- Brief-Time period Bullish Momentum: DOT has reclaimed the $3.85 degree and is approaching the $4.00 resistance. A profitable breakout above this might sign a bullish reversal, with potential targets at $4.44 and $4.76 .

- Technical Indicators Present Combined Indicators: Whereas the 4-hour chart signifies a bullish construction with larger highs and lows, the each day chart’s Superior Oscillator stays under zero, and the A/D indicator is flat, suggesting warning amongst merchants.

- Key Help and Resistance Ranges: Rapid resistance lies at $4.18 and $4.44, with main resistance at $4.76. On the draw back, help is discovered at $3.70 and $3.58. A drop under these ranges may invalidate the bullish setup .

Polkadot (DOT) is displaying indicators of a possible breakout because it approaches key resistance ranges, with technical indicators suggesting a bullish momentum increase.

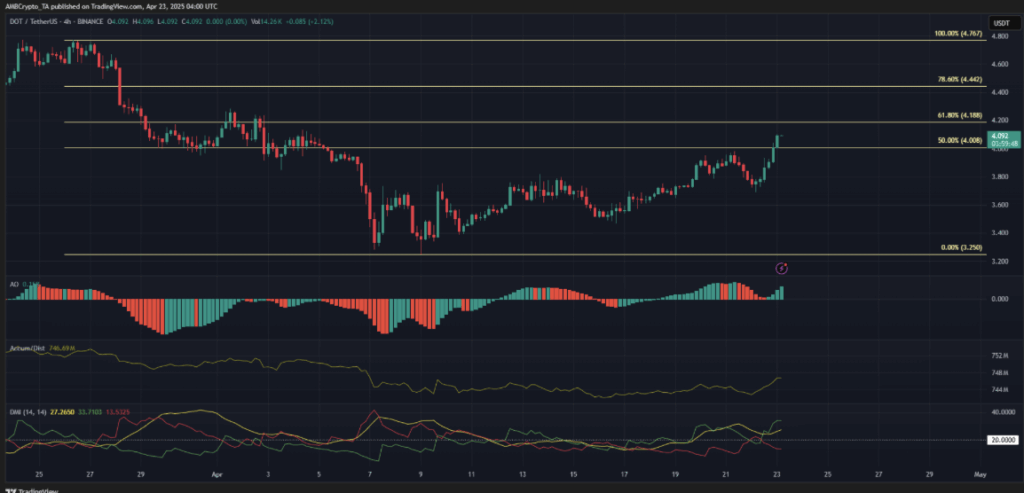

Every day Chart: Approaching Essential Resistance

On the each day timeframe, DOT is nearing the $4.18 resistance degree. A profitable shut above this degree may sign a bullish breakout, probably focusing on the $4.44 and $4.76 resistance zones. Nonetheless, indicators just like the Superior Oscillator stay under the zero line, and the Directional Motion Index (DMI) reveals each +DI and -DI under 20, indicating a scarcity of robust development path.

4-Hour Chart: Bullish Momentum Constructing

Zooming into the 4-hour chart, DOT has been forming larger highs and better lows over the previous two weeks, indicating a bullish construction. The DMI displays a powerful uptrend in progress, and the Accumulation/Distribution (A/D) line’s uptick hints at elevated demand for Polkadot.

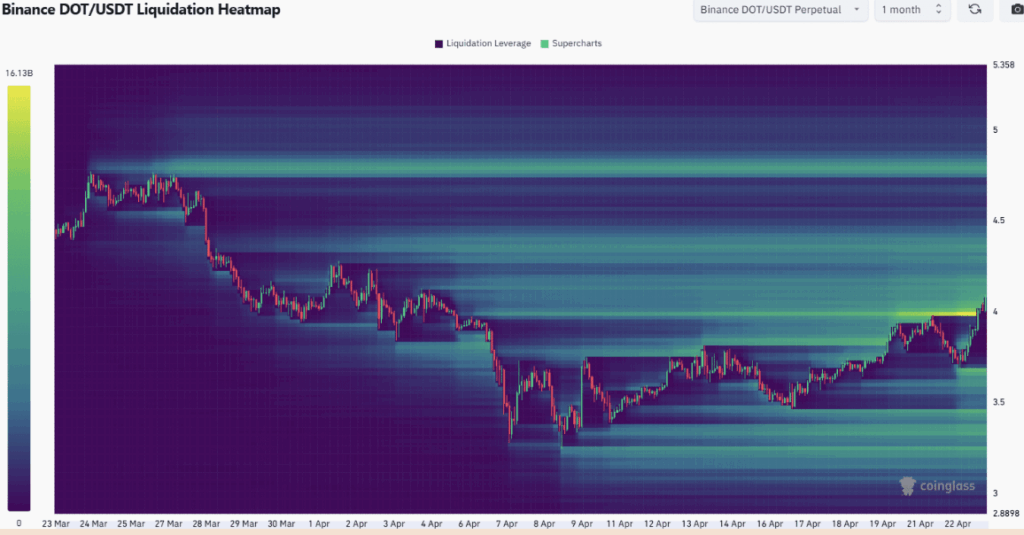

Liquidation Heatmap: Potential Reversal Zones

The liquidation heatmap highlights the $4.00–$4.18 and $4.30–$4.40 areas as areas with vital buying and selling exercise.These zones may act as magnets for the worth, pulling DOT larger. Nonetheless, additionally they pose dangers of bearish reversals if the worth fails to interrupt via convincingly.

Buying and selling Technique: Key Ranges to Watch

- Rapid Resistance: $4.18 and $4.44

- Main Resistance: $4.76

- Help Ranges: $3.80 and $3.60

Merchants ought to monitor these ranges carefully. A breakout above $4.44, adopted by a retest, may present a powerful entry level for lengthy positions. Conversely, a drop under $3.80 would possibly point out a return to the earlier vary, warranting warning.