- Key Resistance Forward: Ethereum is going through robust resistance between $2,295–$2,350, the place over 6 million ETH is held. This space may set off heavy promoting as many wallets are nonetheless underwater.

- Weak On-Chain Help: Community exercise and whale accumulation are each down sharply, with charges and large-holder netflows dropping—signaling lowered confidence from institutional gamers.

- Restoration Potential, However Cautious: ETH has bounced lately and is testing resistance at $1,703. A breakout may result in a run towards $2,330, however with out stronger on-chain assist, momentum would possibly stall.

Ethereum (ETH) is at present grappling with a reasonably cussed resistance wall proper close to the $2,330 mark—a stage that might find yourself shaping the place issues go subsequent, not less than within the quick time period. However right here’s the place it will get a bit difficult: greater than 106 million ETH addresses are nonetheless sitting underwater, which implies an enormous chunk of holders are ready for breakeven costs earlier than they even take into consideration holding longer.

Now, zooming in slightly, information reveals that about 6.28 million ETH is parked between $2,295 and $2,350 throughout roughly 2.6 million wallets. That’s not a small quantity. This cluster is without doubt one of the largest resistance zones on Ethereum’s community proper now, and any transfer towards it’d set off promote stress from holders itching to chop their losses.

If ETH does handle to slice by way of this zone, although, it may flip a serious resistance into assist—and extra importantly, increase market confidence.

Whale Exercise Drops as Community Slows

Issues aren’t wanting too vigorous on-chain, both. Ethereum community charges have dropped—like, rather a lot. We’re speaking a 56% drop within the final week and almost 89% over the previous three months. That type of slide normally factors to weaker demand and lighter exercise throughout the board.

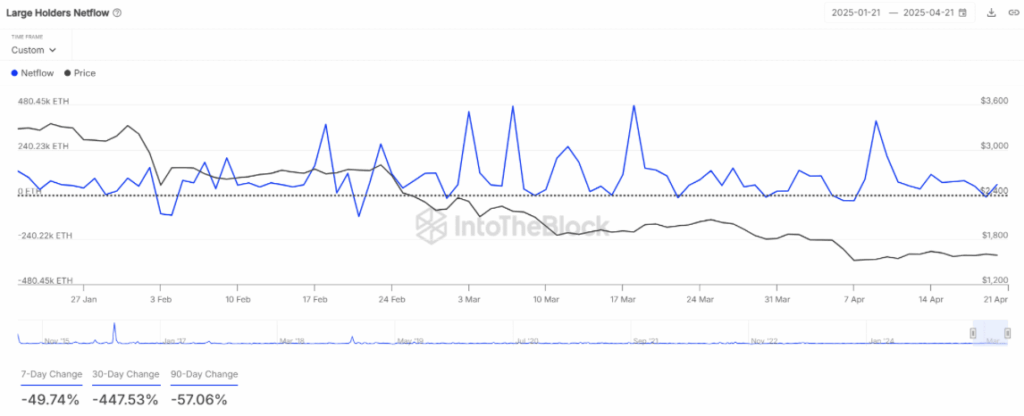

On the similar time, whales appear to be chilling on the sidelines. Giant holder netflows tanked by virtually 50% this previous week—and over 447% (!) within the final month. It’s a transparent signal that big-money gamers are holding again, which doesn’t do any favors for Ethereum’s short-term breakout hopes.

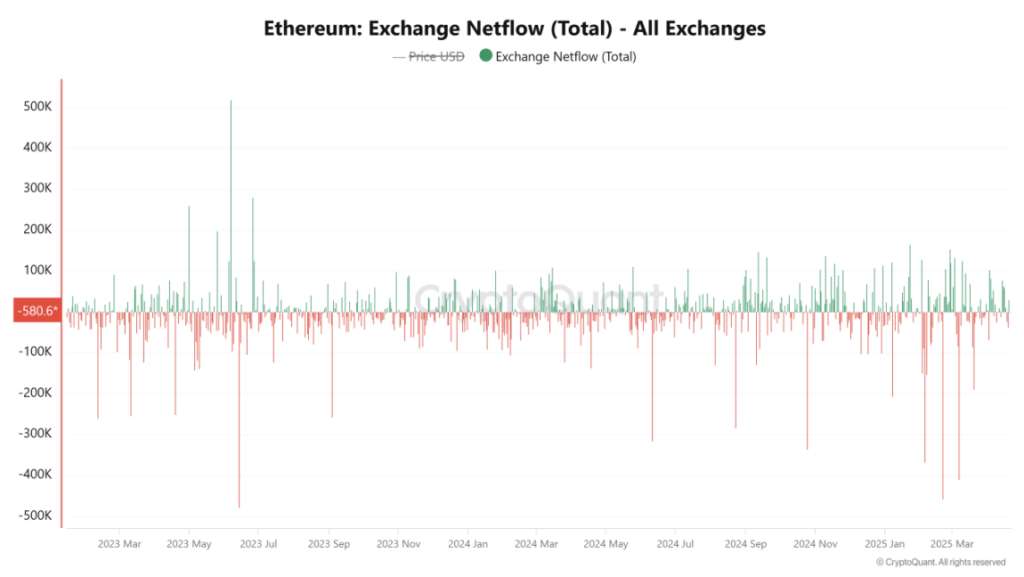

Regardless that some ETH has been shifting off exchanges (which is normally a great factor), the dearth of significant whale accumulation means the buy-side momentum simply isn’t robust sufficient—not less than not but.

Worth Tries to Bounce, However Downtrend Isn’t Damaged

ETH has proven a little bit of life currently. It bounced 3.6% within the final 24 hours, buying and selling round $1,647 on the time of writing. That’s after a strong rebound from the $1,385 zone, now testing resistance between $1,650 and $1,703.

However—yeah, there’s all the time a “however”—Ethereum’s nonetheless shifting inside a descending parallel channel. That sample has smacked down a number of restoration makes an attempt in current weeks. The $1,703 stage additionally occurs to align with the highest of that channel, forming a double whammy of resistance.

If ETH can really escape above that, it’d invalidate the bearish development and perhaps set the stage for a push to $2,330. Till then although, the downtrend continues to be technically intact.

Retail’s Hanging On, Establishments? Not So A lot

Even with all this backwards and forwards, retail merchants don’t appear too fazed. Change netflows present that about 29,948 ETH left buying and selling platforms final week—a virtually 2% drop in balances. That’s normally a bullish sign, suggesting people are prepping for long-term holds relatively than fast flips.

Nonetheless, optimism isn’t common. The divide between retail hope and institutional hesitation continues to be very actual. Community exercise is quiet. Whale curiosity is missing. And except one thing shifts quickly—whether or not it’s worth, sentiment, or utilization—Ethereum might not have sufficient fuel within the tank to push previous $2,330.

Backside Line?

Ethereum’s caught at a crossroads. The current bounce is encouraging, and merchants are cautiously optimistic. However the lack of on-chain pleasure and big-money backing means any rally try may fizzle out except ETH reclaims $1,703 and stirs up contemporary demand. For now, the $2,330 barrier isn’t going wherever.