Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

The Bitcoin value spiked to $87,400 on April 21, its highest degree since March 29. The intraday rally added greater than $3,000 to the asset in lower than 24 hours, erasing a considerable portion of April’s drawdown. Whereas the one‑day appreciation of about 4% will not be unprecedented for the notoriously unstable asset, the backdrop that accompanied Monday’s advance has market contributors treating the transfer with further significance.

Why Is Bitcoin Up At this time?

Essentially the most rapid macro‑financial thread was the promote‑off within the US greenback after Nationwide Financial Council Director Kevin Hassett informed reporters on Friday that US President Donald Trump intends to exchange Federal Reserve Chair Jerome Powell. The greenback index (DXY) slipped to 98.182 on Monday, whereas capital rotated concurrently into conventional protected‑haven gold. Spot gold climbed to a brand new excessive at $3,385 per ounce, extending its 2025 acquire to twenty-eight%. In distinction, S&P 500 and Nasdaq futures traded about 0.5% decrease.

Associated Studying

Observers seized on the divergence between Bitcoin and threat‑asset benchmarks. Monetary writer Mel Mattison wrote on X that he’s “seeing extra proof tonight of BTC breaking its sturdy threat‑on/QQQ correlation,” recalling his January thesis that “that is the 12 months BTC breaks that correlation and begins buying and selling extra in sympathy with gold.” Apollo founder Thomas Fahrer reached an analogous conclusion: “Bitcoin is pumping whereas inventory futures are buying and selling down. It’s nearly just like the market is treating it prefer it’s another monetary system or one thing.”

The Kobeissi Letter described the alignment between the 2 arduous‑asset narratives as notable as a result of “Gold has hit its fifty fifth all‑time excessive in 12 months and Bitcoin is formally becoming a member of the run, now above $87,000.” In a observe‑up put up, the macro publication argued that each belongings are “telling us {that a} weaker US Greenback and extra uncertainty are on the way in which,” crediting a part of gold’s power to President Trump’s publication of a “non‑tariff dishonest” listing from Sunday that targets forex manipulation, export subsidies and different types of perceived financial aggression.

Associated Studying

The renewal of commerce‑coverage nervousness capped a 3‑day Easter weekend that had failed, within the phrases of Kobeissi, to ship “the commerce offers the market priced‑in final week.” Trump’s ninety‑day “reciprocal tariff” pause nonetheless has seventy‑9 days remaining, and market sentiment seems more and more sceptical {that a} sweeping accord will materialise in that window.

Nonetheless, FOX Enterprise correspondent Charles Gasparino reported on Sunday {that a} Wall Road government “with ties to the Trump White Home” believes Treasury Secretary Scott Bessent is “near asserting a major commerce deal, more likely to be with Japan,” whereas cautioning that negotiations stay fluid.

Bitcoin Worth Breaks Out

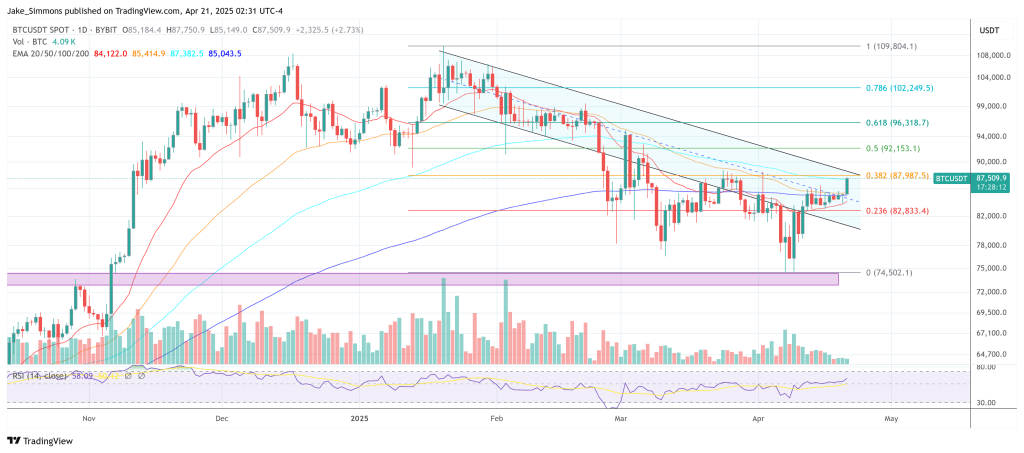

Towards the macro backdrop, chart technicians pointed to an necessary structural break on the each day Bitcoin chart. Dealer Scott Melker noticed that the spot fee is now “breaking via descending resistance from the all‑time excessive” and should clear $88,804 to invalidate the collection of decrease highs and decrease lows.

The account @ChartingGuy highlighted $94,000—the 0.618 Fibonacci retracement of all the drawdown—because the “minimal goal on this rally,” including that market behaviour at that degree will decide whether or not the present impulse proves a mere reduction bounce or the start of a extra sustained advance.

In the meantime, crypto analyst IncomeSharks warned: “Good to see the downtrend breakout however the timing is necessary. Sunday will not be a day to rejoice a low quantity pump whereas inventory markets are closed. If you wish to see a bullish strikes lets see shares open crimson tomorrow and hold this candle inexperienced. Then we are able to have enjoyable.”

At press time, BTC traded at $87,509.

Featured picture created with DALL.E, chart from TradingView.com