- Bitcoin’s unrealized losses proceed to dominate as BTC continues to consolidate.

- Regardless of rising losses, traders are but to capitulate and stay optimistic.

Over the previous week, Bitcoin [BTC] has traded inside a parallel channel, consolidating between $82,000 and $86,000 with out clear path.

With the dearth of upward momentum, traders who purchased Bitcoin at these ranges proceed to document important losses.

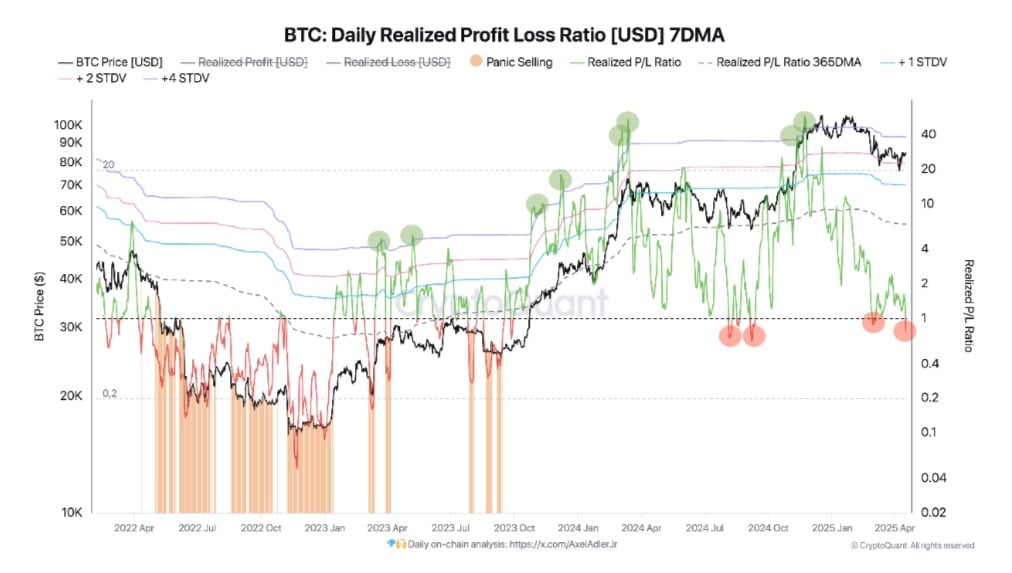

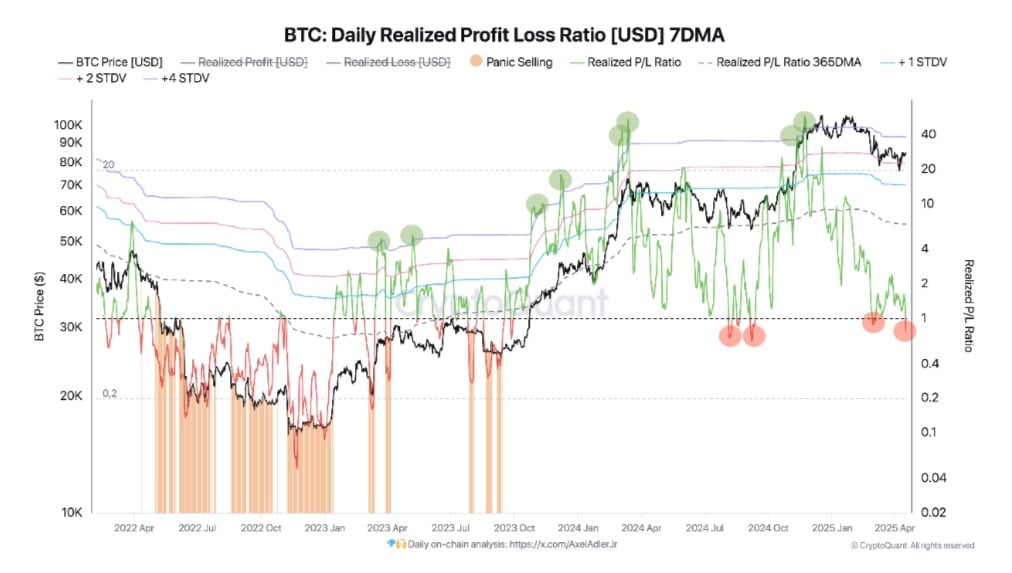

Inasmuch, in response to CryptoQuant, Bitcoin’s Realized Losses are at present dominating the market.

As such, Bitcoin’s Revenue/Loss Ratio (7DMA) has dropped beneath its essential degree of 1. The current drop signifies that almost all of traders are at present realizing losses.

Supply: CryptoQuant

These losses are mounting, particularly amongst short-term holders. The truth is, Bitcoin’s Quick-term Holder SOPR has dropped beneath 1 to settle at 0.9 at press time.

The decline right here means that short-term holders are promoting at a loss.

Supply: CryptoQuant

On prime of that, Bitbo knowledge confirmed that STHs confronted Unrealized Losses. Their Realized Worth stood at $92,174—far above present spot costs close to $84,000.

Supply: Bitbo

Nonetheless, it’s value noting that the drop doesn’t essentially sign a full-blown capitulation however reasonably a part of doubt or potential accumulation.

earlier cycles, we will observe that at any time when the ratio reached the +4 STDV deviation from the 365DMA, an area market prime persistently shaped, adopted by a short-term correction through the bull part.

With a excessive degree of uncertainty prevailing within the markets, there’s a higher probability {that a} capitulation part might unfold, probably driving realized losses even greater.

Is capitulation forward for BTC?

Though unrealized losses are dominating, traders haven’t turned to promoting. Quite the opposite, traders are optimistic and anticipate Bitcoin costs to maneuver greater within the close to group.

Supply: CryptoQuant

As an example, Bitcoin’s Fund Stream Ratio fell from 0.13 to 0.06 over 4 days—indicating fewer trade deposits from retail traders.

Furthermore, whale habits echoed this restraint. The trade whale ratio dropped from 0.51 to 0.37, implying whales had been staying put—and even accumulating.

Supply: CryptoQuant

What comes subsequent?

In conclusion, though unrealized losses proceed to rise, traders have but to capitulate. As such, Bitcoin holders are hopeful and anticipate costs to regain greater ranges.

If these sentiments can maintain, we may see Bitcoin reclaim $86078. Nonetheless, if STH begins to promote to keep away from extra losses, BTC will retrace to the decrease boundary of the consolidation channel round $82800.