- Bitcoin is closing in on $89K whereas conventional markets hunch below Trump’s tariffs and Fed drama.

- Trump’s threats to fireside Fed Chair Powell are including gasoline to financial uncertainty, however BTC appears to be thriving.

- Analysts say Bitcoin is regaining its position as a hedge, with ETF inflows and rising dominance hinting at extra upside.

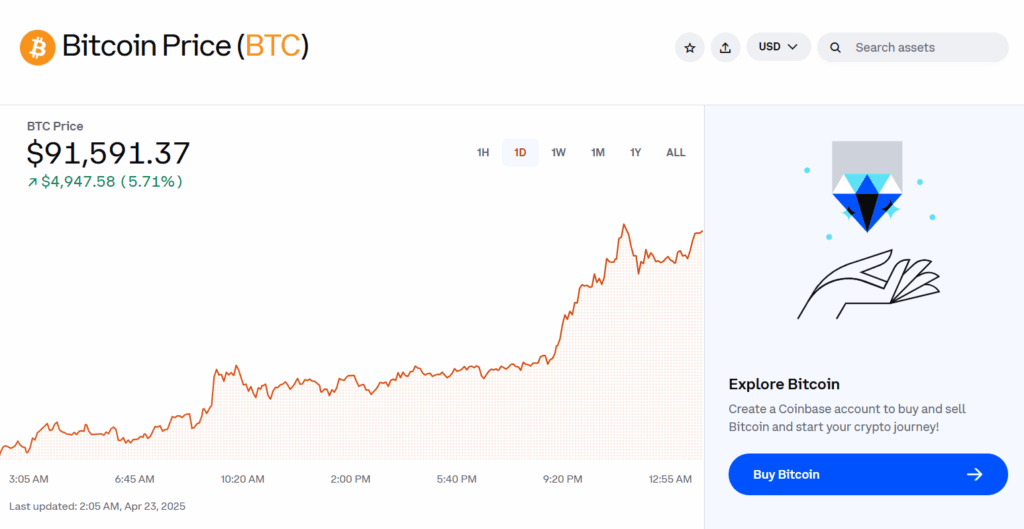

So, right here we’re once more—Bitcoin rising whereas the remainder of the monetary world appears to be sliding into chaos. On Monday, BTC crept near $89,000, whereas U.S. markets had a tough day, largely because of the drama unfolding round Trump’s tariff push and the uncertainty that comes with it.

Markets Stumble, Bitcoin Retains Its Cool

Let’s discuss numbers for a second. The Dow dropped almost 1,000 factors. The Nasdaq fell over 2.5%. The S&P 500 slid too. Tech giants? Took a beating. Tesla down nearly 6%, Nvidia slipped over 4%, and Amazon, Meta… yeah, they obtained hit too. In the meantime, Bitcoin simply stored shifting up.

Lots of this has to do with the weakening greenback. The DXY hit its lowest level in three years, which, traditionally, tends to gentle a fireplace below Bitcoin. Analyst Ben Werkman referred to as it—“Bitcoin is again on the transfer.” And he would possibly simply be proper.

The Trump vs. Powell Present

Now, in the midst of all this, Trump is as soon as once more throwing pictures at Fed Chair Jerome Powell. On Fact Social, he mainly mentioned Powell’s “termination can’t come quick sufficient.” Yeah, that’s… refined. Apparently, his crew is even trying into whether or not they can legally fireplace the man.

Powell, for his half, has warned that Trump’s tariffs may push inflation larger, making issues extra difficult for the Fed’s already tough balancing act. Based on him, we’re staring down the barrel of a situation the place excessive inflation and sluggish development crash into one another. Not perfect.

Bitcoin as a Hedge—Once more?

With all this noise, Bitcoin is as soon as once more being talked about as a hedge—this time not simply towards inflation however towards good ol’ normal political chaos. Geoff Kendrick from Customary Chartered mentioned BTC is a hedge towards each TradFi collapse and U.S. Treasury drama, particularly now that Powell’s job looks like it’s on the chopping block.

He identified that Bitcoin stepped up within the face of SVB’s collapse final yr, and now, with Treasury yields doing bizarre issues, it is perhaps doing it once more.

Sentiment Shifts Barely Bullish

Over within the Bitwise camp, they’re seeing a tiny temper shift. Their crypto sentiment index flipped barely bullish, with 8 of 15 indicators displaying optimistic indicators. Plus, their Cross Asset Threat Urge for food (CARA) index nudged up too—nonetheless unfavourable, however not as grim as earlier than.

Apparently, a superb variety of altcoins—about 20%—have been outperforming Bitcoin these days. That might be a clue that the market’s getting slightly frisky once more.

The Greater Image

So what’s subsequent? Properly, if BTC can punch by that $89K–$90K vary, analysts are saying $92K may come fairly fast. There’s resistance up there, certain, however with ETFs seeing their largest inflows in months ($381M on Monday, by the best way), it seems like institutional cash is creeping again in.

And with Bitcoin dominance hitting 64.5%—a four-year excessive—perhaps, simply perhaps, the following leg up isn’t that far off.