Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

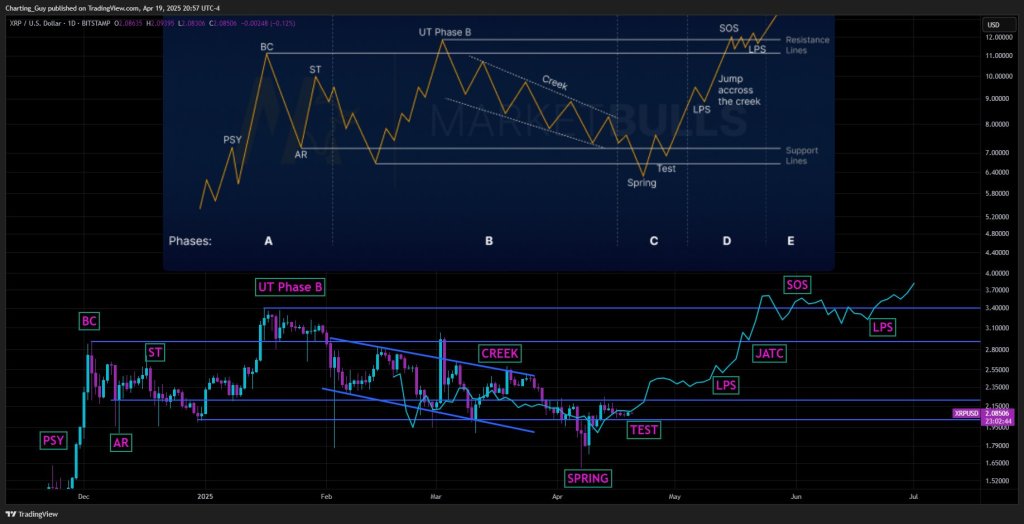

Crypto analyst Charting Man (@ChartingGuy), posting to X on April 20, has mapped the day by day XRP/US Greenback chart on Bitstamp onto a textbook Wyckoff re‑accumulation schematic and argues that the sample is now far sufficient superior to suggest a summer season markup towards— and probably past— the $3.70 area.

“Wyckoff Sample Ignites XRP Bull Case

The chart spans the 5‑month base that started with preliminary provide (PSY) in late November. A vertical surge carried value right into a $2.68 Shopping for Climax (BC) in early December, instantly adopted by an Computerized Response (AR) that washed again to roughly $1.90, anchoring the decrease boundary of what would change into the Part A buying and selling vary. A Secondary Take a look at (ST) in mid‑December revisited the $2.72 zone, finishing Wyckoff’s preliminary “cease‑motion” sequence.

Part B unfolded by way of January: demand rebuilt, producing an Up‑Thrust (UT) in Part B that briefly pierced $3.40 in mid January earlier than provide re‑asserted itself. From that peak XRP traced a descending, low‑angle channel—labelled the “Creek”—with progressively decrease highs and lows into early April. All through this descent, Charting Man’s overlay exhibits the acquainted noticed‑tooth of Wyckoff’s inside testing, suggesting weak‑hand distribution fairly than true distributional topping.

Associated Studying

On April 7 the market underneath‑reduce vary assist, knifing to about $1.61, and instantly snapped again: the basic Spring of Part C. A shallow Take a look at of the spring adopted close to $2.00, satisfying Wyckoff’s requirement for bullish affirmation. From that time the analyst’s projected path turns greater.

Part D begins with what Wyckoff known as Final Level of Assist (LPS) between $2.35 and $2.55 in early Could, adopted by a steeper advance that drives by way of the February crest. That is adopted by a Leap Throughout The Creek (JATC)—a decisive thrust by way of the descending channel high and horizontal resistance at roughly $2.70.

The mannequin then exhibits a value breakout above the mid-January excessive at $3.40 would represent the Signal of Energy (SOS) round $3.40 in late Could, finishing the transition into Part E. Afterwards, Charting Man expects a second backing up into a primary Final Level of Assist (LPS) between $3.10 and $3.30 in mid-June, adopted by a good steeper advance.

Associated Studying

In Part E the schematic accelerates, taking XRP into the $3.70 space by early July—an goal that sits one tick above the $3.40 resistance band on the analyst’s value axis. With the spot fee at $2.12 at publication time, the roadmap implies a possible upside of near 74% over the subsequent two and a half months.

Nevertheless, Charting Man cautions that “this doesn’t imply up‑solely now—timing could also be barely off,” underscoring Wyckoff’s probabilistic nature. However, the meticulous alignment of actual‑world value motion with the classical re‑accumulation phases—full with labelled PSY, BC, AR, ST, UT, Spring, Take a look at, LPS, JATC and SOS—provides weight to the bullish case. If the market respects these technical milestones, XRP may quickly be working with costs not seen for the reason that final cycle’s peaks.

At press time, XRP traded at $2.11.

Featured picture created with DALL.E, chart from TradingView.com