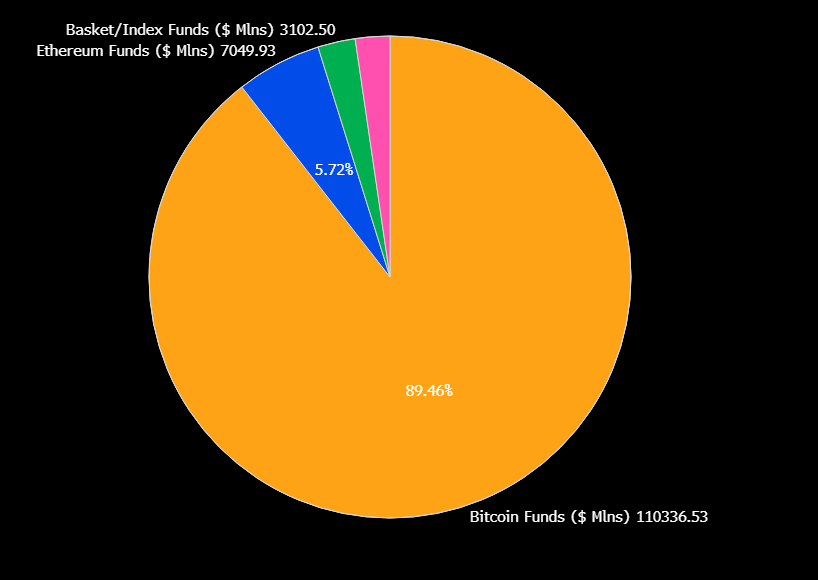

Because the SEC is signaling its willingness to approve new altcoin ETFs, 72 lively proposals are awaiting a nod. Regardless of the rising curiosity from asset managers to launch extra altcoin-based merchandise within the institutional market, Bitcoin ETFs at the moment command 90% of crypto fund property worldwide.

New listings can appeal to inflows and liquidity in these tokens, as demonstrated by Ethereum’s approval of ETF choices. Nonetheless, given the present market curiosity, it’s extremely unlikely that any crypto discovered will replicate Bitcoin’s runaway success within the ETF market

Bitcoin Dominates the ETF Market

Bitcoin ETFs dramatically modified the worldwide digital property market over the previous month, and they’re performing fairly properly for the time being. Within the US, whole internet property have reached $94.5 billion, regardless of steady outflows up to now few months.

Their spectacular early success opened a brand new marketplace for crypto-related property, and issuers have been flooding the SEC with new functions since.

This flood has been so intense that there are at the moment 72 lively proposals for the SEC’s consideration:

“There are actually 72 crypto-related ETFs sitting with the SEC awaiting approval to listing or listing choices. All the things from XRP, Litecoin and Solana to Penguins, Doge and 2x MELANIA and every thing in between. Gonna be a wild 12 months,” claimed ETF analyst Eric Balchunas.

The US regulatory surroundings has turn into a lot friendlier towards crypto, and the SEC is signaling its willingness to approve new merchandise. Many ETF issuers try to grab the chance to create a product as profitable as Bitcoin.

Nonetheless, Bitcoin has a large head begin, and it’s troublesome to think about any newcomer disrupting its 90% market share.

To place that into perspective, BlackRock’s Bitcoin ETF was declared “the best launch in ETF historical past.” Any new altcoin product would wish a big value-add to encroach upon Bitcoin’s place.

Latest merchandise like Ethereum ETF choices have attracted contemporary liquidity. But, Bitcoin’s dominance within the institutional market stays unchanged.

Of those 72 proposals, solely 23 seek advice from altcoins aside from Solana, XRP, or Litecoin, and plenty of extra concern new derivatives on current ETFs.

Some analysts declare that these merchandise, taken collectively, couldn’t displace greater than 5-10% of Bitcoin’s ETF market dominance. If an occasion considerably disrupted Bitcoin, it might additionally impression the remainder of crypto.

Nonetheless, that doesn’t imply that the altcoins ETFs are a futile endeavor. These merchandise have frequently created new inflows and curiosity of their underlying property, particularly with issuers buying token stockpiles.

Nonetheless, it’s essential to be reasonable. Whereas XRP and Solana ETF approvals may drive new bullish cycles for the altcoin market, Bitcoin will doubtless dominate the ETF market by a big margin — given its widespread recognition as a ‘retailer of worth’.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.