-founder of the meme coin. Davis beforehand labored on one other controversial token, LIBRA, which briefly surged after Argentine President Javier Milei endorsed it, then shortly collapsed.

Bubblemaps additionally revealed that wallets tied to the MELANIA crew management roughly 92% of the token’s complete provide. Critics argue that this stage of centralization raises purple flags over potential market manipulation.

On account of these considerations, MELANIA has seen its worth collapse. After reaching a excessive of over $13 earlier this 12 months, the token has dropped by over 96% to an all-time low of $0.38, in accordance with knowledge from BeInCrypto.

Nonetheless, the steep decline displays each inside turmoil and broader weak spot within the meme coin sector. Investor urge for food for high-risk tokens seems to be fading amid world uncertainty and a extra cautious market sentiment

Disclaimer

All the knowledge contained on our web site is printed in good religion and for basic info functions solely. Any motion the reader takes upon the knowledge discovered on our web site is strictly at their very own threat.