Solana (SOL) continues to indicate energy throughout a number of fronts, sustaining a bullish construction on its Ichimoku Cloud chart whereas gaining momentum in key market metrics. The BBTrend indicator has turned larger once more, signaling renewed shopping for stress after a quick cooldown.

On-chain exercise stays sturdy, with Solana main all blockchains in DEX quantity and dominating payment era due to the explosive development of meme cash and launchpad exercise. With SOL now buying and selling above a key resistance degree, the trail is open for additional upside—although a lack of momentum may nonetheless set off a retest of decrease helps.

Solana Maintains Bullish Construction, however Momentum Faces Key Take a look at

On Solana’s Ichimoku Cloud chart, the value is at present above the Kijun-sen (purple final analysis) however has dipped beneath the Tenkan-sen (blue conversion line), signaling weakening short-term momentum.

The flattening Tenkan-sen and value conduct counsel doable consolidation or the early levels of a pullback. Nonetheless, with the value holding above the Kijun-sen, medium-term help stays intact.

The general Ichimoku construction stays bullish, with a thick, rising cloud and main span A nicely above span B—indicating sturdy underlying help.

If Solana finds help on the Kijun-sen and climbs again above the Tenkan-sen, the uptrend may regain energy; in any other case, a take a look at of the cloud’s higher boundary might comply with.

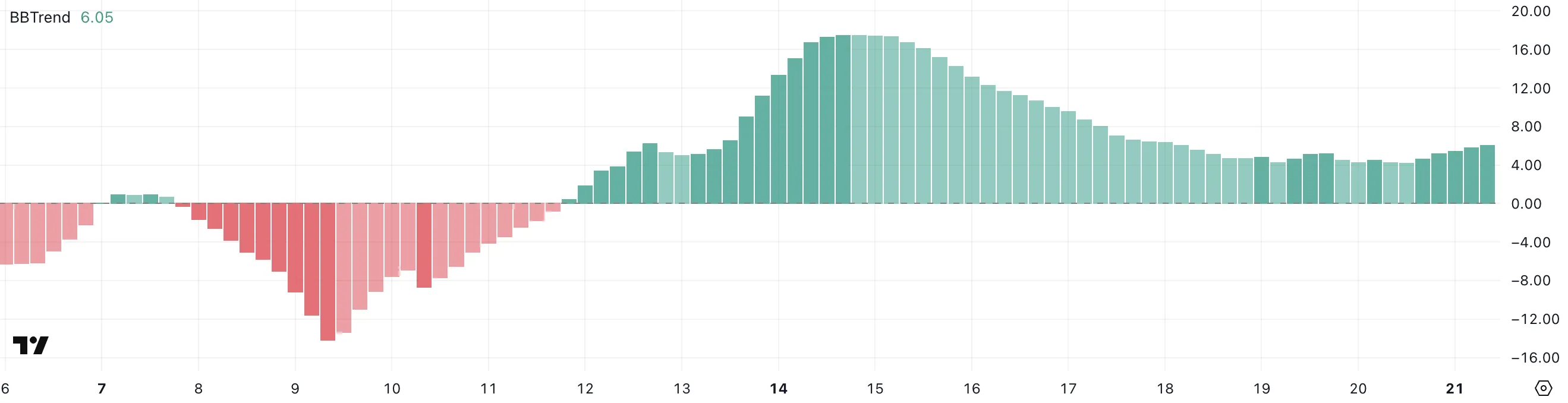

In the meantime, Solana’s BBTrend is at present at 6, extending practically ten days in constructive territory after peaking at 17.5 on April 14. The latest enhance from 4.26 to six suggests renewed bullish momentum following a quick cooldown.

BBTrend, or Bollinger Band Development, tracks the energy of value motion based mostly on Bollinger Band growth.

Constructive values like the present one level to an energetic uptrend, and if the BBTrend continues to rise, it may sign stronger momentum and potential for an additional upward transfer.

Solana Dominates DEX Quantity and Payment Era as Meme Cash Drive Ecosystem Progress

Solana has as soon as once more claimed the highest spot amongst all chains in DEX quantity, recording $15.15 billion over the previous seven days. The mixed whole of Ethereum, BNB, Base, and Arbitrum reached $22.7 billion.

Within the final 24 hours alone, Solana noticed $1.67 billion in quantity, largely fueled by its booming meme coin ecosystem and the continued launchpad battle between PumpFun and Raydium. Including to this good momentum, Solana not too long ago surpassed Ethereum in Staking Market Cap.

On the subject of software charges, Solana’s momentum is simply as clear. 4 of the highest ten fee-generating apps over the previous week—PumpFun, Jupiter, Jito, and Meteora—are Solana-focused.

Pump leads the pack with practically $18 million in charges alone.

Solana Breaks Key Resistance as Uptrend Targets Increased Ranges, however Dangers Stay

Solana has lastly damaged above its key resistance at $136, flipping it into a brand new help degree that was efficiently examined simply yesterday.

Its EMA strains stay aligned in a bullish setup, suggesting the uptrend remains to be intact.

If this momentum continues, SOL value may goal for the following resistance zones at $147 and $152—ranges that, if breached, open the door to a possible transfer towards $179.

The present construction favors consumers, with larger lows and robust help reinforcing the pattern.

Nonetheless, if momentum fades, a retest of the $136 help is probably going.

A breakdown beneath that degree may shift sentiment, exposing Solana to deeper pullbacks towards $124 and even $112.

Disclaimer

According to the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.